Here’s where each presidential candidate stands on money issues

Perhaps it’s the aftershock of the 2008 recession, or the impending exit of a two-term president, but most voters are wondering how a new president might affect their finances. DealNews polled over 1,000 adults and found that around 60 percent said that the upcoming election was causing them concern for their finances and the overall economy.

Find out where the 2016 presidential candidates stand on the money issues that are most likely to have an effect on your income and spending habits. Here’s a look at their plans for individual taxation, corporate taxation, higher education and the national budget.

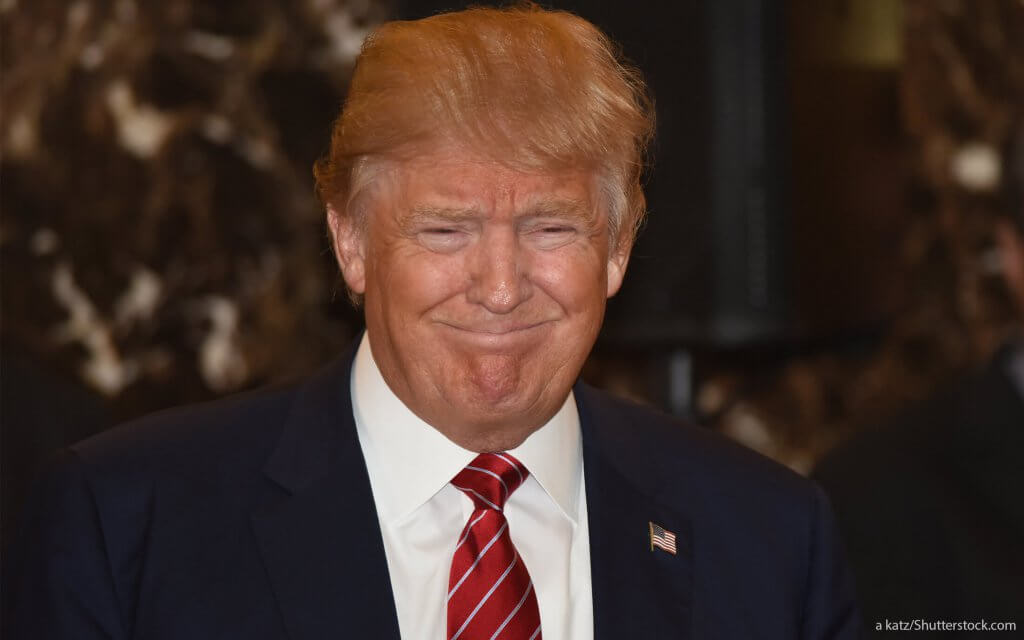

Donald John Trump

Donald John Trump is a businessman and television personality. He is the chairman and president of The Trump Organization. He has shocked everyone, including himself according to Politico, by becoming the presumptive Republican nominee for the 2016 presidential election. His clear win in Indiana in May caused Republican opponents Ted Cruz and John Kasich to drop out of the race.

Trump has appealed to some voters’ desire for a candidate who will buck the system and his own party. Trump has presented extreme ideas, such as deporting millions of immigrants and demanding that other countries pay the U.S. for military protection.

1. Trump’s Stance on Individual Taxes

Trump’s plan is to simplify the tax brackets and reduce them to four: zero percent, 10 percent, 20 percent and 25 percent — the highest rate for individuals earning $150,000 or more. In 2000, according to Ontheissues.org, Trump proposed a one-time 14 percent tax on the wealthy, but not now. Trump is now saying that he will not increase net taxes, but he also is not signing a tax reform pledge that is against raising taxes, saying, “I may want to switch taxes around.”

Trump’s tax policies are reminiscent of the Reagan years, said Tom Wheelwright, a tax and wealth expert, author and CEO of ProVisionWealth. “For the average American… there would likely be a sizable tax reduction… Many people on the lower income side would simply pay no taxes,” he said. However, that might not ultimately benefit taxpayers.

