RICH LOWRY: Joe Biden’s inane war on packaging

Joe Biden has met the enemy, and it is smaller packaging for foodstuffs.

The White House is targeting the practice known as “shrinkflation,” or companies keeping the nominal price of a product the same while decreasing the amount. This, naturally, is just another way of charging more. If the price is the same, but you’re getting only 14 ounces of Wheat Thins instead of 16, you are paying more for your whole-wheat crackers.

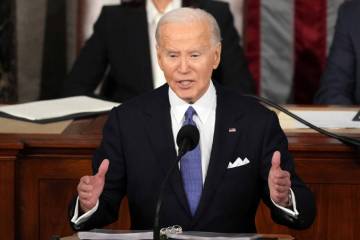

President Biden slammed shrinkflation in a Super Bowl video featuring various offending snacks, including Doritos, Tostitos and Oreos. He called it a “rip-off” and declared that “the American public is tired of being played for suckers.” He may revisit the theme in his State of the Union address.

This has to rank as one of the most economically illiterate and juvenile presidential crusades in recent history.

Shrinkflation is a symptom of inflation, not a cause. And to the extent it is fooling anyone about higher prices, it is helping Biden, whose economic record has been blighted by persistently high prices, especially for food. A company that is raising its prices can either charge more or reduce the size of its product. What Biden is suggesting is that the former is the best option and companies should always increase their sticker prices.

If he were being cogent, Biden should have held up a bag of Doritos in his Super Bowl video and said, “I don’t care what Frito Lay says — this bag should be .50 ounces bigger and more expensive than it is now. How dare corporate America deal with the stubbornly high inflation the past few years by trying to hide from people how they are paying more for food.”

Of course, Biden’s goal is to shift blame, yet complaining about smaller bags is only another way of complaining about higher prices. He might as well be pointing out that beef now costs an ungodly $8 a pound, or that the price of baby food has increased nearly 9 percent over the past 12 months. According to a report in The Wall Street Journal, consumers are spending the highest proportion of their disposable income on food since 1991.

The focus on shrinkflation is a variant of the corporate-greed argument advanced by Elizabeth Warren and other progressives. It maintains that inflation is an artifact of companies arbitrarily deciding to raise prices to boost their profits. There is a basic implausibility in this theory. It assumes that for several decades during the long period of low inflation in the United States, corporations didn’t use this pricing power. Then, they suddenly decided to wield it beginning in 2021, coinciding with a period of supply-chain disruptions, loose monetary policy and extravagant federal spending — all of which one would expect to be drivers of inflation.

As for shrinkflation, even the consumer advocate who has been briefing the White House on this trend, Edgar Dworsky, admits that “these tactics tend to become more prevalent during times of high inflation,” in the words of a CNBC report.

The causes of higher food prices, by the way, aren’t a mystery. Why is the price of beef elevated? The supply of cattle has declined. What’s up with the more expensive Oreos? Cocoa prices, the Journal reports, recently passed a 46-year record. And labor costs have gone up with increases in the minimum wage in states across the country.

Still, The New York Times reports that the White House is considering new executive actions to crack down on shrinkflation. Assuming it’s within the power of the presidency to influence the size of bags, boxes and bottles of food and drink, forcing them to stay larger would only render the underlying price increases more plain.

One might think that the nation’s chief executive would have more important things to worry about than the size of Gatorade bottles, but such is the White House’s political desperation on food prices that nothing is too inane or nonsensical.

Rich Lowry is on X @RichLowry.