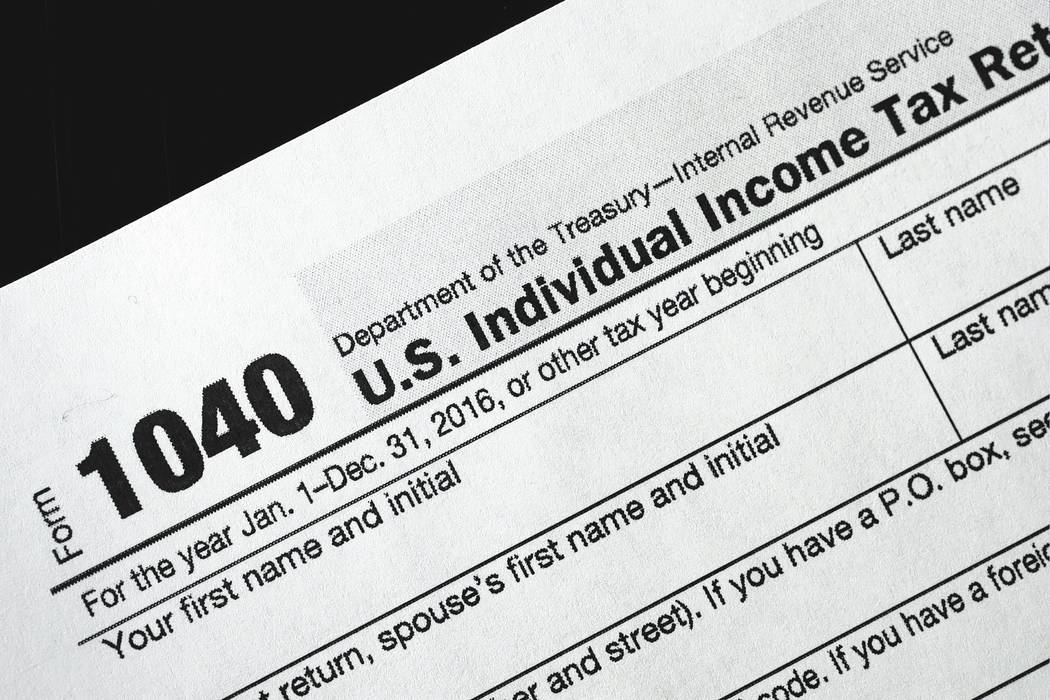

Special-interest tax deductions should all be on the chopping block

In response to Wayne Allyn Root’s Nov. 30 column criticizing the GOP tax plan:

The deduction for property tax and state income tax allows high-tax states to make the argument that that hefty taxes aren’t so bad because you may write them off on your federal return. Take that argument away, and those governments will have to more fully justify their expenditures.

The taxpayers of low-tax states (such as Nevada) should not have to subsidize spendthrift states such as New York, New Jersey, Connecticut, California and others.

As to the deduction for mortgage expenses: Why should those of us who are mortgage-free subsidize those who have indebted their future for immediate satisfaction? How many got caught in the housing bust of 2006 because they did not understand what they were getting into? Your mortgage payments are tax deductible, so no worries.

Owning a home is a major financial commitment and should not be taken on lightly. Medical expenses are part of the cost of staying alive, just like food, clothing and shelter. No one would put off a life-saving procedure because it was not tax deductible, yet some might have an unnecessary procedure because they could deduct the cost.

All these deductions should be eliminated.