“The unintended consequence of the Reagan tax plan was the failure of the savings and loans, and massive loss of wealth to those who owned real estate,” said Wheelwright. “The loss of value in real estate, as a result of the 1986 tax act, was much greater than the loss of value in 2009 and 2010 as a result of the mortgage failures… there will absolutely be unintended consequences whenever you have major changes to the incentives in the tax law.”

2. Trump’s Stance on Corporate Taxes

A proponent of capitalism and the free market, Trump proposed lowering the corporate tax rate to 15 percent. He said that private companies create jobs, which improve the economy. He supports a one-time deemed repatriation of corporate cash held overseas at a significantly discounted 10 percent tax rate to encourage firms to return to the U.S., and not to go overseas in the first place to avoid paying taxes.

U.S.-owned corporations are holding $2.5 trillion in cash overseas, according to Trump’s website. Under his plan, he claimed, these companies will be encouraged to bring home that money and invest it in the U.S. He said he would end tax deferrals for companies that have earned income abroad, but would retain the foreign tax credit because he said that companies should not face double taxation.

Trump plans to eliminate loopholes that benefit the wealthy, special interests and corporations. He said he would eliminate deductions that are redundant because of the lower corporate tax rate, along with capping the deductions for business interest expense.

3. Trump’s Stance on Higher Education

Education should be locally managed, according to Trump. In an interview with The Wall Street Journal, he said he would ‘slash funding for the Department of Education’ if elected.

Trump also said he would end the current Common Core education standards, which he considers an overreach of the federal government, and allow the states to set education policy. Trump advocated for charter schools and vouchers in his 2000 book, “The America We Deserve,” according to online politics resource Ballotpedia. He favors a more competitive, free-market system that he said would improve national education.

Trump has not yet outlined a clear plan to bring down the cost of a college education or to help those with student loan debt. In fact, according to the Washington Examiner, he said, “The only way you can do it is you have to start some governmental program, and you have governmental programs right now.” This runs contrary to his usual balk of “big government.”

4. Trump’s Stance on the National Budget

Trump plans to cut tax revenues by up to $12 trillion, while maintaining Social Security and other entitlements funds without racking up national debt. But this is not feasible, according to The Fiscal Times.

Trump has not yet provided real plans to cut spending. He has said that he plans to address “waste, fraud and abuse” that afflicts Social Security, but experts have said that this is not enough to solve the long-term problems caused by a growing aging population. Trump’s tax plan is predicted to raise public debt to 125 percent of the GDP by 2025, according to The Fiscal Times. It is at 74 percent today.

Trump, however, insists that economic growth will occur as a result of his tax plan, and the return of overseas jobs because of his corporate tax cuts, will protect entitlements such as Social Security and “keep people from dying in the streets.”

Hillary Rodham Clinton

Hillary Clinton is the leading candidate for the Democratic presidential nomination in the 2016 election. Clinton is married to former President Bill Clinton and previously served as secretary of state to Barack Obama. A recent CNN/ORC poll showed Clinton leading Trump 54 percent to 41 percent.

Clinton and Bernie Sanders, as fellow Democrats, agree on many issues. Both believe that wealth should be better distributed and not concentrated among the wealthiest Americans. Clinton’s stance on social programs, similar to Sanders’, is that they are important, such as affordable healthcare and debt-free education for low-income families.

1. Clinton’s Stance on Individual Taxes

Clinton proposed a series of targeted tax credits for the middle class and raising taxes on short-term capital gains or profits from investments. In 2008, she said she would keep capital gains under 20 percent, according to PBS.org.

Clinton considers that the wealthy pay too little in tax and the middle class pays too much. She proposed a tax increase to 30 percent for millionaires, instead of the existing zero to 10 percent, and no tax increases for the middle tax bracket, according to OnTheIssues.org, a resource site for political issues. She proposed a high-level tax rate of 44.6 percent for those who earn over $5 million. Those earning over $1 million would have deductions capped at 28 percent.

