Nearly all gaming stocks gained during February

Investors came home in February.

The average daily stock prices for nine of the 10 publicly traded gaming companies tracked by Las Vegas-based financial consultant Applied Analysis increased during the month.

Only shares of slot machine giant International Game Technology fell in February, trading down almost 9 percent in average daily price compared with January. IGT reported a 1.3 percent decline in first-quarter revenues, which the company attributed to a lack of new casino openings.

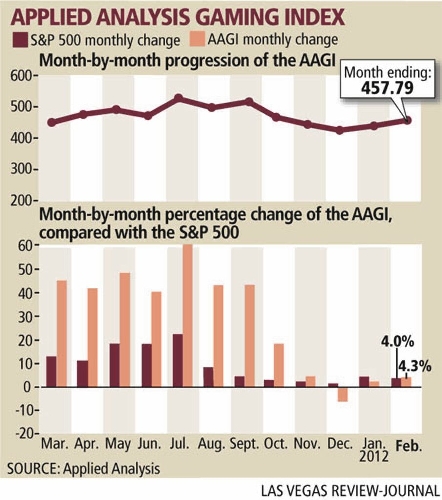

The stock figures helped push the Applied Analysis Gaming Index, which measures some 300 different variables, up 19 points to close at 457.79.

"The bulk of the increase was sourced to positive stock performances turned in by gaming operators, while the gaming equipment manufacturer component of the index slid marginally during the past month," Applied Analysis principal Brian Gordon told the firm's clients in a research report. "The broader equities markets turned in comparable results."

The average daily stock prices of MGM Resorts International and Las Vegas Sands Corp. increased by double-digit percentages.

Shares of Wynn Resorts Ltd. also traded higher than in January despite the company's Feb. 18 move to oust its largest stockholder, Japanese businessman Kazuo Okada, after an investigative report to the board of directors raised issues concerning his "unsuitability" to be a shareholder in the company. The board took the unusual step of terminating his approximately 24 million shares and redeeming him with 10-year $1.9 billion promissory note at a price 30 percent below market value.

Okada, whose holdings include slot machine maker Aruze Gaming America Inc., has threatened a lawsuit to overturn the action.

The dispute with Okada almost overshadowed Wynn's fourth-quarter results, which included an 8.6 percent revenue increase. Las Vegas Sands revenues jumped 26 percent in the quarter while MGM Resorts revenues climbed 7 percent.

Gordon said investors were more focused on the gaming industry's performance, especially on the Strip, than on corporate infighting.

"Recent activity shed additional light on an industry that appears to be benefiting from increased economic stability, improved fundamentals and relatively efficient operating leverage," Gordon said.

Caesars Entertainment Corp. began trading publicly in February, listing more than 1.8 million shares on the Nasdaq Global Select Market in a limited initial public offering. The company's stock began trading at $9 a share, but hit a high of $17.90 that opening day before coming back down in price.

Gordon said the company would be added to the Gaming Index in March to have a comparative month in which to measure growth in valuation.

Contact reporter Howard Stutz at hstutz@reviewjournal.com or 702-477-3871. Follow @howardstutz on Twitter.