Trial set in Stallion Mountain golf course dispute

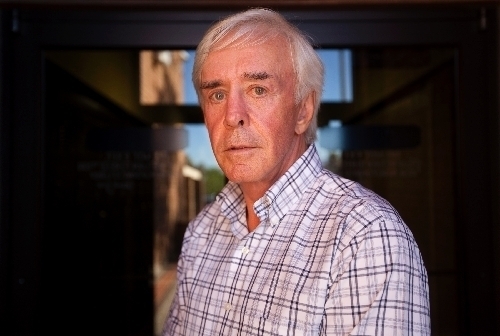

A civil lawsuit alleging that Las Vegas golf course developer Bill Walters, as well as principals in his golf management companies, defrauded investors in the sale of Stallion Mountain Country Club will go to trial in December, a federal judge ruled late Tuesday.

District Judge Philip Pro cleared the way for the trial one day after ordering Walters' Stallion Mountain LeaseCo to pay $3.26 million to investors. LeaseCo managed Stallion Mountain after it was sold for $24.4 million in 2006.

LeaseCo, Walters and business associates Michael Luce and Joe Munsch were all named as defendants in the lawsuit.

According to court papers, Luce and Munsch announced in July 2007 that LeaseCo would stop paying rent to the investors, forcing them to pour money into the property to prevent foreclosure. Adam Thurston, lead attorney for the plaintiffs, said the judgment covers the unpaid rent.

The investors, a group of 26 limited liability companies, seek total damages in excess of $10 million.

Plaintiffs in the case allege that Fairway Signature Properties, another company owned by Walters, gave them misleading financial performance statements in a private placement memorandum, or PPM, that they used in deciding to buy the 18-hole, semiprivate golf course on 194 acres at 5500 E. Flaming Road. The property includes a 33,568-square-foot clubhouse, special event center, administrative offices and golf pro shop.

The PPM projected cash flow revenues of $6.25 million in 2007 without disclosing that LeaseCo had internally budgeted a much lower total gross revenue of $4.87 million for that period. Net cash flow was projected at $54,173, while the internal budget forecast was a negative $684,899.

Pro this week also dismissed several counter-claims made by Walters, which included allegations of mismanagement by the investors.

Calls to Walters' attorney, Dennis Kennedy, were not returned Wednesday. Kennedy also represents Luce and Munsch.

Walters argued that he could raise questions about the investors' management of the golf course because he personally guaranteed $15 million on the group's loan to purchase Stallion Mountain. Pro ruled that he has no standing to do so "because it is undisputed that Walters has not paid any obligation on the guarantee in question" to Community Bank of Nevada.

The golf course was foreclosed upon by Community Bank of Nevada in 2008, and the bank was seized by the FDIC in 2009. The golf course was then sold for $3.8 million in July to Ohio-based Tartan Golf Management.

Tom FitzGibbon, attorney for defendant Direct Capital Securities, said none of the major motions in the case has been decided, including the plaintiff's allegation of securities law violations, fraudulent misrepresentation and concealment, and breach of fiduciary duty.

The sale of Stallion Mountain was structured through an IRS Code 1031 Exchange, also known as tenant-in-common interests, bundled with a leaseback to LeaseCo.

In court papers, the plaintiffs say Walters and other defendants knew they wouldn't be able to sell the golf course for such an inflated price to someone knowledgeable about the business, so they "target(ed) potential investors with little or no knowledge of the golf course business generally or the Las Vegas golf market in particular."

Kennedy had argued in court last week that there is "no evidence whatsoever" that Walters made statements misrepresenting the financial viability of Stallion Mountain, and that he had no role in the private placement memorandum prepared for investors.

In addition to Stallion Mountain, Walters owns the Royal Links and Desert Pine golf courses in east Las Vegas. He developed Bali Hai Golf Club through a ground lease with Clark County, though county commissioners are currently reviewing the lease agreement that has produced no revenue for the county. Walters has said he wants to redevelop the Bali Hai for industrial and retail use.

Contact reporter Hubble Smith at hsmith@review journal.com or 702-383-0491.