‘Swapping homes like stocks’: Wall Street-backed firm buys 264 valley homes in a day

A Wall Street-backed corporate landlord bought hundreds of Clark County homes in a staggering one-off residential sale in summer 2023.

Miami-based investment firm Starwood Capital Group sold 264 homes in Clark County for $98 million to Dallas-based Invitation Homes (NYSE: INVH), according to Clark County property records.

The deal, made in three separate transactions, closed on July 18, property records show. The largest sale was $57.5 million for 155 homes, the second was $26.3 million for 70 homes and the third was $14.1 million for 39.

The majority of the homes sold are in the city of Las Vegas (94), followed by the city of North Las Vegas with 77. The price range for each home ranged from around $292,000 to $694,000, with the average price at $371,514.

The sale is part of a much larger deal between Starwood Capital and Invitation Homes, a $650 million swap for a portfolio of close to 1,900 single-family rental homes, with the majority being in the Sun Belt, including in Texas, Florida, Phoenix, Las Vegas and Los Angeles.

Wall Street-backed hedge funds, corporate landlords and cash-rich investors have been buying up single-family homes across the country as far back as 2009, which experts say means fewer houses on the market for families to purchase. That also could lead to higher rental prices and fewer affordable homes in regions such as the Las Vegas Valley. A MetLife Investment Management study shows these companies could own close to 40 percent of all U.S. houses by 2030.

Concerning the $98 million sale, an Invitation Homes representative said the purchase was part of a “larger portfolio acquisition across multiple markets,” but declined to comment further on the deal. As of the third quarter of 2023, the company had bought 2,291 homes for $854 million during the year, which includes the 264 homes in the Las Vegas Valley, according to its latest earnings report. Starwood Capital declined to comment on the sale.

Noah Herrera, a real estate agent who has worked in the Las Vegas Valley for nearly 30 years, said Wall Street-backed hedge funds and large corporate landlords first got involved in the housing market after the Great Recession in 2008-09, when real estate values bottomed out across the country.

Herrera said he worked with a few corporate landlords during the initial buying phase in 2008-09, and they told him they would resell what they bought in five years. But these landlords never put these houses back on the market, he said.

He said what scares him the most about corporate America getting involved in residential real estate is what are known as “rental-backed securities,” where companies such as Invitation are selling to investors. The product has a lot of similarities to mortgage-backed securities, one of the downfalls of the housing market during the 2008-09 crash.

“They’ve turned these homes into collateralized rental obligations. They’ve collateralized them and what they’re doing is swapping homes like stocks for one another.”

How many homes does Invitation own?

Rutgers University researcher Eric Seymour, who compiled data with the Las Vegas Review-Journal, said Invitation Homes owns about 3,500 homes in Clark County, a number that has jumped since 2019 when they owned fewer than 3,100 homes. That makes it the second-largest owner of single-family rental homes in Clark County.

Progress Residential — the largest corporate landlord in Clark County — owns more than 3,700 homes, more than double their portfolio in 2019.

Seymour said Starwood recently purchased some properties from Scottsdale, Arizona-based Progress Residential, which builds and owns more than 85,000 single-family rental homes across 30 metros. He added this is par for the course in today’s real estate market, as massive multibillion-dollar companies are swapping housing stock like stocks.

“Large single-family landlords like Invitation and Progress first acquired inventory following the foreclosure crisis, when they bought homes at discounted prices,” he said. “They’ve since grown primarily through acquisitions of competitor firms. As these companies settled in as landlords, they’ve also made bulk deals with competitor firms to grow or shed their presence in particular markets. They are essentially trading with each other to enhance the performance of their overall inventory.”

UNLV’s Lied Center for Real Estate Director Shawn McCoy estimates that investors (anyone who has bought more than 10 homes in the past five years) own approximately 15 percent of all of the single-family homes in Clark County, a number that has been rising steadily since the Great Recession.

But to Mark Pingle, a professor of economics at the University of Nevada, Reno, this swap might not be the best rate of return on the company’s investment. On average, each home sold for roughly $370,000 and many of the rentals listed on Invitation Homes’ website average around $2,600, which gives the companies a low rate of return on their investment at about 5 percent.

“They must be thinking the prices of those houses, long term, will go up,” Pingle said. “It doesn’t seem like it’s a great financial deal.”

But because people need a place to live, ultimately the economist believes the revenue is relatively safe.

Although corporate landlords are exchanging hundreds of homes at a time, Pingle said he is not concerned about what the companies are doing and believes it’s “a drop in the bucket,” as there are more than a quarter of a million homes in Clark County. He also doesn’t believe there is a risk of a monopoly just yet, as there are many competing companies in the area.

“To me, what you’ll tend to see is more people living in, instead of single-family homes, you’ll see a higher percentage living in apartment buildings,” Pingle said, noting there will be a decline in home ownership.

Political movement?

Politicians and housing advocates across the country point to the growing corporate ownership of American homes as the reason for inflated home prices and rental rates across major cities and counties in the U.S., including Clark County.

U.S. Rep. Steven Horsford, D-Nev., who represents Nevada’s 4th Congressional District including North Las Vegas, where the majority of corporate owned single-family rental homes in Clark County reside, said one of the biggest concerns he hears from constituents is the high cost of rent and access to affordable housing.

Horsford reintroduced legislation early in 2023, called the Housing Oversight and Mitigating Exploitation (HOME) Act, noting that “large institutional speculators” are buying up America’s housing market at an alarming rate. The bill aims to help protect Americans by creating institutional oversight in the housing market, such as allowing the U.S. Department of Housing and Urban Development to investigate corporate landlord purchases and stamp out market manipulation.

