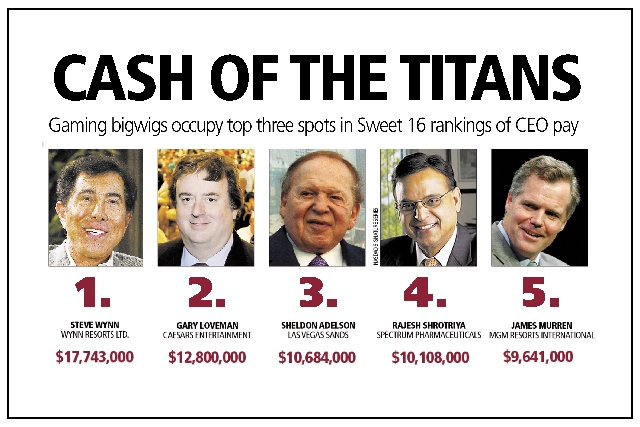

Gaming bigwigs occupy top three spots in Sweet 16 rankings of CEO pay

The natural order returned last year to the CEO pay ranking for Las Vegas public companies.

After a year that saw the head of a pharmaceutical maker incongruously rise to the top of the last, the titans of the Strip dominate the top of the list in 2012.

But don’t feel sad for Rajesh Shrotriya of Spectrum Pharmaceuticals, a cancer drug maker that quietly shifted is headquarters from Southern California to Henderson two years ago. He fell from the top spot but landed in fourth place even with 60 percent pay cut caused almost entirely by lower stock and option awards.

THE EFFECT OF EXERCISING

In coming up with the annual Sweet 16 of CEO compensation, the Las Vegas Review-Journal followed the calculations prescribed by the Securities and Exchange Commission for the proxy statements that announce annual meetings. By that standard, Steve Wynn of Wynn Resorts Ltd. led the pack at $17.7 million.

But when adding the $30.6 million he netted by exercising stock options on top of his $10.7 million in regular pay, Sheldon Adelson of Las Vegas Sands Corp. blew the rest of the field away.

Because options are included in the pay numbers when they are awarded, generally several years before an exercise, SEC rules preclude double counting options when they are cashed in. The amount also does not always represent cash in the CEO’s pocket, but just the difference between a stock’s market price and the lower option price.

For exercises, Sheldon Adelson’s wife, Dr. Miriam Adelson, came in light-years ahead of everyone else. She earns about $50,000 a year on Las Vegas Sands’ payroll as the director of community involvement. But she reaped at least $3.8 billion in 2012 for her role in helping to stabilize the company when its balance sheet wobbled during the recession.

The Las Vegas Sands proxy does not calculate the size of the benefit but rather describes the structure of the transaction. In November 2008, Miriam Adelson invested $525 million in the company for a package of preferred stock and warrants for common stock on the same terms as those offered to the public in a concurrent securities offering. The warrants, which closely resemble options, allowed her to buy 87.5 million shares at $6 each.

The proxy said she chose to exercise the warrants on March 2, when the stock’s low price was $56.31. Multiplying the $50.31 difference by the number of shares yields $4.4 billion, dropping to $3.88 billion when subtracting the 2008 purchase price. Company documents don’t detail how much of the purchase price was allocated to the warrants, but a spokesman said she has kept the shares rather than sell them.

DISSECTING THE NUMBERS

Spring has become the busy season for the cottage industry that has emerged around executive compensation as proxy statements get filed. Numerous advocacy groups have dissected the numbers to back cases that CEOs have come to view companies as personal ATMs for pay and perks.

This year, International Game Technology joined the critics. In trying to fight off a board of directors election fight from a group that included former Chairman and CEO Charles Mathewson, the incumbents adopted language that even the most avid critics would embrace. In a Feb. 1 letter to shareholders, the incumbents took aim at “questionable compensation practices” that included having shareholders “continue funding his lavish lifestyle even after his retirement from the board” in 2003.

Now, midsize and large companies go to great lengths to spell out their policies, explaining how they compare with those of similar companies and detailing standards for computing equity or cash bonuses. NV Energy, for example, spends 40 pages to explain not only what it did but why.

The ultimate stated goal remains aligning pay with shareholder interests, as measured by stock price and dividend gains. But in only eight instances did pay and return rise or fall in tandem on the Sweet 16 list, while others diverged — including lower pay after better stock performance.

For most of the companies, base salary now accounts for one-fourth or less of the total pay package.

