COMMENTARY: Corporate welfare, EVs and industrial policy — perfect together

In January, Rasmussen Reports and the Woodford Foundation announced the results of their latest national telephone and online survey that found 64 percent of likely U.S. voters favor ending “corporate welfare,” while 20 percent disagree. An additional 16 percent are not sure.

Sixty-five percent of Republicans support ending “corporate welfare,” as do 64 percent of Democrats and voters not affiliated with either major party. In a 2019 academic paper, Byron Schlomach, Stephen Slivinski and James Hohman define “corporate welfare” as “any financial benefit (including grants, loans, tax breaks or other subsidies) purposely granted by the government to a business or class of businesses and that is not generally available to all businesses and taxpayers.”

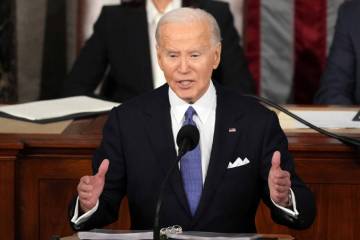

The Biden administration is a champion of “green industrial policy” embedded in the Infrastructure Investment and Jobs Act of 2021 and the Inflation Reduction Act of 2022. Economists Howard Pack and Kamal Saggi define industrial policy “as any type of selective intervention or government policy that attempts to alter the sectoral structure of production toward sectors that are expected to offer better prospects for economic growth than would occur in the absence of such interventions, i.e., in the market equilibrium.”

This green industrial policy is illustrated in electric vehicle corporate welfare provisions found in both acts.

In the Infrastructure Act, the Transportation Department received $7.5 billion to develop a national EV charging network that meets “current or anticipated market demands.” Some policymakers argue that building more EV chargers in low-income areas will encourage additional EV sales despite a lack of data supporting this assertion.

Faster EV chargers in denser population areas may also require electrical grid capacity to be upgraded, as was demonstrated in California, where EV owners were asked during heat waves to not charge their vehicles overnight.

Likewise, the IRA includes a revamped $7,500 tax credit for a new electric vehicle purchase or $4,000 for a used one. The IRA revamps the existing EV tax credit from the buyers’ income level ($300,000 for married couples filing jointly, $225,000 for heads of households, and $150,000 for all other filers) to which models can qualify (must be assembled in North America, and have a sticker price of less than $55,000 for cars and $80,000 for SUVs and trucks).

How successful has this green EV industrial policy been over the past two years?

Cox Automotive expects EV sales in the United States to grow to 10 percent in 2024, up from 7.6 percent in 2023 and 5.9 percent in 2022. However, this 2024 EV sales forecast may be optimistic, as interest rates make vehicle purchases — and especially EV purchases — a more difficult decision for consumers.

Moreover, Cox estimates that the average transaction price for a vehicle in the United States was $48,000 in September 2023. However, for EVs, it ranged between $53,000 and $60,000. Over the past year, the EV market has struggled with price cuts and rising inventories. In August, it took about twice as long to sell an EV as it did the previous January.

Also, EV chargers have emerged as a significant “reliability” issue. For example, in a July 2023 Pew Research Center survey, 53 percent of U.S. adults “have low levels of confidence” that the United States will build sufficient EV charging stations and infrastructure to support a large volume of EV vehicles. More than two years later, the Department of Energy vehicle charging program has yet to install a single charger. An August 2022 survey by J.D. Power found that one in five EV owners who had recently visited a charging station could not charge due to a system malfunction. Add to consumer “range anxiety” the results of a 2019 AAA research study found that EVs (running exclusively on battery packs) lose 41 percent of their operating range when outdoor temperatures drop to 20 degrees Fahrenheit and the heater is operating.

A productive company approach to automotive electrification incorporates the realities of technological reliability, cost and consumer acceptance. One prescient automotive analyst recommends that “greater hybrid vehicle production and purchasing could generate a slew of new opportunities in the short to medium term.”

Toyota has addressed this recommendation with a technology strategy combining an internal combustion engine (for long trips) and a plug-in EV battery available (for short trips) in the same vehicle.

Thomas A. Hemphill is David M. French Distinguished professor of strategy, innovation and public policy in the School of Management, University of Michigan-Flint. He wrote this for InsideSources.com.