Need money before payday? These apps will help. But at a big cost

NEW YORK — When Anna Branch, 37, had her hours at work reduced at the start of the pandemic in 2020, she suddenly noticed ads for an app called EarnIn.

“You know how they get you — the algorithms — like they’re reading your mind,” Branch said. “The ad said I could get up to $100 this week and repay it in my next pay period.”

Branch, who was working as an administrative assistant in Charleston, South Carolina, downloaded the app, agreed to the flat fee, and added the suggested “tip.” The cash helped her cover expenses until payday, when the app debited the borrowed $100, plus $18 for the fee and tip. Four years later, Branch said she still uses the app, as often as once a month.

EarnIn is one of more than a dozen companies that provide this service, billed as Earned Wage Access. The apps extend small short-term loans to workers in between paychecks so they can pay bills and meet everyday needs. On payday, the user repays the money out of their wages. Between 2018 and 2020, transaction volume tripled from $3.2 billion to $9.5 billion, according to Datos Insights.

While Earned Wage Access apps have been around for over a decade, the pandemic and its aftermath boosted their popularity. Some apps have approachable human names — like Dave, Clio, Albert, and Brigit — while others suggest financial freedom: Empower, FloatMe, FlexWage, Rain. The typical user earns less than $50,000 a year, according to the Government Accountability Office, and has experienced the pinch of two years of high inflation.

Proponents of the apps say they help people living paycheck to paycheck manage their finances and avoid the need for more onerous options, such as payday loans or overdrawing a bank account. But some analysts, consumer advocates and lawmakers say the apps are actually payday loans in a new tech wrapper, and that they can trap users in an endless cycle of borrowing that depletes their earnings.

Critics also say the costs of the loans are not always transparent. Many charge monthly subscription fees and most charge mandatory fees for instant transfers of funds, though there is typically a no-cost option to receive funds in one to three business days. The average APR for a loan repaid in seven to 14 days was 367%, a rate comparable to payday lending, according to a report from the Center for Responsible Lending.

Muddying the waters is the fact that some employers have integrated Earned Wage Access apps into their payroll, with different costs, models, and fee structures. Amazon and Walmart, for example, do not always charge employees for early access to earned wages outside of regular pay periods.

‘They get you hooked’

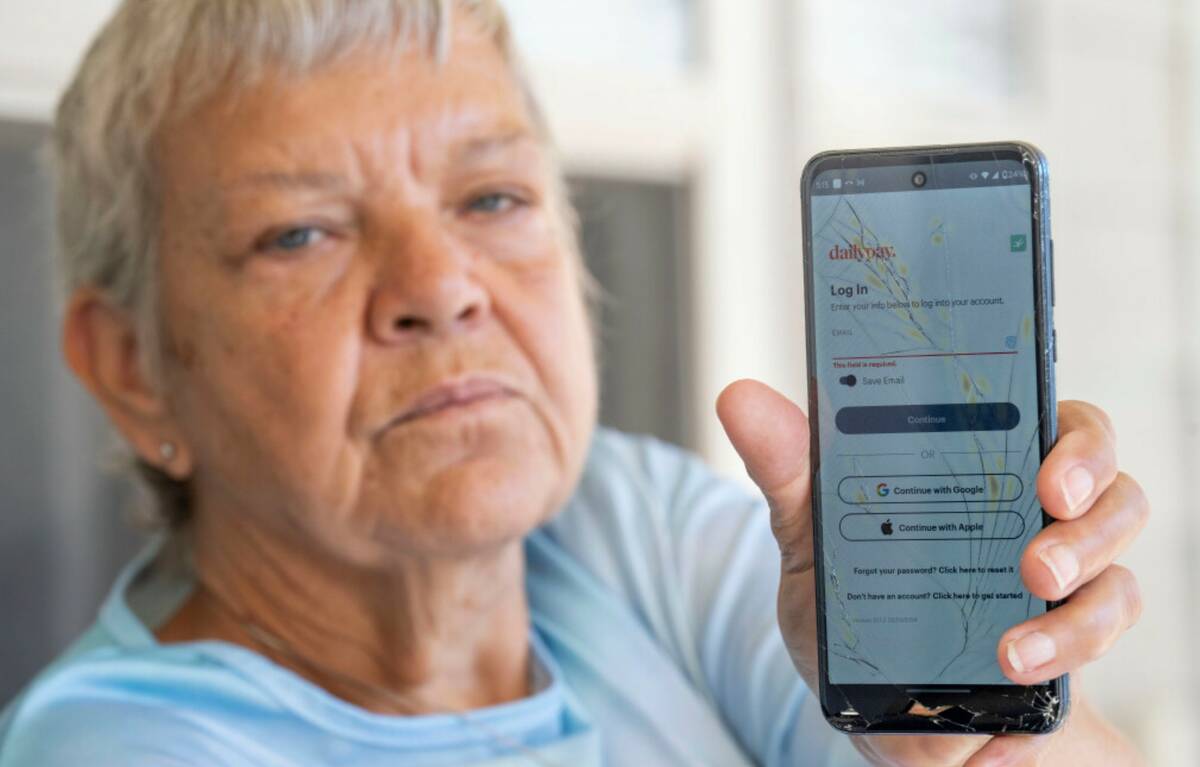

Sheri Wilkins, 60, who works as a home health aide in College Station, Texas, said she’s used the apps since 2020, and that she feels “dependent on the money.”

