State insurance exchange may be new to those without coverage

The state insurance exchange has been around for nearly a year, but it may be a whole new world to people who’ve recently lost employer coverage.

So this week, we help a consumer who’s essentially starting the buying process from scratch after her workplace disappeared.

We also respond to a cry for positive news about the Affordable Care Act’s launch.

■ First up, Ann of Las Vegas writes for guidance on behalf of her daughter, a 28-year-old who voluntarily moved from full-time to part-time work for a local megaresort operator. Ann wants to know the name of the website through which her daughter can buy coverage, as well as how to find out what she qualifies for and whether she can even sign up right now.

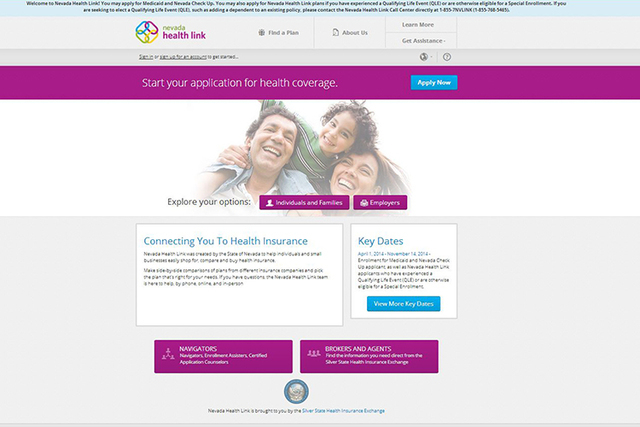

So Ann, the website you want is www.nevadahealthlink.com. And that will still be the website consumers visit come open enrollment in November, when the state marketplace begins borrowing enrollment functions from the federal exchange.

To begin shopping, visit the website and click on the “Individuals and Families” button in the “Explore Your Options” section. After your daughter enters basic information, including her name, ZIP code and income, she can look at what’s available in the market.

But to determine how much of a federal tax credit she can get to lower her premiums, she’ll need to apply for coverage through the website. Given her income, which you listed at $16 an hour for 24 hours to 30 hours a week, your daughter is almost certainly eligible for a premium-subsidizing tax credit. That means she should definitely buy through Nevada Health Link because that’s the only way to earn the federal assistance.

And unlike most people, your daughter is eligible to buy today, outside of open enrollment, because she’s had what’s called a qualifying life event — in this case, losing her employer-sponsored coverage. Other qualifying life events include moving, having a baby, getting married, facing enrollment glitches on a state insurance exchange or even experiencing a death in the family.

With a qualifying life event, there’s no waiting period, which means your daughter’s coverage can begin as early as Sept. 1. She does need to act fairly quickly, though: Her eligibility to buy before open enrollment expires within 60 days of the life event.

Before you both begin shopping, remember that buying a silver-tier plan is the only way to qualify for not just a premium tax credit, but also cost-sharing reductions that can slash co-pays and other out-of-pocket expenses.

It’s possible you and your daughter will see some technical problems on the site, especially when trying to make a payment. If the website is too glitchy, your daughter can either consult a health insurance broker for help enrolling at no upfront cost to her, or she can buy a plan off of the exchange directly through the insurer of her choice. She just won’t get the tax credit until she can buy through Nevada Health Link.

■ Local resident Amy Farnsworth is “very disturbed” by the “negativity” surrounding the Affordable Care Act and wants to see more success stories on how the law has changed the lives of “normal, middle-class Las Vegans for the better.”

Amy, you’re right that coverage of the law — not just locally, but nationally — has focused more on technical glitches and coverage horror stories.

There are reasons for that: For one thing, it’s the nature of the media to focus on the unusual. That’s why the evening news reports the fatal wreck, but ignores the 260,000 cars a day that make it safely past the interchange of Spring Mountain Road and Interstate 15.

Also, people typically call us to complain. So we’re simply likelier to learn about the problem cases.

Which brings us to our final point: When they come across our desk, we highlight those problem cases because sometimes that’s the only way to get them fixed. More than once, we’ve heard from consumers who spent months trying to untangle coverage problems to no avail, only to have their mix-ups fixed within hours of a full airing in the paper.

And sometimes, our reporting is how elected officials and policymakers learn just where the Affordable Care Act’s rollout is going wrong. That makes it likelier those issues get addressed, which only helps implementation of the law in the long run.

But you have a positive story to tell, Amy, and in the interest of fairness, we’ll share it:

“My previous health care was almost $400 per month with a deductible of $4,000. Through the (state insurance exchange), I am paying $267 for a $500 deductible. I recently broke my foot, and while I did have significant out-of-pocket expenses, I am still very satisfied with the way (insurer) Nevada Health Co-op dealt with it. Those who choose to hate ‘Obamacare’ may not believe there are success stories and need to realize that they exist!”