Falling home values translate to reduced bills for most parcels

An octogenarian received a mixed blessing in the slumping housing market.

Robert Petty, 82, has watched his home's value nose-dive from $500,000 during the boom to under $300,000.

But he's also paying $1,000 less on his property taxes than he did two years ago, a break he says really helps because he's on a fixed income.

"It makes me feel better that they tried to give us some relief," Petty said, adding that he has reached the age he doesn't worry so much about his property's value.

Petty's northeast valley home is among the 434,000 parcels in Clark County that will receive lower taxes this year. That's more than half of the valley's 730,000 parcels, a smaller portion than last year when 90 percent of parcels got reduced tax bills.

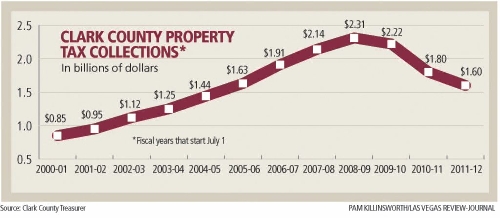

While owners such as Petty enjoy some savings, the dip in taxes also resulted in a $200 million drop in revenue this year for local governments, which are dealing with strained budgets.

The revenue hit is spread across 40 entities, including the county, cities, libraries and school district.

It's less severe than last year's

$470 million plunge in revenue, a sign that properties aren't depreciating so much. But, as officials point out, that's like saying one flat tire is better than two.

"Things aren't declining as rapidly, but there still appears to be a downward trend," said Rocky Steele, assistant assessor.

Resort hotels and apartment complexes seem to be holding their property values better, Steele said. However, his office won't have a complete picture of how the market is faring until after it is done analyzing properties at the end of the year, he said.

Waning property tax revenue contributed to the county's current $48 million shortfall, which will be filled with money pulled from a reserve.

"It's not a surprise at all," county spokesman Erik Pappa said of the thinner revenue. "It just underscores the need to try to gain concessions from our employee groups."

County firefighters made about

$13 million in concessions, partly from an arbitrator's ruling and partly in a recent bargaining pact. The county now is negotiating with its largest union.

The budget hole could have been more glaring. County leaders were bracing for the state to scoop as much as $70 million in tax revenue this year. But Gov. Brian Sandoval asked lawmakers to not raid county coffers after the state Supreme Court ruled that it was unconstitutional to single out specific local entities for a revenue grab.

Records show Las Vegas collecting about $6 million less in property taxes this year and the Clark County School District losing about

$45 million in revenue for its maintenance and operations.

In all, the district faces a $150 million shortfall, which officials say they hope to close by freezing certain pay raises, spending less on textbooks, reducing administrative budgets, passing some pension costs to employees and consolidating bus routes.

The Las Vegas-Clark County Library District took less of a blow than officials expected. The district had a $3.2 million shortfall but offset it with $1.5 million in union concessions, a $1.2 million transfer from its capital fund and almost $500,000 in reduced services and supplies.

"We did have to cut a little bit but not as much as we thought," said Pat Marvel, library spokeswoman. "So we're in pretty good shape."

Many property owners are receiving smaller tax bills because they challenged their assessments.

Ralph Millard, 74, was one of 10,400 owners -- a record number -- who appealed their properties' taxable values.

He asked the county's equalization board to lower his southwest valley home to $300,000 from $386,000.

The board split the difference at $340,000, saving Millard about $100 on this year's tax bill.

Not a lot, but it beats having his house over-assessed, he said.

"It's the principle, I think, that's involved here," Millard said.

Contact reporter Scott Wyland at swyland@reviewjournal.com or 702-455-4519.