Five medium-term tax rates would cover capital gains and dividends, and the rate would be between 27.8 and 47.4 percent for substantial earnings on securities held for one to five years. High-frequency transactions would also be taxed under Clinton’s proposals, according to Forbes. There would be a ceiling on retirement accounts, and an increase in the top estate tax rate, from 40 to 45 percent. The estate tax exemption would change from $5.45 to $3.5 million.

2. Clinton’s Stance on Corporate Taxes

Clinton has said she would close tax loopholes for industries that move overseas, Wall Street and the wealthy. She plans to eliminate corporate inversions, where companies partner with a company overseas to avoid paying taxes in the U.S., by requiring the U.S. partner to control 50 percent of the partnership in order to initiate the deal, according to The New York Times.

She would also charge an “exit tax” on that company’s untaxed overseas earnings. Clinton claimed this and similar loopholes cost taxpayers $60 billion over 10 years.

3. Clinton’s Stance on Higher Education

Clinton’s plan for higher education is called the New College Compact. Clinton said, “No family and no student should have to borrow to pay tuition at a public college or university.” She proposed lower financing rates to help those with student debt. She would eliminate government profit on student debt, according to Business Insider.

Clinton would also offer grants to states that provide funding to public colleges to allow students to attend on wage-based fees and with no debt accumulation. Community colleges would be tuition-free. Student loans would have their interest rates lowered, and repayment options would be simplified.

According to Clinton, her plan would increase completion rates, improve education methods and require colleges to contribute to programs supporting low-income students. It sounds like a lofty and expensive plan, and estimates put the price at $350 billion. However, Clinton said her tax adjustments for the wealthy and corporations will cover the cost.

4. Clinton’s Stance on the National Budget

Clinton’s budget is based on higher taxes for the wealthy and corporations, the revenues from which will pay for education improvements and entitlement spending. Clinton has a national infrastructure plan to spend over $27 billion annually, according to AboutMoney.com.

She would initiate an expanded childcare plan and an early education plan, at $27.5 billion a year. Her energy plan would spend $9 billion annually and would include reducing carbon emissions and providing funds for coal workers’ health and retirement.

The Tax Foundation predicted that her proposals would cut 10-year gross domestic product growth by 1 percent, hurt capital formation by 2.8 percent, wages by 0.8 percent and cost 311,000 jobs over the next decade. The plans would raise $191 billion for government expenditure and redistribution.

Clinton said, ”Measures like closing corporate tax loopholes would pay for expensive government proposals, like a program to make college more affordable and one to develop infrastructure,” according to The New York Times. Quoting her husband from his early days as president, she said, “I do come from the Clinton school of economics.”