Among the highlights:

■ Wynn continues to have by far the largest severance plans. The $58.3 million he would receive in the event of death or complete disability by itself is larger than anyone else’s, but it rises to $239.2 million if he loses his job in a takeover. Also, Wynn was the only one who claimed merchandise discounts.

■ NV Energy bases one bonus payment partly on a customer satisfaction survey. The proxy said that the report, prepared by the firm Market Strategies International, gave the company a 71.8 percent score, 0.2 points below the level designated as “on target.”

■ Only three companies paid cash bonuses. The bulk of nonsalary compensation now comes in securities that take several years to mature.

■ Gary Loveman’s 37 percent year-to-year drop at Caesars Entertainment Corp. was almost entirely because of lower stock option awards and a nonequity bonus program.

His above-median salary, according the proxy, reflects the size of the company and that several peers own much larger stakes in their companies.

■ Sheldon Adelson and Maurice Gallagher Jr. of Allegiant Travel Co. were the only bosses who had several subordinates earning more in regular pay than they did. Gallagher takes no salary despite heading what has grown into a $1 billion-a-year company.

Contact reporter Tim O’Reiley at toreiley@reviewjournal.com or 702-387-5290.

1. STEVE WYNN

WYNN RESORTS LTD.

$17,743,000

Total compensation

2011: $16,474,000

2010: $14,615,000

Year-end stock price:

2012: $112.49

2011: $110.49 ($100.85)*

2010: $103.84 ($89.97)*

2012 pay components:

Salary: $4,000,000

Cash bonus: $2,000,000

Stock awards: $0

Option awards: $0

Nonequity incentives: $10,000,000

Other: $1,743,000

Equity holdings:

10,031,000 shares

Footnotes:

$451,000 for villa at Wynn Las Vegas

$1,188,000 for company jets

$18,000 for medical and life insurance

$61,000 for driver and cars

$23,000 in merchandise discounts

Severance:

$58,281,000 to $239,167,000

2. GARY LOVEMAN

CAESARS ENTERTAINMENT CORP.

$12,800,000

Total compensation

2011: $20,403,000

2010: $18,266,000

Year-end stock price:

2012: $6.92

2011: Not public

2010: Not public

2012 pay components:

Salary: $1,900,000

Cash bonus: $0

Stock awards: $0

Option awards: $7,456,000

Nonequity incentives: $2,400,000

Other: $1,043,000

Equity holdings:

931,000 shares and options

Footnotes:

$237,000 for security

$536,000 for corporate jets

$53,000 for tax reimbursement for lodging

Severance:

$297,000 to $17,737,000

3. SHELDON ADELSON

LAS VEGAS SANDS CORP.

$10,684,000

Total compensation

2011: 13,845,000

2010: 11,356,000

Year-end stock price:

2012: $46.16

2011: $42.73 ($39.06)*

2010: $45.95 ($42,00)*

2012 pay components:

Salary: $1,000,000

Cash bonus: 0

Stock awards: $1,825,000

Option awards: $1,825,000

Nonequity incentives: $2,933,000

Other: $3,100,000

Equity holdings:

78,357,000 shares, or 431,599,000 shares when including family trusts

Footnotes:

$161,000 for health insurance

$2,796,000 for family security detail

$100,000 for professional fees

$42,000 for car

$30,585,000 netted on option exercise

$649,000 netted on stock vesting

Severance:

$15,373,000 to $28,129,000

4. RAJESH SHROTRIYA

SPECTRUM PHARMACEUTICALS

$10,108,000

Total compensation

2011: $25,215,000

2010: $5,514,000

Year-end stock price:

2012: $11.19

2011: $14.63 ($14.43)*

2010: $6.87 ($6.78)*

2012 pay components:

Salary: $800,000

Cash bonus: $1,600,000

Stock awards: $1,849,000

Option awards: $5,535,000

Nonequity incentives: 0

Other: $322,000

Equity holding:

6,725,000 shares and options

Footnotes:

$1,780,000 netted on option exercises

$3,786,000 netted on stock vesting

$46,000 for life insurance Less than $25,000 for use of car and estate planning fees

$240,000 deferred compensation

Severance:

$420,000 to $31,884,000

5. JIM MURREN

MGM RESORTS INTERNATIONAL

$9,641,000

Total compensation

2011: $9,933,000

2010: $9,775,000

Year-end stock price:

2012: $11.64

2011: $10.43

2010: $14.85

2012 pay components:

