Data centers may help unlock the new Nevada economy

In order for the new Nevada economy to mature, the state needs more data centers, experts say.

Gov. Brian Sandoval has selected nine industries to target for growth: aerospace and defense, agriculture, information technology, energy, health care, manufacturing, logistics and operations, mining and gaming, hospitality and tourism.

All those industries increasingly rely on big data — drones equipped with sensors are increasingly being used to help detect the health of crops, for example — and all that data will need a physical home.

“Data centers are the brick and mortar of our fast-growing digital economy,” said Jeff West, head of data center research at commercial real estate services provider CBRE.

Steve Hill, the outgoing director of the Governor’s Office of Economic Development, said he’s confident that the needed data center capacity will emerge locally to support the envisioned economy.

But “that industry is going to have to grow pretty quickly,” he said.

Current capacity

Las Vegas has about 1.32 million square feet of data center space from 13 providers, according to Dan Thompson, senior analyst at 451 Research.

But one provider, Switch, owns an estimated 90 percent market share.

“While Switch is growing in the Las Vegas market, it is not necessarily growing because of that market. We estimate that only about 12 percent of Switch’s business is from companies based in Las Vegas, with the rest from out-of-state and global corporations,” Thompson wrote in a recent report.

Hill said Switch and other providers are building additional data storage facilities as a response to demand.

And that demand is only slated to grow, but how much will it grow in Nevada?

Over 200 billion smart devices will be connected to the internet by 2020, compared with only 15 billion in 2015, according to estimates by Intel cited in Tesla’s Securities and Exchange Commission filing.

According to research firm Gartner, smart cities will use 7.3 billion connected sensors by 2020, almost six times more than in 2015, representing a 42 percent compound annual growth rate.

More than 75 million autonomous vehicles will be sold by 2035, according to IHS Markit estimates.

Clustering

To take advantage of growth, Nevada needs a “data center cluster.”

John Lenio, senior vice present and economist at CBRE’s Economic Incentives Group, said Nevada is still in the early stages of developing such a cluster.

“Usually what we see economic development-wise is when there is a change in policy or a change in focus of the industries that are being attracted, it tends to take three to five years until you actually see impacts on the economy as a whole,” he said.

Business development drives data center construction, but data center construction also drives business development.

Companies see the benefits of having a technology infrastructure already in place to support their business, he said.

This type of relationship has already started to take shape in Reno, Hill said.

Google purchased 1,210 acres at the Tahoe Reno Industrial Center in April, for example. And, Hill said, Rackspace “is committed to coming” as well.

