Centex buy helps Pulte grow locally

Pulte Homes' purchase of Centex Homes will help the homebuilder strengthen its local market share and reach a new segment of homebuyers, industry officials said Wednesday.

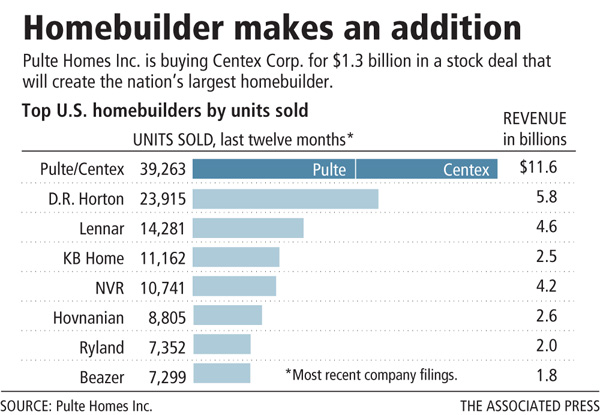

Pulte on Wednesday agreed to acquire Centex Homes for $1.3 billion in stock, creating the largest home-building company in the United States with combined annual sales of 39,000 homes and $11.6 billion, Pulte spokeswoman Jackie Petroulakis said from her Phoenix office.

"We're better positioned for growth through segment and market diversity," she said. "It's a very good combination of complementary brands. The company as a whole is better poised to accelerate our return to profitability."

Housing analyst Dennis Smith of Las Vegas-based Home Builders Research said the acquisition will make Pulte, which already has a major presence in Las Vegas, even stronger locally by giving it control of Centex's lots in North Las Vegas, giving the company a shot at the lower-end home segment. Most of Pulte's subdivisions are in upscale communities such as Anthem and Summerlin.

The acquisition also gives Pulte large tracts of land in Texas and the Carolinas, two of the nation's most resilient real estate markets. Centex is based in Dallas.

The new company, which will include the Del Webb and Fox & Jacobs brand homes, will keep the Pulte name and headquarters in Bloomfield Hills, Mich. There will be an unspecified number of job cuts.

"It allows us to not only survive, but thrive in any economic climate," said Richard Dugas Jr., Pulte's president and chief executive, who will retain those titles over the combined enterprise.

Smith said he wasn't surprised by the news. He'd heard that Pulte was looking to acquire Centex for a while, and said it probably won't have much of an effect on Las Vegas.

Centex has been winding down its local operations for the last couple of years, selling off finished lots and moving staff to Phoenix, he said.

"They lost faith in the Vegas market," Smith said. "They were the first, or at least the biggest builder that basically pulled out of Vegas."

Centex let the option expire on a 2,000-acre development in Henderson that required extensive land remediation for toxic soil. Another part of the company, Centex Destinations, had purchased the planned Urban Village mixed-use development on Las Vegas Boulevard South and eventually sold the 50-acre parcel at a loss.

Tim Sullivan of San Diego-based Sullivan Group Real Estate Advisors said it's not a bad thing overall for the builders to consolidate.

"It's absolutely a sign of the times," Sullivan said. "Notice it's a stock swap and not a cash deal. It lets them combine their platforms. It's probably a wise defensive move. The market is contracting and they're getting together to be the biggest, baddest guy on the block. That's the offensive part of it."

Homebuilders have been pummeled by declining sales and tight financing, Smith of Home Builders Research said. He reported just 8,994 new-home sales in Las Vegas in 2008, compared with 15,584 closings in 2007 and a peak of 30,829 closings in 2005. Pulte-Del Webb was the No. 1 homebuilder in Las Vegas with 1,471 closings in 2008, while Centex closed 390 new-home sales. KH Home was second with 1,052 sales.

Pulte expects to save $350 million a year by integrating Centex's operations. The new company will have $1.8 billion in debt and cash reserves totaling $3.4 billion. The company will pay off $1 billion in debt by the end of the year.

Wall Street analysts are concerned about the risk of taking on so much land in other areas where home prices are still plummeting, including Sacramento and Riverside, Calif., and Cape Coral, Fla.

"I never would have thought Centex and Pulte would have gotten together, but of all the sort of potential combinations out there, it's probably the one that makes the most sense," said Robert Stevenson, an analyst with Fox-Pitt Kelton.

Las Vegas is left with about 100 homebuilders and that will probably drop to 50 within a year, said Larry Murphy, president of SalesTraq. Avante is long gone, Rhodes recently filed for bankruptcy, Astoria went into "hibernation" and Beazer cut its staff from 70 employees to eight. Kimball Hill requested that it be removed from SalesTraq's brochures, an indication it may be the next acquisition, Murphy said.

"It makes perfect sense," he said. "There are probably 10 other builders who wish somebody would buy them out. They're selling cheap, they've got few starts and they're down to skeleton crews."

Centex has three active subdivisions in North Las Vegas with homes starting at $139,900 for a 1,375-square-foot single-family home. A two-story, 2,945-square-foot Centex home in Berkshire Estates is selling for $235,900, or $80 a square foot.

Pulte is offering Centex shareholders 0.975 shares of its common stock for each share of Centex that they own. The transaction is valued at $10.50 per Centex share based on Pulte's Tuesday closing stock price of $10.77. That represents a 38 percent premium to Centex's closing price of $7.62 on Tuesday.

Pulte stockholders will own about 68 percent of the combined business and Centex shareholders will own the remaining 32 percent.

Shares of Centex soared $1.44, or nearly 19 percent, to $9.06 Wednesday on the New York Stock Exchange. Pulte stock sank $1.13, or about 10.5 percent, to $9.64, also on the NYSE.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491. The Associated Press contributed to this report.