IN BRIEF

LV-based American Pacific reports loss for first quarter

American Pacific Corp., a Las Vegas-based chemical manufacturer that sells to NASA, on Wednesday reported a first-quarter loss, reversing year-earlier income.

In a statement, the company said it lost $1.4 million, or 19 cents a share, in the quarter ended Dec. 31, reversing a year-earlier profit of $500,000, or 6 cents a share.

Consolidated revenues fell 25.2 percent to $34.1 million from $45.6 million.

Revenues in American Pacific's fine chemicals segment dropped 53 percent and revenues in specialty chemicals plunged 26 percent, but revenues in the aerospace equipment segment jumped by 45 percent.

The company attributed the decline in fine chemical sales to the timing of customer orders.

A 46 percent decrease in perchlorate volume affected specialty chemical results, but a 27 percent increase in average price per pound of perchlorate offset the sales decrease. The biggest contributor to the specialty segment was product for the space shuttle reusable rocket motor program.

Aerospace equipment revenue grew mainly because of increased revenues from in-space propulsion engines.

American Pacific shares fell 2 cents, or 0.31 percent, Tuesday to close at $6.47 on the Nasdaq National Market.

Pinnacle Entertainment bonds rated 'negative' by Moody's

Pinnacle Entertainment's bonds were given a "negative" rating by Moody's Investors Service, nearly a week after the casino operator reported declining earnings from its Louisiana and Indiana casinos.

Moody's had previously rated Las Vegas-based Pinnacle's bonds as "stable."

In a statement, the ratings service said Pinnacle experienced declining fourth quarter earnings at the L'Auberge du Lac casino in Lake Charles and the Boomtown New Orleans, as well as the Belterra in Indiana.

Pinnacle, which doesn't operate a casino in Las Vegas, said last year that it would scale back a second casino in Lake Charles and make the building an expansion to L'Auberge. Moody's also considered the planned March 3 opening of River City, Pinnacle's third casino in St. Louis.

"Positive rating consideration is given to the company's leading market share position in Lake Charles and expectation that the company's River City casino development in will contribute favorably to earnings and cash flow," Moody's said in a statement.

The service said the company had an "adequate liquidity profile. Pinnacle recently entered a new $375 million revolving credit agreement expiring in 2014 that refinanced a $531 million revolver which had a December expiration date.

NEW YORK

U.S. retail sales increase for third straight month in January

Americans backed off from their holiday spending pace in January, but retail sales rose for a third month in a row compared with a year earlier, largely because of higher gasoline prices, according to figures released Wednesday.

Including goods from food to clothing to gasoline -- but excluding cars -- U.S. retail sales rose 3.6 percent from January 2009, according to MasterCard Advisor's SpendingPulse, which estimates spending in all forms including cash.

That increase followed a 4.8 percent gain in December and a 2.1 percent gain in November, according to SpendingPulse.

Excluding both gasoline and auto sales, retail sales rose 0.3 percent in January, 2.1 percent in December and 0.2 percent in November compared with a year earlier. The year-over-year figures are not seasonally adjusted.

NEW YORK

Sprint Nextel slows rate of user exodus but posts loss

Sprint Nextel Corp. managed to slow the rate of subscriber loss in the fourth quarter, an encouraging sign for a wireless carrier that has lost millions of customers over the past few years.

Sprint, the third-largest U.S. wireless carrier, said Wednesday that it lost a net 148,000 subscribers during the last three months of 2009, far fewer than the 545,000 who fled in the third quarter.

However, much of the improvement came from the recruitment of lower-paying subscribers to prepaid services such as Boost Mobile, and that has been getting more difficult as competition increases.

Meanwhile, Sprint reported a quarterly loss of $980 million, or 34 cents per share, for the three months ended Dec. 31, compared with a loss of $1.62 billion, or 57 cents per share, a year earlier.

Analysts expected a loss of 19 cents per share, but that figure didn't include the effects of a noncash $306 million tax charge.

Revenue fell 7 percent to $7.87 billion.

WASHINGTON

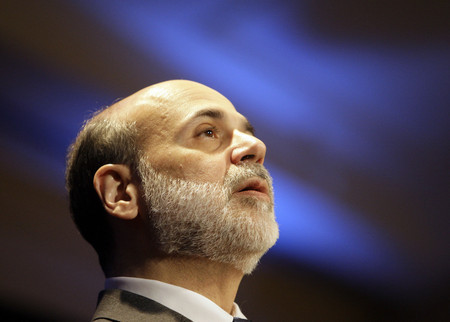

Record-low interest rates will end someday, Fed chief says

Prepare for the end of record-low interest rates, Federal Reserve Chairman Ben Bernanke says. Just not yet.

Higher rates on credit cards, home equity loans and some mortgages will follow the Fed's eventual pullback of the trillions it injected into the economy. Savers will benefit, though. As rates gradually climb, certificates of deposit and savings accounts will finally pay more.

Bernanke indicated Wednesday that the Fed is still months away from raising rates or draining most of the stimulus money it injected to rescue the financial system.

WASHINGTON

European debt crisis could spell trouble in America

The United States, which led the world into recession, may now see its fragile recovery stifled by events across the globe.

Dangerously high debt levels in Greece and some other European countries could trigger a wave of national defaults, undermining revival in Europe and probably in the United States as well.

And China's recent steps to cool its economy also complicate President Barack Obama's plan to attack high unemployment here by increasing U.S. exports.

Financial markets have been whipsawed over concerns that debt problems in Greece -- and perhaps also in high-debt Spain, Portugal, Ireland and even Italy -- might infect stronger European neighbors.

A strike by civil servants to protest wage cuts shut schools and grounded flights across Greece on Wednesday. European Union leaders plan to discuss the crisis -- and the feasibility of rescue attempts -- during a summit today in Brussels.

NEW YORK

Dow Jones to sell 90 percent interest to CME Group Inc.

Dow Jones & Co. is selling a 90 percent stake in its stock market index unit to exchange operator CME Group Inc. for $607.5 million, the companies announced Wednesday.

The joint venture will let the Dow Jones industrial average keep its famous name through a long-term licensing agreement, the companies said in a statement.

Dow Jones will retain a 10 percent stake and a management role in Dow Jones Indexes. The business offers more than 130,000 stock indexes that are used as benchmarks by investors and licensed for use by mutual funds and other investment products.

The business includes widely watched indexes like the Dow Jones utilities average and the Dow Jones transportation average. It also owns such diverse barometers as the Dow Jones Islamic market index and the Dow Jones European energy index.

DALLAS

No more free standby switches for American Airlines fliers

Next time you think about flying standby on American Airlines, be prepared to give the gate agent your name and $50.

The days of hanging around the agent's desk, hoping for a free switch to an earlier flight are over at American for many passengers.

The nation's second-largest airline said Wednesday that starting with tickets bought on Feb. 22, only elite frequent fliers, travelers in first or business class, military personnel and people who bought pricey coach tickets will be allowed to fly standby for free.

Everyone else switching flights on their day of travel will have to pay $50 to get a confirmed seat.