Report: Nevadans divided over strategic defaults

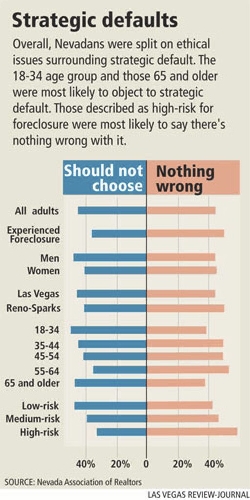

Nevada homeowners are equally divided over the ethics of "strategic default" or not paying their mortgage even though they can afford to, a report released Thursday by the Nevada Association of Realtors shows.

Forty-five percent of adults surveyed said there's nothing wrong with strategic default, while an equal percentage said homeowners have a legal and ethical obligation to pay their mortgage.

The 52-page "Face of Foreclosure" report, conducted by Gainesville, Fla.-based SGS Research, surveyed 500 Nevada adult residents and 500 individuals who had received at least one foreclosure filing, lead researcher Joel Searby said.

The most significant finding is the one-to-one split over strategic defaults and whether it's a financial decision or an ethical decision, Searby said.

A second noteworthy finding is that 40 percent of those who had gone through foreclosure were advised by financial experts to default on the loan to receive government assistance, he said.

"In order to have any recourse, they have to default. That creates incredible instability in the market when they're advised to default," Searby said Thursday. "Despite all of that, there's still a fundamental belief in home ownership in Nevada. As a researcher, I would expect that to take a major hit given all the negative news in Nevada."

Nevadans expressed a dim view of government programs such as the Home Affordable Modification Program, or HAMP. Only 9 percent of those facing foreclosure and 10 percent of all Nevadans said foreclosure prevention programs have helped. Still, 55 percent believe government has a role in addressing the problem.

Despite frustration with government programs designed to assist distressed homeowners, Nevadans place a high value on home ownership. The survey found that 79 percent of those who faced foreclosure still believe owning a home is part of the American dream.

Also, 55 percent of survey respondents said owning a home is a better value than renting, compared with 39 percent who said renting was better.

Last year's "Face of Foreclosure" report found that 23 percent of Nevadans who lost their homes to foreclosure admitted they simply walked away from mortgage payments they could otherwise afford to make. That percentage climbed to 27 percent this year.

"People were not admitting to it a couple years ago," said Blane Johnson, president of Nevada Association of Realtors in Incline Village. "Now more people are willing to say they did it. They're never going to get their money back. It's easier and cleaner to walk away."

Bankers should take note of the report, Johnson said. If they see that strategic default is becoming more socially acceptable, they should "get ahead of these issues" and modify loans to keep people in their homes, he said. Strategic defaults bring home values in the neighborhood down by 7 percent, he said.

Everybody who's upside down on their home - owing more than it's worth - would love to see principal reduction, but just getting them down to current interest rates would help, he said.

"If I could refinance and get a $1,000 break on the payment, at least I'm getting equity built back up by paying down the loan, or I could be spending it in the community," Johnson said. "It might take weight off my shoulder."

Rick Piette, owner and broker of Premier Mortgage Lending in Las Vegas, said people are more likely to strategically default if they know someone else who did and if they're so far underwater they don't ever see their home value coming back. Nationally, people walk at about 40 percent negative equity, he said.

"It really comes down to how many folks do you know who've done it, people on your block or relatives. That kind of softens the blow," Piette said. "But the main thing is how far you're underwater. That influences when they walk."

The survey was conducted by telephone interviews March 29 to April 2 and April 22-24, and the margin of error is 5 percent.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.