“I continue to call for federal investigations into whether corporate landlords have artificially inflated rent and property costs or have systematically targeted certain communities of color, single mothers, or retirees,” Horsford said in a statement to the Review-Journal. “These bulk sales are evidence that once an out-of-state corporate speculator purchases a home, it is unlikely to resurface on the housing market for everyday working families, artificially lowering our already dire supply of housing in Southern Nevada.”

Estimates from the National Low Income Housing Coalition are that Clark County is already short more than 80,000 affordable housing units, a number that has been rising for years.

Horsford said under the Republican majority in the House this year, they only had one hearing for the housing subcommittee he sits on.

“If we are to address this issue that is impacting so many Nevadans, we have to spend more time discussing the facts,” he said. “In the last Congress, under Chairwoman Maxine Waters, the Financial Services Committee had a hearing on this topic. Progress Residential and Invitation Homes were included in the research conducted by the committee and showed that these companies had elevated fees, higher than average evictions, and were more likely to cost burden their lower-income rentals.”

Another bill was also introduced in December by Democrats U.S. Rep. Adam Smith of Washington and U.S. Sen. Jeff Merkley of Oregon in both houses of Congress called the End Hedge Fund Control of American Homes Act of 2023. This bill would tackle the problem by banning hedge fund investors from owning large numbers of homes by establishing a $20,000 federal tax penalty per single family owned in excess of 100.

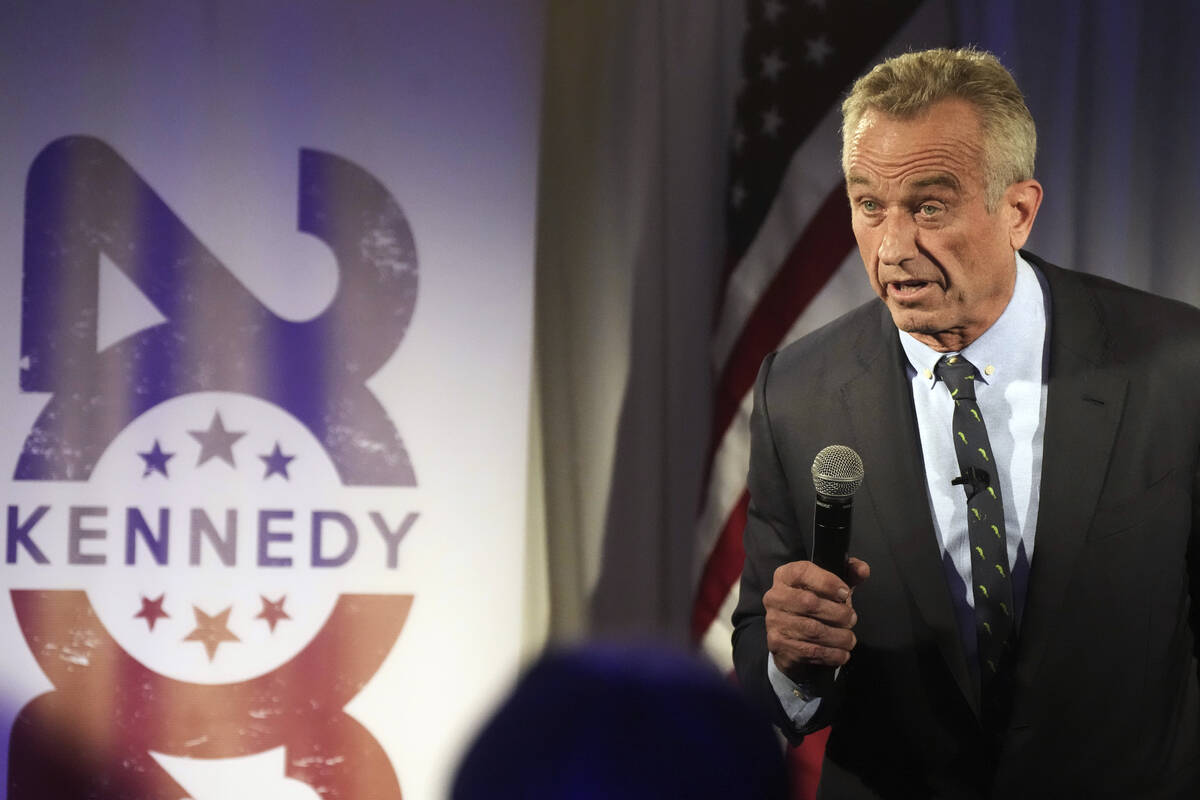

Independent presidential candidate Robert F. Kennedy, Jr., who is currently polling third behind President Joe Biden and Republican front-runner Donald Trump in a NPR/PBS NewsHour/Marist National poll, said he is not sure why this has not already become a major campaign platform given its overall impact on the American real estate market, and does expect housing to become a big ticket item in the 2024 presidential election.

Both the White House and Trump’s media team did not respond to a request for comment on this story.

“Honestly, I don’t know why this isn’t a more prominent issue among national politicians,” Kennedy said in a statement. “Possibly, they are reluctant to offend Wall Street and the big institutional buyers. In any event, this is a serious issue for our country, because home ownership is the quintessence of the American Dream and a key to stable communities. When people do not own their own home, they are in a literal sense less invested in their community. They are also economically vulnerable to rent hikes.”

Contact Patrick Blennerhassett at pblennerhassett@reviewjournal.com.