How fast is the southwest Las Vegas Valley growing?

Enterprise and the southwest valley are the talk of the town as the unincorporated township and submarket are experiencing booming population and commercial and residential growth.

In fact, Enterprise is growing more than twice as fast as the Las Vegas Valley as a whole, according to population figures from Esri, a GIS mapping software company. The unincorporated township grew almost 60 percent (compared to 20 percent for the overall Las Vegas Valley) from 2010 to 2023 and now has 245,243 residents as of the end of 2023. Enterprise is estimated to add another 13,713 residents by 2028.

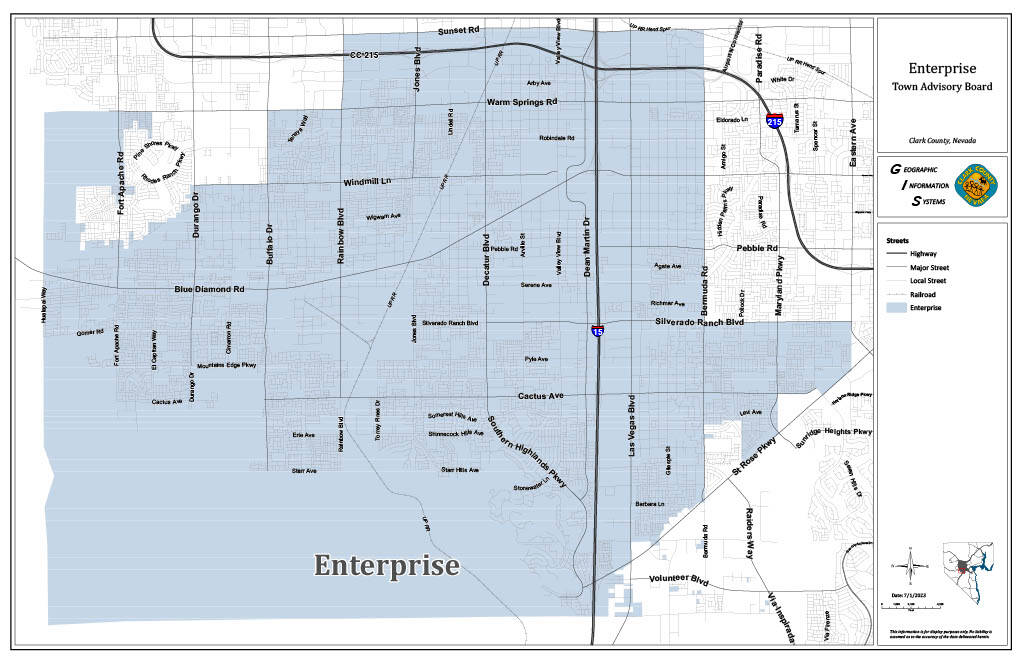

The roughly 46-square-mile area in the southwest valley is bordered by Spring Valley to the north, Paradise to the east, Henderson to the southeast, Sloan to the south, and Blue Diamond to the west.

And data shows Enterprise is adding more educated residents who make more money than the rest of the valley. The median household income in Enterprise is estimated to be $88,573, well above the metro average of $65,264, according to Esri. Looking at Enterprise residents over 25, a full quarter of them have bachelor’s degrees, compared to 19 percent of the rest of the valley. The unincorporated township also has a higher rate of residents with associate and graduate degrees.

Why Enterprise?

Enterprise and the rest of the southwest valley are seeing this boom because of the abundance of available land for development, experts say. And it’s starting to rival Summerlin and Henderson for new office development.

Charles Van Geel, a senior director with Cushman & Wakefield, said most of the Las Vegas Valley is surrounded by federally owned land or entities such as the Lake Mead Recreational area to the east or Red Rock Canyon’s National Conservation Area to the west.

“One could support the argument that the vast majority of our market’s future growth is in the southern and southwest areas of the Las Vegas Valley, towards Los Angeles,” he said. “Like most comparable cities, Las Vegas has its centrally located downtown office node along with a second office node in Summerlin and the third node in Green Valley, essentially Henderson’s central business district. Located at the mid-point between Summerlin and Green Valley, at the intersection of Durango and Interstate 215, the southwest is quickly becoming our valley’s fourth office node, with a high concentration of new office and medical product.”

Jonathan Catalano, an agent with ERA Real Estate, said it’s time to put Enterprise on par with places such as Henderson and North Las Vegas in terms of development clout.

“A large part of its growth can be attributed to the constant expansion of Blue Diamond Road fostering every business imaginable alongside the development of one of the country’s top master-planned communities of Mountain’s Edge offering diverse and affordable housing options, a number of community parks and constant community events,” he said.

What’s being developed in Enterprise?

Retail is currently leading the charge in Enterprise and the southwest as 58 percent of all retail completions in the entire valley since 2023 have taken place within that submarket. This includes 128,488 square feet of space added to the market since the start of 2023 and an additional 6,008 currently under construction.

High-profile deliveries over the past few years, including UnCommons, a mixed-use development which includes retail, apartments and office space and the Durango hotel-casino, are to be followed by more commercial completions including a Costco Wholesale on 22 acres at the southwest corner of Buffalo Drive and the 215 Beltway and an Ashley Furniture store that is currently under construction to the west of IKEA.

On the residential side, a mix of apartments projects that are either in the works, or recently completed, and a host of single-family construction are taking place, mostly in the far southeast corner near Mountain’s Edge.

What’s next for Enterprise?

Owen Sherwood, who works in the commercial title industry for Fidelity National Title, said he’s watched the Enterprise area go from barren land to a burgeoning corner of the valley in a matter of decades.

“Through the late 2010s and early 2020s areas like the speedway and west Henderson drew significant development interest due to their population centers and land availability,” he said. “As that land has been snapped up and developed, commercial real estate developers have looked to Enterprise and Blue Diamond in particular to find opportunities in an otherwise land constrained market.”

Sherwood pointed to a number of significant deals on the commercial side, including industrial developer Becknell selling the Blue Diamond Business Park to East Group Properties for $53 million, which contains two recently developed buildings totaling 255,000 square feet. Panattoni, another commercial developer, is spearheading the Oasis Commerce center south of Blue Diamond Road and Rainbow Boulevard, which will include 422,000 square feet of industrial space. Sherwood also said EBS Realty Partners is building the Rainbow at Blue Diamond logistics park, which will include 256,000 square feet of industrial space.

“The key going forward will be meeting demand for retail, housing, and industrial space while also balancing the concerns of the Enterprise submarket’s residents,” he said.

Catalano said the area is now bumping up against the master-planned community of Southern Highlands to the south along Interstate 15, and then, of course, the Durango corridor to the west.

Van Geel said when it comes to the southwest part of the valley and Enterprise, this is just the beginning of what will be a very long boom period of development.

“The Interstate 15 corridor, as you head south to Southern California, and the southwest valley are well positioned to enjoy decades of new residential and commercial development. With little momentum forcing Las Vegas to grow up, Las Vegas will continue to grow out, and the southwest will see the large majority of our market’s new product. The demographic profile is constantly improving in those two areas providing commercial developers the supporting trends they require to justify new development.”

Contact Patrick Blennerhassett at pblennerhassett@reviewjournal.com.