MGM Growth earnings match first-quarter results from 2021

The real estate investment trust affiliated with MGM Resorts International reported first-quarter earnings nearly equal to what the company reported a year ago.

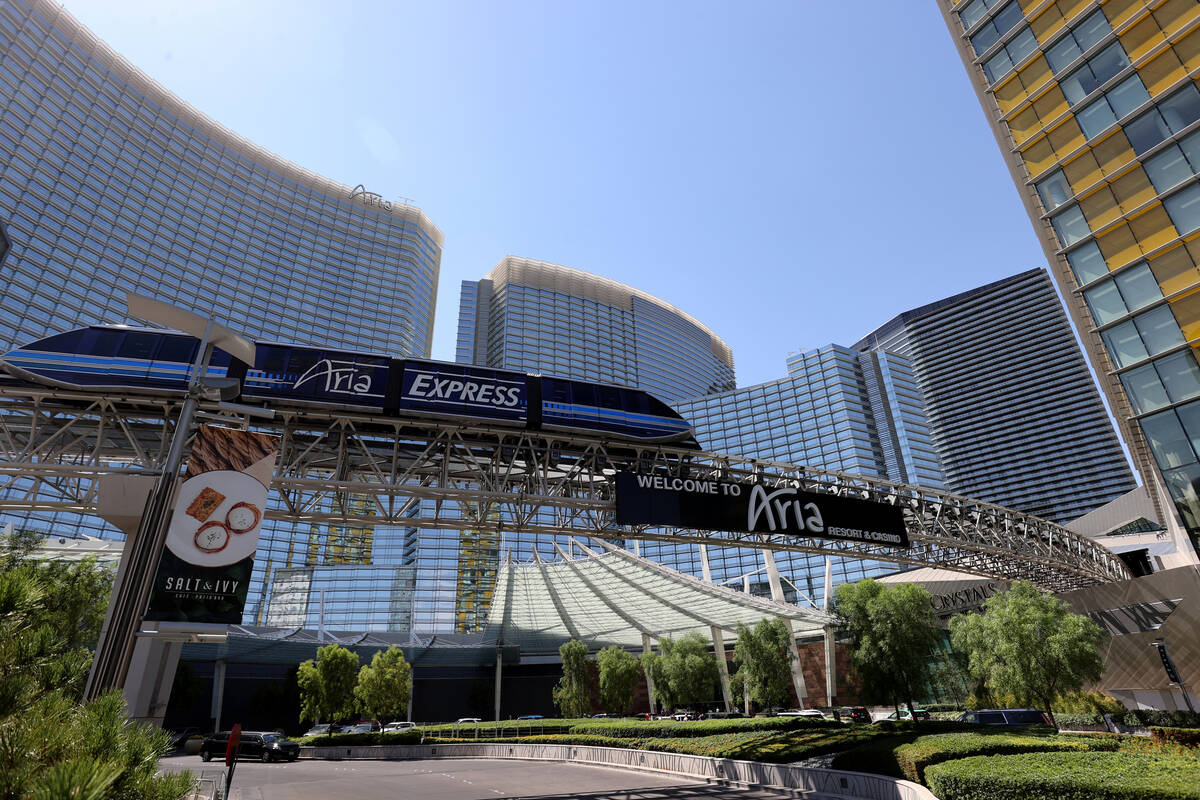

MGM Growth Properties LLC, a REIT that owns the land beneath 13 resorts with 32,700 hotel rooms, 1.7 million square feet of casino space, and 3.6 million convention square footage, on Friday reported net income of $116.5 million, 44 cents a share, on revenue of $201.9 million for the quarter that ended March 31.

A year ago, net income of $115.4 million, 44 cents a share, on revenue of $194.3 million was reported.

Analysts with Zacks Equity Research said the company’s results outperformed its estimates by 2 cents a share. Over the last four quarters, the company has surpassed consensus estimates twice.

The company collected $195.1 million in rental revenue for the quarter.

In mid-March, MGM Growth reported it is paying a quarterly cash dividend of 53 cents per Class A common stock, or $2.12 a share annually. That’s a 2-cent increase from previous dividends and is the 16th dividend increase since MGM Growth’s initial public offering in April 2016.

The dividend was paid April 14 to shareholders of record as of the close of business on March 31.

MGM Resorts International owns 41.5 percent of the shares and MGM Growth shareholders own the rest.

MGM Growth shares, traded on the New York Stock Exchange, were up 52 cents, 1.3 percent, to $41 a share in average trading Monday. After hours, shares continued to climb, up another 95 cents, 2.3 percent, to end around $41.95 a share.

Contact Richard N. Velotta at rvelotta@reviewjournal.com or 702-477-3893. Follow @RickVelotta on Twitter.

MGM Growth Properties LLC

First-quarter revenue and earnings for Las Vegas-based MGM Growth Properties, the real estate investment trust affiliated with MGM Resorts International, and owner of the real estate beneath 13 properties housing 32,700 hotel rooms. (NYSE: MGP)

Revenue

1Q 2022: $201.9 million

1Q 2021: $194.3 million

Change: +3.9%

Net income

1Q 2022: $116.5 million

1Q 2021: $115.4 million

Change: +0.1%

Earnings per share

1Q 2022: $0.44

1Q 2021: $0.44

Change: 0%