Salary: $2,000,000

Cash bonus: 0

Stock awards: $3,376,000

Option awards: 0

Nonequity incentives: $3,241,000

Other: $1,023,000

Equity holdings:

2,070,000 shares and options

Footnotes:

$259,000 for company jet use

$750 for 401(k) contribution

$36,000 for insurance premiums

$100,000 for life insurance or other uses

$325,000 for personal security

$284,000 for legal fees to negotiate new employment contract

$17,000 for taxes

$184,000 netted on vesting of stock awards

Severance:

$9,144,000 to $20,000,000

6. MARK SMITH

MOLYCORP

$6,530,000

Total compensation

2011: $3,543,000

2010: $864,000

Year-end stock price:

2012: $9.44

2011: $23.98

2010: $49.90

2012 pay components:

Salary: $830,000

Cash bonus: 0

Stock awards: $2,128,000

Option awards: 0

Nonequity incentives: 0

Other: $3,570,000

Equity holdings:

1,336,000 shares and convertible notes

Footnotes:

Left company in December

Subject to a two-year, noncompete agreement

$10,000 for 401(k) match

$125,000 payment for unused vacation

All unvested equity grants were cancelled

$425,000 one-year consulting agreement

Severance:

$3,549,000 paid on departure

7. MICHAEL YACKIRA

NV ENERGY

$6,484,000

Total compensation

2011: $7,741,000

2010: $5,336,000

Year-end stock price:

2012: $18.14

2011: $16.35 ($15.60)*

2010: $14.05 ($12.98)*

2012 pay components:

Salary: $900,000

Cash bonus: $0

Stock awards: $2,039,000

Option awards: $0

Nonequity incentives: $1,038,000

Change in deferred pay: $2,343,000

Other: $162,000

Equity holdings:

520,000 shares

Footnotes $92,000 for two 401(k) plans

$45,000 for life insurance

$24,000 for club memberships

$254,000 netted on stock options

$4,080,000 netted on stock vesting

Severance:

$90,000 to $13,657,000

8. PATTI HART

INTERNATIONAL GAME TECHNOLOGY

$5,999,000

Total compensation

2011: $8,553,000

2010: $5,482,000

Year-end stock price:

2012: $14.17

2011: $17.20 ($16.83)*

2010: $17.69 ($17.05)*

2012 pay components:

Salary: $955,000

Cash bonus: $1,564,000

Stock awards: $3,445,000

Option awards: $0

Nonequity incentives: $0

Other: $34,000

Equity holdings:

1,288,000 shares and option

Footnotes $691 for 401(k) and profit-sharing match

$5,900 for life insurance

$27,000 for corporate jet

$629 for medical reimbursements

$1,218,000 netted on stock award vesting

$1,232,000 netted on option exercise

Severance:

$3,744,000 to $4,733,000

9. JEFFREY SHAW

SOUTHWEST GAS CORP.

$3,598,000

Total compensation

2011: $3,232,000

2010: $2,575,000

Year-end stock price:

2012: $42.41

2011: $42.49 ($41.08)*

2010: $36.67 ($34.47)*

2012 pay components:

Salary: $771,000

Cash bonus: 0

Stock awards: $1,125,000

Option awards: 0

Nonequity incentives: $445,000

Change in pension value and deferred earnings: $1,206,000

Other: $51,000

Equity holdings:

171,000 shares

Footnotes:

$1,349,000 netted on stock vesting

$27,000 for deferred compensation match

$9,300 for car use

$7,100 for club dues

$6,100 for life insurance

$1,300 for financial planning

Severance:

$6,442,000 to $11,807,000

10. ANTHONY SANFILIPPO

PINNACLE ENTERTAINMENT

$3,381,000

Total compensation

2011: $1,684,000

2010: $5,595,000

Year-end stock price:

2012: $15.83

2011: $10.16

2010: $14.02

2012 pay components:

Salary: $900,000

Cash bonus: 0

Stock awards: $769,000

Option awards: $970,000

Nonequity incentives: $737,000

Other: $3,800

Equity holdings:

1,072,000 shares and options

Footnotes: $3,800 for 401(k) match

$608,000 netted on stock vesting

Severance:

$4,797,000 to $7,948,000

11. KEITH SMITH

BOYD GAMING CORP.

