50 mindless ways you’re burning through your paycheck

Budgeting your money is important, but even with a budget in hand, you might be spending and wasting your hard-earned dollars without even knowing it. And if you’re doing that, then you’re just going to have to work harder and longer to achieve all your goals.

By reducing your bills and watching how much you spend on incidentals, you can cut costs while stowing away funds for the future, so you can enjoy it more once you get there.

1. Paying too much for housing

Since housing is likely to be an individual’s biggest monthly expense, paying too much for it can easily break your budget. Personal finance experts recommend spending no more than 30% of your income on housing. You can spend less and save more by getting a roommate or moving to a different neighborhood or a city where housing is less expensive.

2. Spending too much on car costs

From car insurance to the cost of gas, transportation is probably one of your larger expenses. Buy a reliable and affordable used car, try to live close to work or see if you can work from home sometimes. You should also consider taking public transportation, if it’s available where you live, to cut down on gas and maintenance costs.

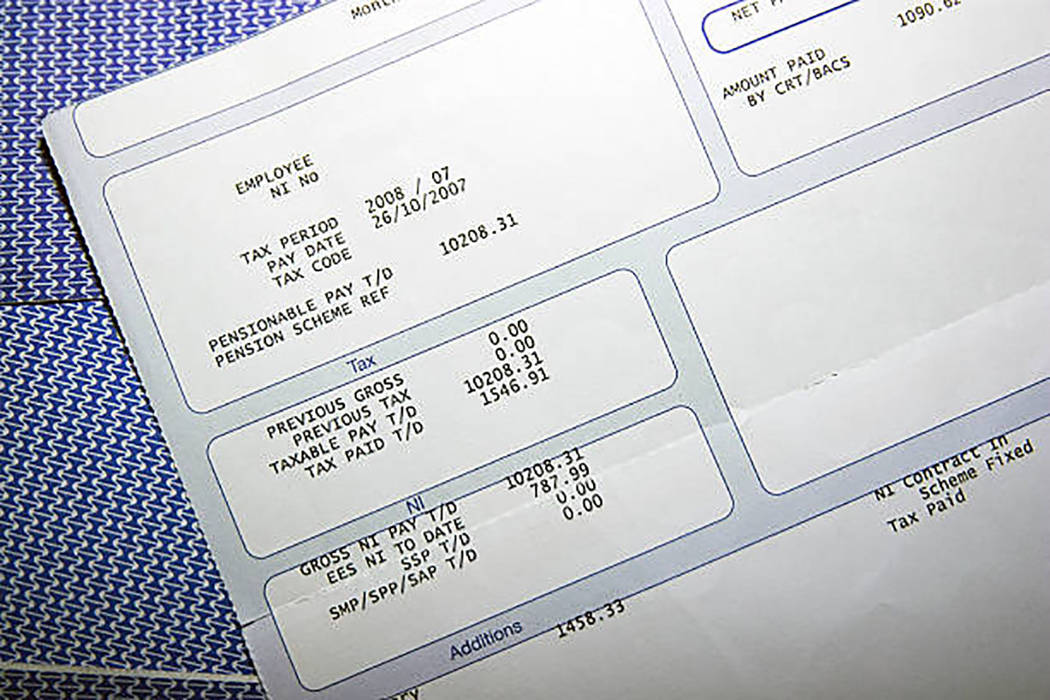

3. Putting your paycheck in a regular bank account

If you want to make the most of your money, it’s important to choose a savings account with attractive interest rates or one that pays dividends. By choosing a high-dividend savings account, your money will grow while it waits for you until you need it.

A savings account like PenFed’s Premium Online Savings Account1 comes with an annual percentage yield of 1.60% and only requires $5 to open it. By using this type of savings account, your paycheck will grow instead of those potential earned dollars being thrown away in a low-interest account or one that doesn’t pay dividends. (1 FEDERALLY INSURED BY NCUA. Annual Percentage Yield is accurate as of Jan. 22, 2020, and is subject to change at any time. Fees may reduce earnings.)

4. Wasting energy

You can lower your utility bills by conducting an energy audit on your home to find energy leak sources, such as old windows or water heaters. Even renters can improve their energy efficiency by using insulating curtains and unplugging appliances. After all, every little bit counts when it comes to saving money.

5. Buying movie theater popcorn

Movie theaters don’t actually make the bulk of their profits from movie ticket sales — concessions are the real moneymakers. Make it easy on yourself to avoid these treats by eating at home before you head to a show.

6. Paying ATM fees

When you use an ATM that is outside of your network, your bank and the ATM might both charge you fees. Find a bank with plenty of ATMs in the places you frequent or with a wide network of partners to save.

7. Not planning meals ahead of time

Keep your grocery budget under control by planning out your meals and shopping accordingly. You can use an app like Mealime or FoodPlanner to help you do this.

8. Grocery shopping without a list

Maintain a running list of what you need to pick up at the grocery store to avoid making any unnecessary purchases. You’ll know exactly what needs replacing, and you won’t have to do any guesswork.