Competition

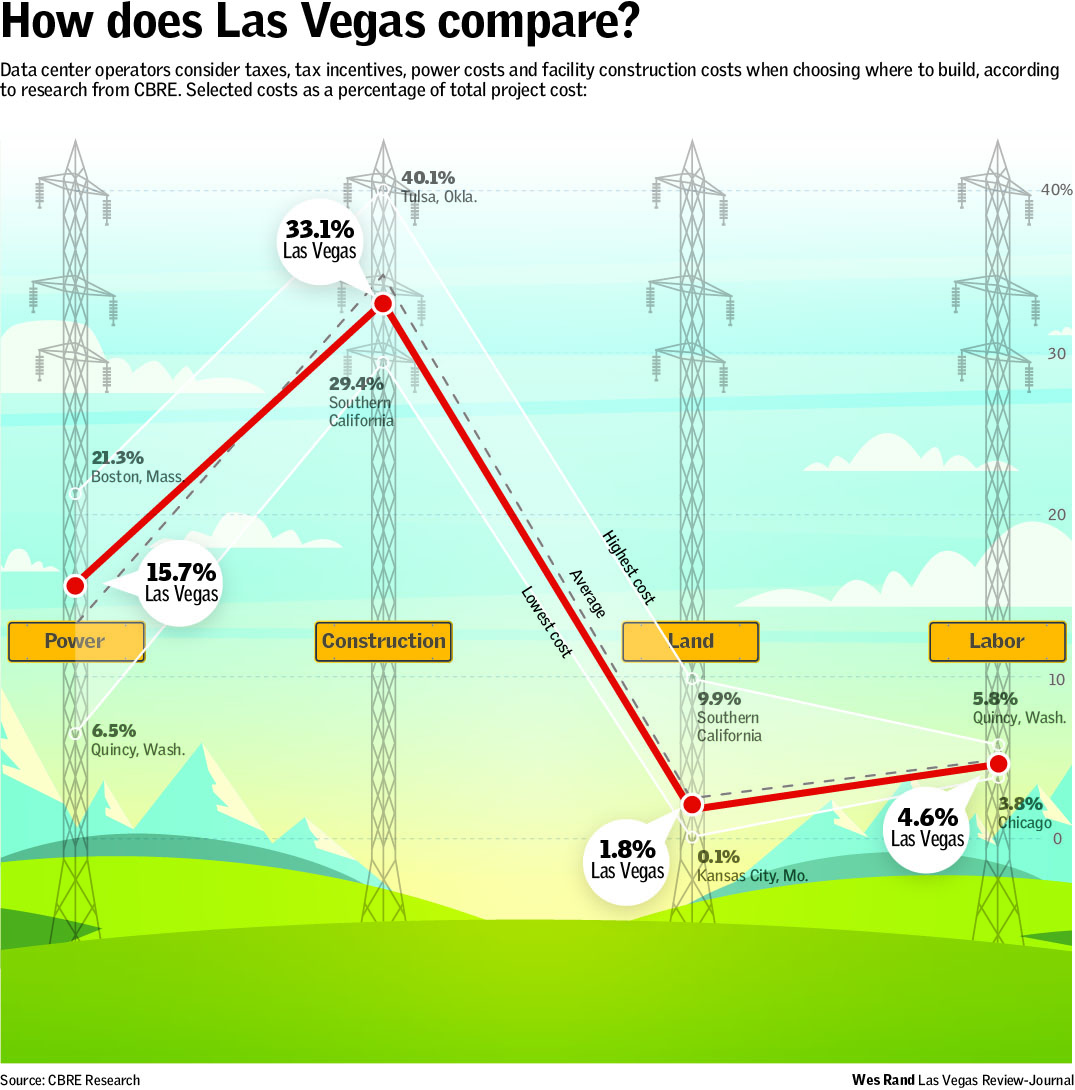

Some of the most important factors that data center operators consider when choosing where to build are taxes, tax incentives, power costs and facility construction costs, according to research from CBRE.

According to CBRE, Nevada is in the middle of the road when it comes to the costs to build and operate a data center, qualified as costing between $252.9 million and $275.8 million.

Las Vegas competes for data centers with Phoenix, Denver and Salt Lake City, according to 451 Research.

Since 2005, other states have used data center-specific tax incentives to give them an edge. Lenio estimates that about 20 states are now using them, but Nevada “is a little bit behind the curve.”

Nevada began offering data center-specific tax incentives only in 2015.

Three companies have been approved for such incentives since.

Hill said the data center-specific tax incentives focus on tax revenues instead of job creation, since data centers are not big permanent job creators.

Easy money

The typical data center will hire between 25 and 50 employees, Lenio said. But a CBRE study found that “a $1 billion data center could generate upward of $200 million in total tax revenues over 10 years.”

Hill said data centers in Nevada typically generate in excess of $30,000 a year per employee.

“And that is quite a bit higher than the cost of providing services to employees and their families, so it is a great fiscal deal for the state,” Hill said.

Capital investment by the companies approved for data center abatements since 2015 — Switch, Rackspace and ViaWest — totals $3.2 billion, according to the economic development office.

Hill said local data center companies are adequately responding to the growing needs of their customers, and the local data center industry is certain to grow in tandem with development as needed.

According to documents that Switch filed Sept. 8 with the SEC, Switch’s campus in Northern Nevada “is designed to provide more gross square feet upon full build-out than any other data center campus announced globally.”

Contact Nicole Raz at nraz@reviewjournal.com or 702-380-4512. Follow @JournalistNikki on Twitter.