$3,048,000

Total compensation

2011: $3,907,000

2010: $3,407,000

Year-end stock price:

2012: $6.64

2011: $7.46

2010: $10.60

2012 pay components:

Salary: $1,100,000

Cash bonus: $0

Stock awards: $1,159,000

Option awards: $517,000

Nonequity incentives: $242,000

Other: $29,000

Footnotes:

$3,700 for 401(k)

$442 for life insurance

$14,000 for corporate jet

$11,000 for medical purposes

$254,000 netted on stock vesting

Equity holdings:

1,503,000 shares and options

Severance:

$1,840,000 to $17,550,000

12. SCOTT BETTS

GLOBAL CASH ACCESS

$2,555,000

Total Compensation

2011: $1,677,000

2010: $1,961,000

Year-end stock price:

2012: $7.84

2011: $4.45

2010: $3.19

2012 Pay Components:

Salary: $600,000

Cash bonus: $56,000

Stock awards: 0

Option awards: $1,224,000

Nonequity incentives: $618,000

Other: $56,000

Equity holdings:

2,390,000 shares and options

Footnotes:

$25,000 for executive housing

$26,000 for travel reimbursement

$5,500 for 401(k) contributions

$1,603,000 netted on stock options

$342,000 netted on stock vesting

Retired on Dec. 31, 2012, stayed on payroll three more months

Remains a director

13. FRANK FERTITTA III

STATION CASINOS

$2,444,000

Total compensation

2011: $1,703,000

2010: Not available

Year-end stock price:

2012: Not traded

2011: Not traded

2010: Not traded

2012 pay components:

Salary: $1,000,000

Cash bonus: $1,000,000

Stock awards: $0

Option awards: $0

Nonequity incentives: $0

Other: $444,000

Equity holdings:

61 percent of voting units, 58 percent of non voting units, held with brother Lorenzo Fertitta

Footnotes:

$216,000 for life insurance

$102,000 for executive medical coverage

$125,000 for director fees

14. RICHARD HADDRILL

BALLY TECHNOLOGIES

$1,610,000

Total compensation

2011: $6,977,000

2010: $2,654,000

Year-end stock price:

2012: $44.71

2011: $39.56

2010: $42.19

2012 pay components:

Salary: $998,000

Cash bonus: $0

Stock awards: $0

Option awards: $0

Nonequity incentives: $600,000

Other: $12,000

Equity holdings:

851,000 shares and options

Footnotes:

$7,300 for 401(k)

$4,600 for President’s Club Travel

$8,406,000 netted on stock options

$1,031,000 netted on stock vesting

Severance:

$2,707,000 to $6,708,000

15. MICHAEL ISAACS

SHFL ENTERTAINMENT

$1,413,000

Total compensation

2011: $689,000

2010: Not with company

Year-end stock price:

2012: $14.50

2011: $11.72

2010: $11.45

2012 pay components:

Salary: $516,000

Cash bonus: 0

Stock awards: $187,000

Option awards: $174,000

Nonequity incentives: $525,000

Other: $10,500

Equity holdings:

78,000 shares and options

Footnotes:

$7,500 for 401(k) contribution $3,000 in premiums for executive health coverage

$766 for insurance premiums

$234,000 netted on stock vesting

Severance:

$1,052,000 to $1,915,000

16. ANDRE HILLIOU

FULL HOUSE RESORTS

$1,382,000

Total compensation

2011: $970,000

2010: Not with company

Year-end stock price:

2012: $3.45

2011: $2.63

2010: $3.39

2012 pay components:

Salary: $322,000

Cash bonus: 0

Stock awards: $582,000

Option awards: 0

Nonequity incentives: $473,000

Other: $4,800

Equity holdings:

626,700 shares

Footnotes:

$4,800 for office away from headquarters

Severance:

$1,675,000 to $1,983,000

BELOW THE RADAR

John Unwin, Nevada Property 1 (The Cosmopolitan of Las Vegas), $1,206,000.

Joseph Carleone, American Pacific, $1,112,000.

David Ross, Affinity Gaming, $1,018,000.

Alex Yemenidjian, Tropicana Las Vegas, $994,000.

Frank Rioli, American Casino & Entertainment Properties, $912,000.

Maurice Gallagher Jr., Allegiant Travel Co., $775,000.

Anthony Rodio, Tropicana Entertainment, $569,000.

Gregory Gronau, Gaming Partners International, $468,000.

Andy Choy, Riviera Holdings, $450,000.

* The first number for a year represents the actual closing price; the second reflects adjustments for splits and dividends.

SOURCES: Company proxy statements filed with the Securities and Exchange Commission. Stock prices from Yahoo Finance.