IN BRIEF

WASHINGTON

Fewer jobless-benefits claims spark optimism

Fewer people are claiming jobless benefits, leading economists to project that next week's employment report will show a sharp drop in job losses for July compared with June.

Claims for jobless aid, which track layoffs and firings, are falling in a modest sign of improvement in the labor market, economists note.

That helps explain why analysts are forecasting that a net of about 340,000 jobs will be lost in July. This would compare with a net of 467,000 jobs lost in June and 741,000 that were lost in January -- the most for any month since 1949.

The slowdown in job cuts is a positive sign for the labor market, though most economists still expect the unemployment rate to keep rising into next year. The jobless rate, which reached 9.5 percent in June, is widely expected to top 10 percent by the end of the year.

Slumping demand stings oil companies

Oil giants Exxon Mobil and Royal Dutch Shell on Thursday added to the industry's worst midyear showing in years, stung by slumping global energy demand that threatens to further slow exploration and production.

For Exxon, the world's biggest publicly traded oil company, a 66 percent profit plunge for the second quarter was its lowest result in nearly six years.

Exxon Mobil, based in Irving, Texas, said earnings for the April-June period came to $3.95 billion, or 81 cents a share. That was down from $11.68 billion, or $2.22 a share, a year ago, a record at the time.

Excluding one-time items, net income in the most-recent quarter amounted to $4.09 billion, or 84 cents a share.

The latest result missed the average Wall Street profit forecast by a wide margin. Analysts polled by Thomson Reuters were looking for net income of $1.02 cents a share. Those estimates typically exclude one-time items.

Revenue fell 46 percent, to $74.5 billion from $138.1 billion a year ago.

Shell said its profit slid 67 percent to $3.82 billion, but results exceeded analysts estimates.

Lawsuit accuses Sahara of harassment

The Equal Opportunity Employment Commission has filed a lawsuit against the Sahara, alleging harassment and retaliation.

In the federal complaint, filed Thursday, the EEOC cited the national origin of Egyptian native Ezzat Elias. A joint statement released by the agency's Las Vegas and regional offices said Elias was harassed "through a daily barrage of derogatory comments due to his national origin."

After he complained about the way he was treated, Elias' "supervisors retaliated against him, which included disciplinary action, write-ups and suspension," the agency alleges.

The EEOC seeks monetary damages for Elias and an injunction against the Sahara "to prevent such discrimination in the future," according to a statement.

A representative of the Sahara declined to comment specifically on the Elias case, but defended the company's overall harassment policies.

Restraining order will prevent sale of plant

The Culinary Union Local 226 won a temporary restraining order motion in Nevada federal court Thursday to prevent Mission Industries from selling its plant in Carson City.

The plant was scheduled to be sold Wednesday.

The union filed the lawsuit in Las Vegas on Wednesday asking to block the sale until the terms of a collective bargaining agreement can be enforced with the new owners.

Judge James Mahan is scheduled to hear the union's application for preliminary injunction at 9 a.m. Aug. 10.

Mission Industries had planned to sell the Carson City facility to Salt Lake City-based linen service company, Alsco Inc.

According to the lawsuit, the union's collective bargaining agreement prevents the laundry company from selling any part of its operations without a written agreement from the buyer to honor the union's contract.

Political stars to come to energy summit

Senate Majority Leader Harry Reid, D-Nev., and former Vice President Al Gore announced in a Thursday conference call an expanded lineup of guests set to participate in Reid's National Clean Energy Summit 2.0.

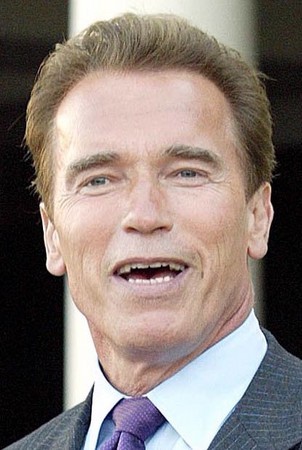

Reid confirmed that California Gov. Arnold Schwarzenegger would participate in the event, scheduled for Aug. 10 and 11 at the Cox Pavilion on the campus of the University of Nevada, Las Vegas. Reid said U.S. Secretary of Labor Hilda Solis and Rep. Tim Wirth, D-Colo., would also attend. The three join a roster of notables already scheduled to appear at the summit, including Gore, oilman T. Boone Pickens and U.S. Energy Secretary Steven Chu.

The summit's focus will be jobs, investment and consumer savings.

NEW YORK

Citigroup gave workers $5.33 billion in bonuses

Citigroup Inc., one of the biggest recipients of government bailout money, gave employees $5.33 billion in bonuses for 2008, New York's attorney general said Thursday in a report detailing the payouts by nine big banks.

The report from Attorney General Andrew Cuomo's office focused on 2008 bonuses paid to the initial nine banks that received loans under the government's Troubled Asset Relief Program last fall. Cuomo has joined other government officials in criticizing the banks for paying out big bonuses while accepting taxpayer money.

Citigroup, which is one-third owned by the government as a result of the bailout, gave 738 of its employees bonuses of at least $1 million, even after it lost $18.7 billion during the year, Cuomo's office said.

INDIANAPOLIS

Share prices growing for big health insurers

Sliding enrollment or rising expenses marred the second-quarter performance for nearly all major health insurers, but sector stock prices have responded with a growth spurt.

Share prices of several companies have climbed around 10 percent since Minnetonka, Minn.-based UnitedHealth Group Inc. became the first insurer to report earnings July 21.

Analysts say they see many positives in insurance stocks when they look beyond factors like slumping enrollment. Investors also are becoming less concerned about how the health care overhaul debate in Washington may affect the industry.

UnitedHealth, WellPoint Inc. and Cigna Corp. all had their enrollments fall during the quarter, largely due to employer job cuts. WellPoint and Aetna Inc. also pointed to rising expenses spurred by the economy as an additional detriment.

NEW YORK

Losing skid ends as Motorola posts profit

Helped by extensive cost cuts, Motorola Inc. on Thursday posted an unexpected profit for the second quarter after several quarters of losses.

Motorola earned $26 million, or 1 cent per share, in the three months ended July 4, up from $4 million, or break-even per share, a year ago.

The latest results were boosted 2 cents per share by various one-time effects, but even so, Motorola exceeded its own earnings forecast, which called for a loss of 3 cents to 5 cents per share, excluding the cost of its restructuring initiatives.

LONDON

Oil prices increase as signs signal recovery

Oil prices rose Thursday as upbeat corporate earnings suggested the global economy is slowly recovering, though inventories data showed U.S. crude demand remains weak.

Investor sentiment improved after several big companies in Asia and Europe reported good earnings.

More evidence emerged on Wednesday that drivers may be cutting back on gasoline consumption when the Energy Information Administration said crude supplies in the U.S. grew by 5.1 million barrels last week, or about 18 percent above last year's levels.

Benchmark crude for September delivery rose $3.59, or 5.6 percent, to settle at $66.94 a barrel on the New York Mercantile Exchange.