‘Suspects are pretty sly’: Skimming fraud on rise in Las Vegas Valley

Law enforcement officials are urging caution when using any type of bank or ATM card in public because of the rise of skimming devices that can steal financial information.

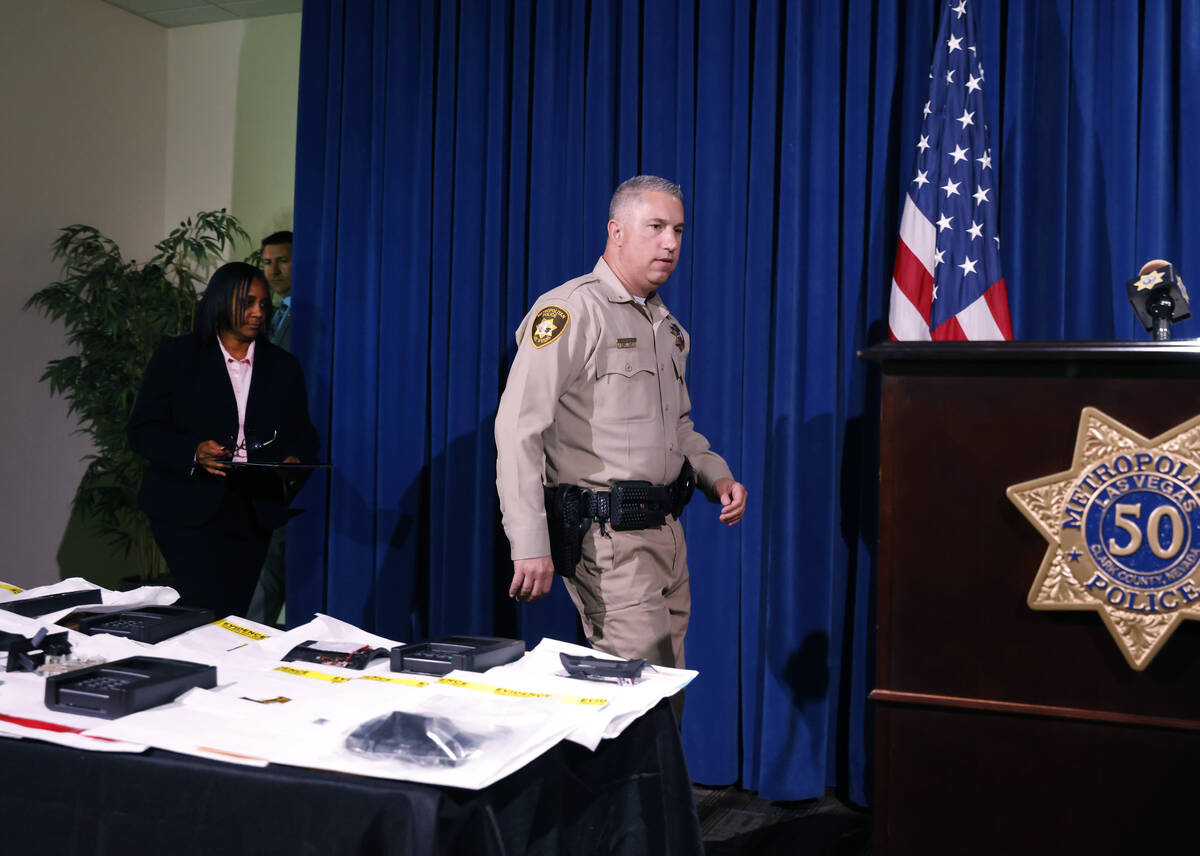

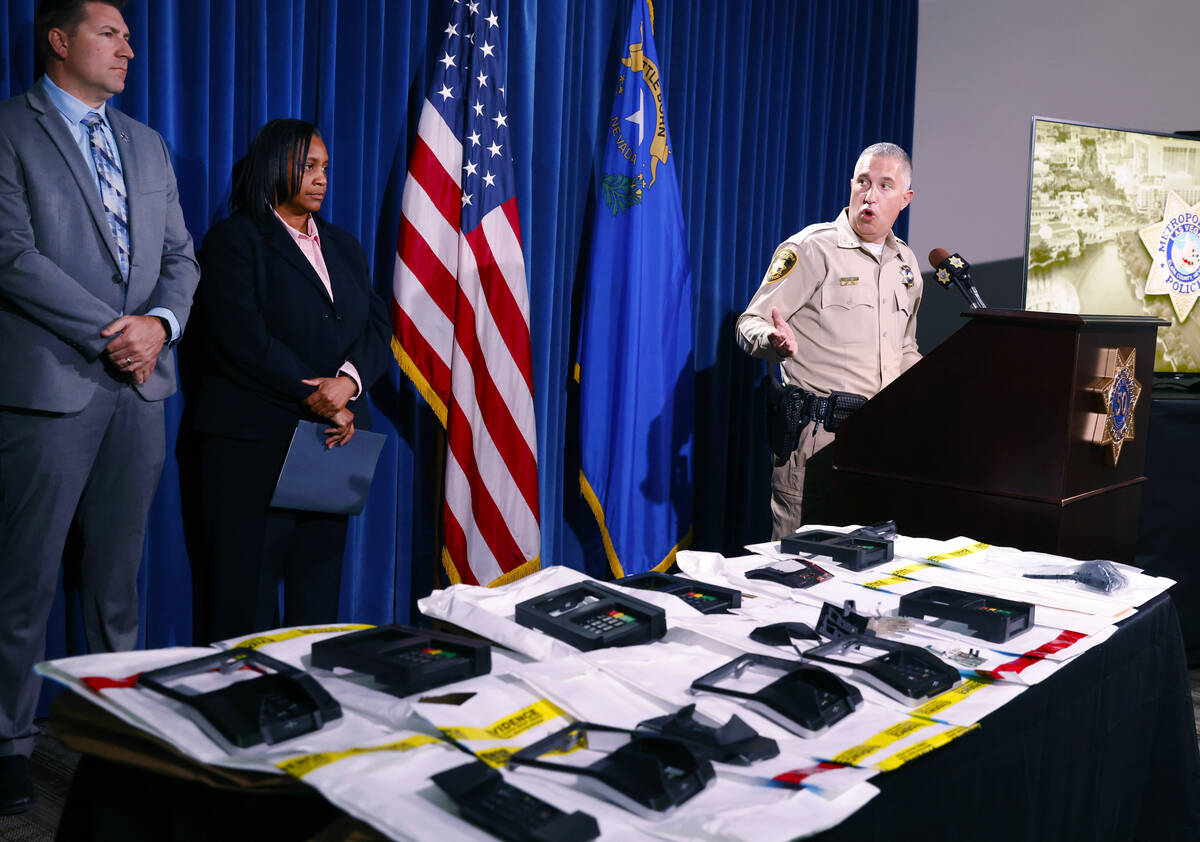

Skimming device fraud often targets people that use Electronic Benefits Transfer (EBT) cards and debit cards, and the financial impact is “easily in the millions of dollars,” Metropolitan Police Department Deputy Chief Nicholas Farese said during a Friday news conference at police headquarters. Officials from multiple agencies discussed the prevalence of skimming devices in Southern Nevada during the event and how to prevent becoming a victim.

