Foreclosure filings drop

Reflecting a national trend, the number of preforeclosure filings and real estate-owned, or bank-owned properties, in Las Vegas fell in October from the previous month, Foreclosures.com reported Tuesday.

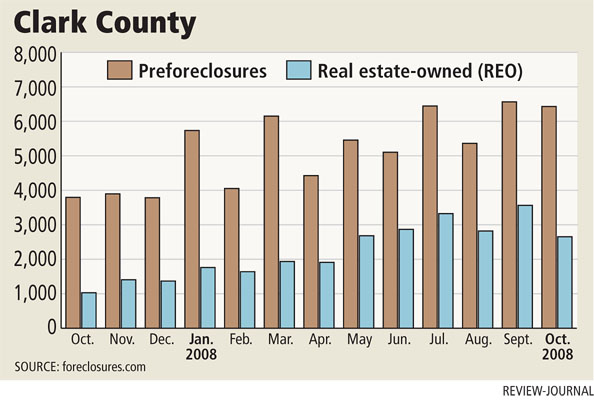

In Clark County, preforeclosures dropped to 6,420 in October from 6,565 in September, while REOs were down to 2,653 from 3,563, the California-based online provider of foreclosure information reported.

Still, preforeclosures and REOs have increased 69.2 percent and 157.6 percent, respectively, from the same month a year ago.

The U.S. Foreclosure Index showed a dramatic drop in foreclosures nationally, though the Southwest and Southeast regions continue to post high numbers.

Lenders took control of 84,286 properties in October, down 22 percent from September's high of 107,950. October's number was the lowest since May.

Preforeclosure filings dropped to 166,230 nationally in October, down from 178,523 in September and 185,362 in August -- a signal of a continued future slowing of foreclosures. October numbers were down in about half of the states in the U.S. Foreclosure Index.

Foreclosures will likely be part of the broader economic issue facing President-elect Barack Obama when he takes office in January, Foreclosures.com president Alexis McGee said.

"He has promised a 90-day freeze on foreclosures," she said. "But each state has its own regulations relating to foreclosures, so whether the promise will become reality is another question."

Meanwhile, for the next three months, foreclosures and economic stimulus packages remain the purview and the problem of the Bush administration.

Government intervention in foreclosures could end up a moot issue, McGee said, since some key banks and lenders already have recognized that keeping homeowners out of foreclosure is good business.

Banks such as FDIC-operated IndyMac, Bank of America and most recently JP Morgan have pledged to cut monthly payments for many strapped borrowers by lowering interest rates and temporarily reducing home loan balances, McGee added.

Tim Kelly Kiernan, REO specialist with the Brodkin Group at ReMax Pros, said prospective buyers of foreclosed homes are making offers on four or five properties at a time to increase their odds of getting one approved by the bank.

"A lot of people are low-balling the banks, which is not very smart," he said. "They hear everything on TV about foreclosures and they think they can get it for less than it's listed for. Banks have done their homework. If they list it for $100 a square foot, they're not going to take $75 a square foot."

States with the highest number of foreclosures in October were California (17,209); Arizona (12,002); Florida (10,186); Georgia (5,518); and Texas (5,112). Nevada ranked No. 8 in the nation with 3,176 foreclosures, down from 4,020 in September.

"I still think there's another 10,000 to 20,000 REOs sitting there waiting to be released on us," Kelly Kiernan said.

Foreclosures.com reported that 11.5 out of every 1,000 households nationwide have been repossessed by lenders this year, up 71.6 percent from a year ago. Another 24.6 of every 1,000 households have had to deal with preforeclosure filings.

Foreclosures.com numbers are based on formal notices filed against a property, including notice of default, notice of foreclosure auction or notice of lender-owned real estate that occurs after a foreclosed property reverts back to the lender.

A separate report from Credit Suisse said new foreclosures outpaced sales in Las Vegas, leading to higher inventory and lower prices.

Foreclosures continue to drive home prices lower and inventory increased as foreclosure sales slowed, but the pace of new foreclosures didn't, the report said.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.