Nevada regulators close down Cumorah Credit Union

Nevada officials late Friday shut down Cumorah Credit Union, which serves 15,000 members of The Church of Jesus Christ of Latter-day Saints, and turned over its deposits and assets to an Illinois credit union.

Credit Union 1, a $574 million institution based in Rantoul, Ill., will assume all of Cumorah's deposits and loans.

Cumorah has 60 employees, two offices in Las Vegas and two in Henderson. It was not clear Friday night whether Credit Union 1 will keep all of Cumorah's employees and branches.

However, none of Cumorah's members will lose their deposits because of the credit union failure, said George Burns, commissioner of the Financial Institutions Division.

Cumorah members may continue to write checks, withdraw money from automated teller machines and conduct other business with Credit Union 1.

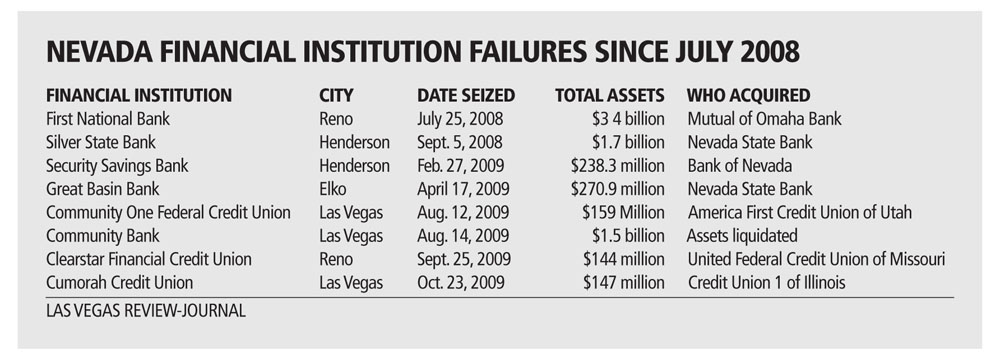

The failure of Cumorah marks the eighth time since July 2008 that regulators have closed a Nevada bank or credit union because of loan losses related to the recession.

Cumorah, however, is the first privately insured Nevada credit union to fail since the financial crisis began that relies on deposit insurance from American Share Insurance, a mutual insurance company in Ohio.

While some Nevada credit unions have federal deposit insurance, Cumorah is among several that rely on American Share Insurance to protect members' deposits.

"Due to inadequate capital and mounting loan losses, it was necessary to take possession of Cumorah Credit Union," Burns said in a statement.

In an administrative order, Burns said Cumorah was "operating in an unsafe and unsound manner" and was "in imminent danger of insolvency." Burns also cited lack of capital or net worth, poor liquidity, inadequate earnings and "excessive loan risk."

Cumorah's members and employees got earlier warnings about problems at the credit union. Former Chief Executive Tony Mook last month said he had laid off 42 of 101 employees to cut expenses over the last 18 months.

After Mook was quoted in the Review-Journal, the Cumorah Web site posted a notice titled "Your Money is Safe."

The credit union said: "As a result of the difficult economy and perhaps increased media attention, we've also become aware of several rumors in circulation. Each is a different variation of an impending closure or merger for Cumorah."

Cumorah leaders reassured members that they were "looking forward to emerging from the recession as a stronger organization more capable of meeting your changing financial needs."

Early this month, Mook, chief executive officer of Cumorah for 19 years, resigned.

Paul Simons, the CEO of the Credit Union 1, took over as interim chief executive officer of Cumorah, but it wasn't disclosed until Friday night that Simon's credit union would assume all the deposits and loans at Cumorah.

Simons this week disclosed that Cumorah ran into problems when its commercial real estate loans started to become delinquent.

Some bankers privately argue that credit unions should stick to consumer loans, car loans and home loans, because they lack the expertise needed for commercial lending.

Credit Union 1 does not make commercial loans, but Simons disagreed with critics earlier this week.

"There are credit unions that are extremely successful with commercial real estate and business (loans) in general," Simons said. A credit union in New York makes loans on taxi medallions.

Contact reporter John G. Edwards at jedwards@reviewjournal.com or 702-383-0420.