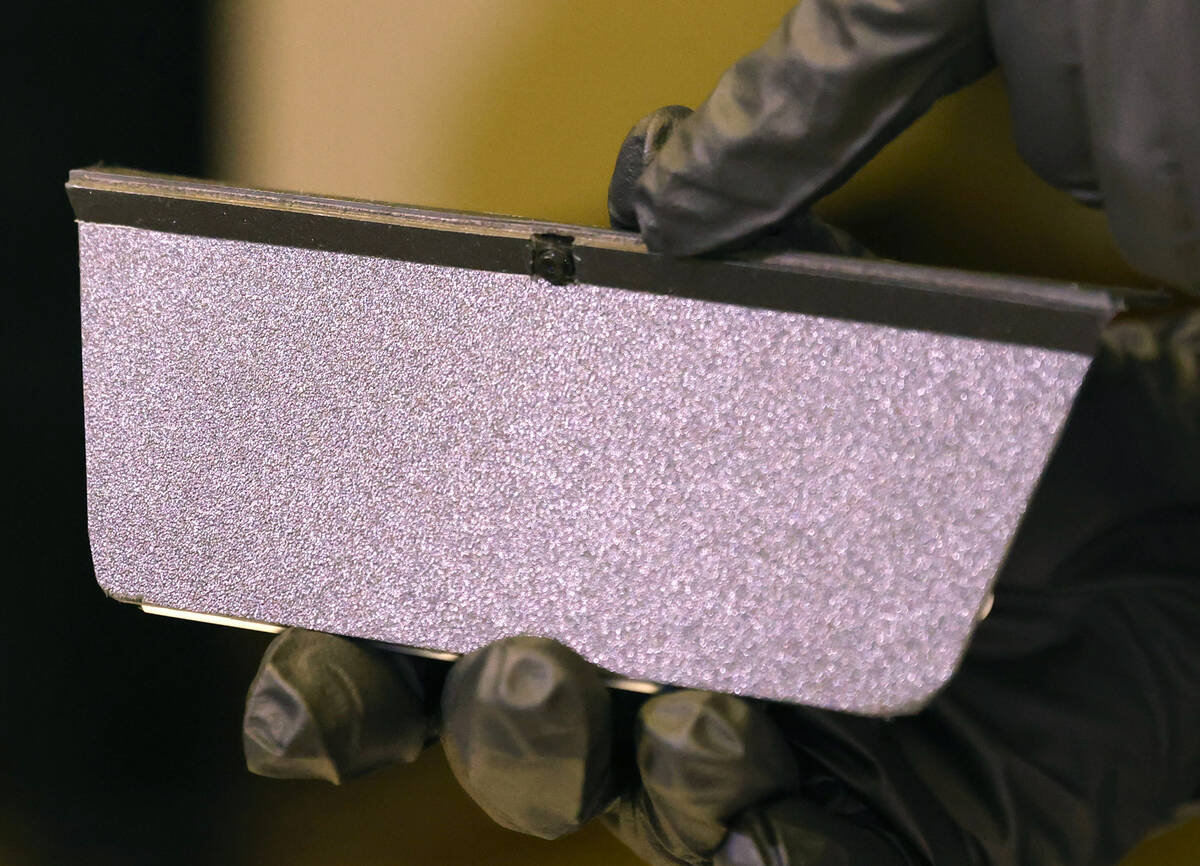

Skimming devices are difficult to detect and can be placed within card readers or are placed over card readers. These devices steal financial information that is then used by criminals to make illegal purchases or withdraw cash from accounts, Secret Service Special Agent Karon Ransom said.

Personnel from Metro, the Secret Service, Nevada State Police, the Clark County School District and the Henderson Police Department engaged with 1,150 businesses over 2½ days to educate them on the problem of skimming and to check for and remove illegal skimming devices. Most of the time businesses are unaware there are skimming devices on their card readers, Farese said.

“The suspects are pretty sly in doing these things, and sometimes there will be distractions where they distract the clerk or the merchant and put the device on gas pumps,” he said. “They’re very strategic and what pumps they choose to put the skimming devices on, usually far away from the building, far away from cameras.”

While visiting these businesses in Clark County, law enforcement officials checked over 11,600 ATMs and other card reading devices and found 18 skimming devices, Ransom said.

Metro said this is the first time such an operation has been conducted by the Secret Service and law enforcement partners. The operation targeted Las Vegas because in early April, 10 arrests were made in California related to skimming devices, and those arrests were connected to Eastern European crime networks that also have skimming activities in Southern Nevada and other states, Ransom said.

Scope of skimming and what to do about it

Ransom said skimming is a problem that has been on the rise across the nation in the past 18 months.

The number of cards affected by skimming activity in the U.S. rose by 77 percent from the first half of 2022 to the first half of 2023, according to FICO, a data analytics company.

Skimming devices have been on Metro’s radar for a while. In 2023 the department found 41 gas pump skimmers and two ATM skimmers. In 2024, six gas pump skimmers, 16 card reader skimmers and three ATM skimmers were found, Farese said.

Law enforcement officials ask members of the public to do the following to prevent being a victim of skimming:

— Check a card reader for skimming devices by seeing if the device is loose, damaged or scratched.

— Run your debit card as a credit card at gas stations and minimize the usage of PIN numbers.

— Cover your hand when entering a PIN number because some skimming operations place tiny cameras to capture PIN numbers.

Farese also said it’s better to use credit cards to avoid the impact of skimming.

“If (they) get access to your ATM card, instant access to your account, whatever money is in your account is gone,” he said. “That’s why we really encourage our community as much as possible to use their ATM card as a credit card or use credit cards.”

If someone does find a skimming device, they shouldn’t try to remove it themselves and should contact Metro at 702-828-3111.

Contact Sean Hemmersmeier at shemmersmeier@reviewjournal.com. Follow @seanhemmers34 on X.