Sports betting cannot survive as is, experts say

The existing sports-betting financial model is unsustainable and executives of the nation’s 48 brands have begun analyzing what they must do to generate revenue while keeping players happy.

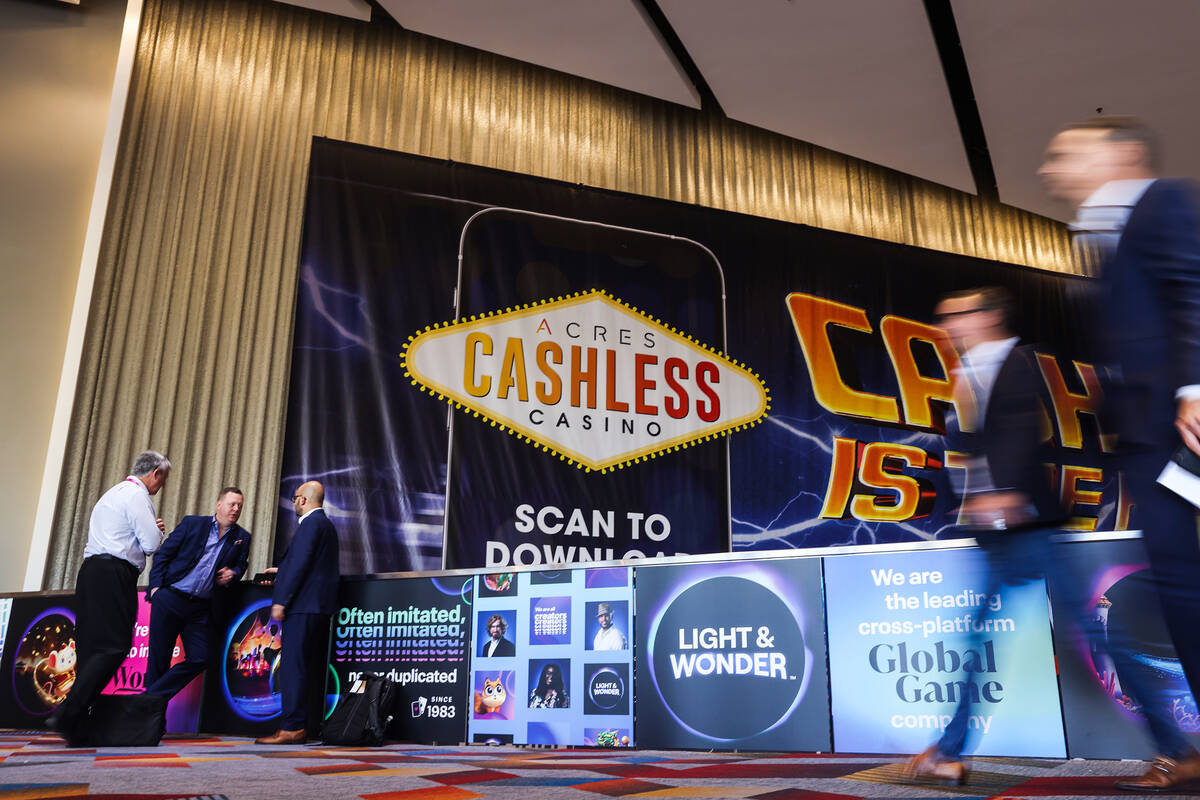

Industry experts in a panel Monday — the opening day of the Global Gaming Expo at The Venetian Expo — said companies that take wagers on sports must trim player acquisition costs and educate bettors on how to place different types of bets to generate additional revenue.

On Tuesday, the trade show floor, featuring more than 250 exhibitors, will open and a series of keynote speeches with top gaming industry executives is scheduled in the morning.

G2E panelists Adam Krejcik, Marina Bogard and Andrew Fabian said changes are needed in order for sportsbooks to sustain profitability.

“We’re still in the early innings of the market,” said Fabian, an investment banker with Citi who cofounded Betcha Sports Inc., a sports-betting app that was acquired last year by online ticket marketplace Vivid Seats.

“Companies need to find more ways to monetize their systems,” he said.

Since the Professional and Amateur Sports Protection Act of 1992 was struck down by the U.S. Supreme Court in 2018, 35 states have joined Nevada in taking legal sports wagers with four more states on the verge of opening their markets and three more with pending legislation authorizing betting.

Irvine, California-based market research firm Eilers &Krejcik Gaming in September reported that 58 percent of the U.S. adult population resides in a state in which sports betting is legal.

In each new state, marketing and advertising increased and some companies offered players bonuses to sign up for their apps or visit their brick-and-mortar betting locations.

Krejcik, partner at Eilers &Krejcik Gaming, said operators need to educate their customers about sports betting, including an explanation of calculating odds so that they can expand their betting portfolios.

“They need to challenge themselves to provide more entertainment experiences,” he said.

Bogard, U.S. managing director for Betsson Group, said companies must work to retain customers once they sign them up.

Panelists suggested companies also should reduce their $200 to $400 per player acquisition costs by cutting back on marketing and advertising and reducing signup incentives.

Some states, in their initial startups to sports betting, enabled companies to deduct some marketing and advertising costs before their gaming tax assessments. As the market matures, some states are legislating reductions in deductible promotional expenses.

Panelists said some companies are using partnerships with teams and leagues to cut their own expenses. They also said they expect more mergers and acquisitions to take place as the industry matures.

Some companies, Fabian said, are expanding their product offerings in the same way Uber expanded its ride-hailing services by developing food and alcohol deliveries in addition to transporting people. Some of that expansion involves adding in-game wagering and parlay betting to their menus of betting options.

Krejcik said FanDuel, which has broadened its sports-wagering offerings from its roots as a daily fantasy sports site, has the highest market share of sports betting in the U.S. The company recently got a toehold in Nevada with a consulting partnership with Boyd Gaming Corp.’s Fremont casino property in downtown Las Vegas, but it has no plans to introduce its own app and take sports bets in Nevada.

Caesars Entertainment Inc.’s William Hill subsidiary is Nevada’s market leader for sports wagering.

Contact Richard N. Velotta at rvelotta@reviewjournal.com or 702-477-3893. Follow @RickVelotta on Twitter.