The healthcare contractor that employs Wilkins offers DailyPay, and Wilkins typically uses the app to transfer the amount of that day’s wages ($10.60 an hour) twice a day — once after each of her two shifts, for which she’s paid separately. Each time, she pays a $3.49 fee, for a total of $7 a day. At $35 a week, the app eats up more than three hours of her pay weekly, or a-day-and-a-half’s work per month.

“They get you hooked on having that money,” Wilkins said. “It’s fine and great to have it — to buy groceries and cigarettes — but when it comes time to have your paycheck, it’s only $50-$60.”

Wilkins said she was not aware the app had a free option, which would transfer the money in one to three days. She said the app always directed her to the instant transfer option.

A spokesperson for DailyPay said in a statement that the app offers two options with no fees to most users and a third with what they described as a “small ATM-like fee.”

Matt Bahl, who researches workplace issues for the Financial Health Network, said the growth of the Earned Wage Access industry is a symptom of widespread financial insecurity.

“It’s meant to help solve short-term liquidity challenges,” he said. “But if those challenges are the result of insufficient income, it won’t solve them. You can’t ‘tech’ your way out of material deficits.”

The tips

Andrew Lewis, 32, who lives in Bucks County, Pennsylvania, said he uses EarnIn, in part to meet unexpected expenses. Lewis works as a process technician for an electronics manufacturing company, and said he sometimes uses the app as often as every week, for gas money or something his toddler or wife needs.

Lewis usually pays the “tips” the apps suggest, he said, but he doesn’t “like them that much,” in part because of the messaging.

“Tips keep us running for millions of members like you,” EarnIn’s in-app copy reads. The company says it uses tips to maintain a no-fee option.

“I feel a little guilty because of how they make it sound,” Lewis said.

In 2021, the California Department of Financial Protection and Innovation found “users often feel compelled to leave (tips) due to applied pressure tactics like… claiming tips are used to support other vulnerable consumers or for charitable purposes.”

In its report, the department found that borrowers who use Earned Wage Access take out an average of 36 loans a year. On 5.8 million transactions, 73% of consumers paid a “tip,” at $4.09 per tip on average. On three dozen loans, that’s $147 annually in tips alone.

Convenience and no credit check

Penny Lee, head of the Financial Technology Association, an industry group, says more people are turning to Earned Wage Access as a convenience that allows them to make up for the “disconnect between what the consumer needs to be able to spend … and their pay cycle.”

Like Buy Now, Pay Later loans, the apps don’t run credit checks and bill themselves as interest-free. Unlike payday loans or auto title loans, where borrowers pledge their vehicles as collateral, users of the apps don’t face balloon payments, black marks on their credit reports, or the possibility of losing their car if they fail to pay. Supporters also say the apps don’t sue or send collectors after unpaid debts.

The FTA says the average cost per use of an Earned Wage Access app is between $2.59 and $6.27. The companies say the charges are comparable to ATM fees and cheaper than overdraft fees, which people incur if they don’t have enough money left in a checking account to cover a bill before payday. The average overdraft fee is more than $25 and can be as high as $36.

However, in its report, the Center for Responsible Lending found that users of the apps experienced a 56% increase in checking account overdrafts.

A pivotal moment for regulation

A number of states have moved to regulate Earned Wage Access by capping fees on these products. The industry backs a federal bill, currently before Congress, that would exclude the apps from being regulated by the Truth in Lending Act.

When Connecticut passed a law capping the fees the apps could charge, EarnIn stopped operating in the state. Asked why, EarnIn CEO Ram Palaniappan said it was no longer “economically viable.”

Both California and Hawaii are currently drafting laws to rein in Earned Wage Access fees.

Rep. Bryan Steil, R-WI, one of the federal bill’s backers said, it will “ensure workers across the country can continue to use these services, which help them to better connect work to reward.”

But Hawaii State Sen. Chris Lee, a Democrat who introduced regulation targeting Earned Wage Access in the state Senate, called the 300-plus percentage interest rates a “modern payday loan scheme.” Lee said he would like to see more transparency and worker protections.

Lauren Saunders, an attorney at the National Consumer Law Center, says this a pivotal moment for regulation.

“If (Earned Wage Access) were being used by people to cover one emergency cost a year, it could be better than being subject to overdraft fees or payday or auto title loans,” she said. “But being better than terrible predatory products shouldn’t be the bar.”