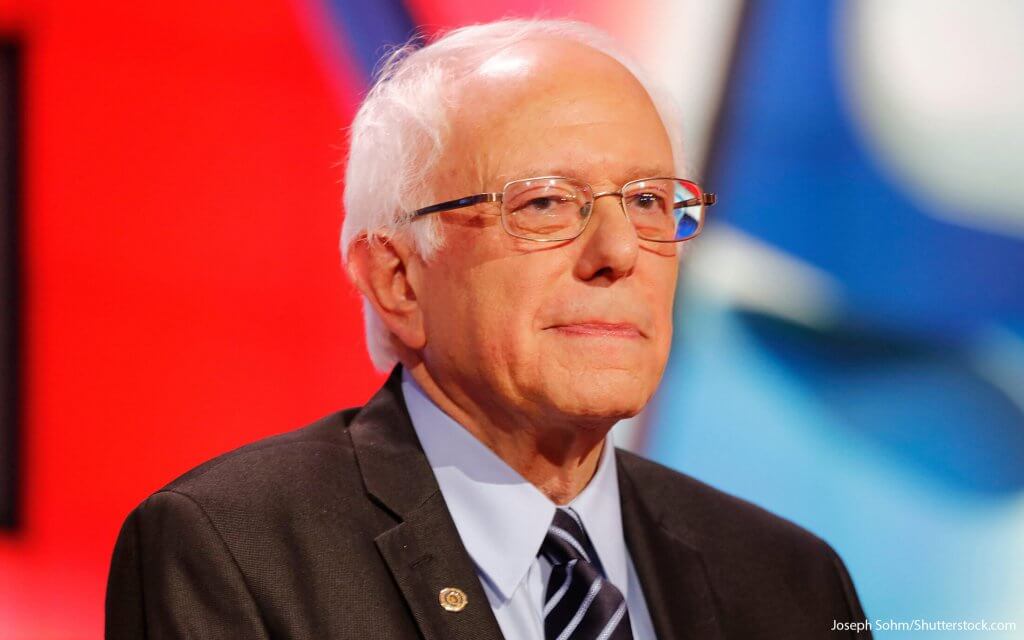

Bernie Sanders

Bernie Sanders is a popular senator from Vermont and a candidate for the Democratic nomination for president. Sanders is positioned further to the left of Clinton with respect to policies, but the two are not far apart on most issues.

Sanders wants to expand public education and give every American healthcare. He has said that Wall Street firms are entitled to make money, but not at the expense of the middle class or through unethical practices. He has advocated raising the minimum wage so that people do not have to rely on government programs to feed their families.

1. Sanders’ Stance on Individual Taxes

Like Clinton, Sanders would like to see some redistribution of the wealth that is concentrated among the wealthiest Americans. He would create four new tax brackets at 37 percent, 43 percent, 48 percent — and 52 percent for those earning over $10 million a year. This tax structure, according to the Tax Foundation, would provide additional government revenues of $9.8 trillion over the next decade.

High earners will have itemized deductions at 28 percent. Employers will be charged an additional 6.2 percent payroll tax on wages and salaries, and will contribute to a 0.4 percent family and medical leave tax shared between employer and employee.

Sanders would tax capital gains and dividends at ordinary income tax rates for earners over $250,000. There would be a tax on financial transactions of between 0.005 percent and 0.5 percent for high earners. Like Clinton, Sanders would lower the exclusion for estate tax to $3.5 million from $5.45 million, and the highest estate tax rate would change from 40 percent to a range of 45 to 65 percent.

2. Sanders’ Stance on Corporate Taxes

Sanders is big on ending “overseas tax havens” for corporations. He would end subsidies to big business and would provide low-interest loans to entrepreneurs and small businesses. “Large businesses rarely pay the full 35 percent rate,” according to his website, FeelTheBurn.org. “Many conglomerates stash their profits overseas to evade taxes by establishing subsidiaries incorporated in foreign countries with laxer corporate tax policies.”

Although the U.S. corporate tax rate of 35 percent is the highest in the world, the Government Accountability Office found that highly profitable companies actually paid only 13 percent income taxes in 2010, which is well below most developed countries.

3. Sanders’ Stance on Higher Education

Sanders would like to lower the interest rate on student loans by taxing Wall Street speculators. Like Clinton, he would like to provide free public colleges and wants to end government profit on student debt.

The presidential candidate also wants to provide free higher education by requiring public colleges to finance low-income students, according to U.S. News & World Report. Under his plan, low-income students could rely on institutional, federal and state aid for tuition and living expenses. Sanders would encourage federal work-study programs, which would pay students for working and contribute to their qualification at the same time.

4. Sanders’ Stance on the National Budget

As a staunch Democrat, Sanders supports social programs. Republicans often plan to reduce the deficit, now at $468 billion, according to FeelTheBurn.org, by cutting back on entitlement programs, which hurts the low-income population.

Sanders’ policies are progressive taxation, to redistribute the wealth of the high-earning 1 percent, eliminating loopholes for the rich and corporations, reducing the defense budget and investing in infrastructure to create jobs and stimulate the economy.

China’s defense spending is one-third that of the U.S., and Sanders said the U.S. could drastically reduce the defense budget, according to his website. Sanders proposed a $1 trillion investment in roads, railways and waterways, which he said will create 13 million jobs.

From GoBankingRates.com: Here’s how each presidential candidate stands on the money issues

RELATED

Cruz, Kasich drop out, waste $171 million

How your favorite presidential candidates spend their money