9. Carrying credit card debt

Credit card debt is one of the most expensive types of debt you can carry. Those minimum payments might seem low now, but they can cost you hundreds to thousands of dollars in yearly interest, depending on the amount of debt you’re carrying. If you have credit card debt, make a debt reduction plan. For example, try transferring your balance to a low-interest credit card and commit to paying it off for good.

10. Drinking bottled water

Bottled water was an $18.5 billion industry in the U.S. alone in 2017, according to the Beverage Marketing Corporation. If you’re still drinking from the bottle, consider buying a water filter to stop wasting money.

11. Paying for cable

Now is a great time to save money by cutting the cable cord. There are plenty of online streaming services, like Netflix, Hulu and Amazon, which cost a fraction of the standard cable service price. To save even more money, share a Netflix or Hulu account instead of getting an individual one for each service.

12. Buying brand-name products

Consumers find comfort in using brands they know and love, but generics often work just as well as their brand-name counterparts. For example, you can save money by buying store-brand medications and grocery store-brand breakfast cereal.

13. Not changing the thermostat setting

It’s a mistake to keep your thermostat running at the same temperature all year long. Turning your thermostat back 7 to 10 degrees for eight hours during the day can save you up to 10% on your heating and cooling bill each year, according to Energy.gov. Or just turn off the heat or air conditioner and open the windows in nice weather for some zero-cost days.

14. Buying coffee

America’s love affair with coffee shows no sign of waning. In fact, almost half of the workers surveyed by CareerBuilder in 2016 said they buy coffee during a typical work week. And 1 in 4 admitted to spending between $10 and $25 each week on coffee. That amounts to between $520 and $1,300 annually. To break this bad habit, learn how to make your favorite coffee drink at home and watch your savings soar.

15. Ignoring your phone bill

Check your phone bill to make sure you’re not getting charged for services you don’t use. You might be paying for things such as unlimited data and other features you don’t really need.

16. Using regular lightbulbs

Compact fluorescent lamps, or CFLs, might not be the most flattering bulbs, but light-emitting diode, or LED, lightbulbs are surprisingly beautiful. LEDs use 75% less energy and last 25 times longer than regular lightbulbs. There are some higher upfront costs, but LEDs can help you save money in the long run.

17. Signing up for a gym membership

Once January hits, many of the treadmills at the gym are occupied, and the Zumba classes are bumping. But just a few months later, the place looks like a ghost town, with many people forgetting their resolutions to work out.

Consider skipping the pricey gym membership and using your neighborhood as a “gym” for walking, running or biking. Or download a cheap fitness app to get in shape for less.

18. Smoking cigarettes

Smoking doesn’t just harm your health — it also busts your budget. Depending on how much you smoke, quitting cigarettes can save you thousands of dollars a year. Just think of what you can do with all that extra cash.

19. Buying lunch at work

You’ve heard it before, but buying lunch at work is a huge waste of money. Instead, buddy up with your co-workers and try “brown bagging” it at work. You can end up saving a good chunk of cash. Or just allow yourself one lunch out a week as a treat.

With the money you save on eating out, you can make the most of it by putting it away each week into a high-dividend savings account like the one at PenFed Credit Union. Dividends are compounded and credited to your account on a monthly basis, so you can let your savings sit and do the work for you.

20. Overdrawing your bank account

According to a CNN study, customers at the three largest banks in the U.S. paid more than $6.4 billion in ATM and overdraft fees in 2016. Track your finances daily or consider switching to a bank that doesn’t have any overdraft fees at all. (Yes, they do exist.)

21. Eating out for dinner

Some dinners out are certainly worth it, but constantly eating in a restaurant can wreak havoc on your finances. Be mindful of how often you eat out. Even something as simple as dining earlier in the evening can help you eat less and save more. Not drinking alcohol with meals also saves a bundle.

22. Grabbing fast food

Instead of spending $20 at a restaurant, you might opt to grab a $5 meal at your favorite fast-food joint. After all, it’s quicker and cheaper. However, if you want to save more of your paycheck, reduce the number of times you eat out altogether.

23. Ordering appetizers

Restaurant portions are huge these days, so why order an appetizer when the entree is already going to be more than enough? Instead, eat a light snack about an hour before you have dinner out to help you resist the urge to order a starter.

24. Driving around with flat tires

You could improve your gas mileage by up to 3% by keeping tires properly inflated, according to the U.S. Department of Energy. For best results, read your car’s manual to find the recommended pounds per square inch and fill your tires at the gas station. The attendant can usually help if you need assistance.

25. Putting your money in a high-fee checking account

Many people don’t realize how much they’re paying in checking fees. If your checking account includes monthly maintenance fees and minimum balance requirements, it’s time to find a checking account with no fees.

26. Shopping online

It’s easy to burn through your paycheck when you’re shopping at your favorite store. It’s even easier when you can shop at your favorite store without leaving home. However, online shopping can become much more expensive than shopping at a store, especially when you include the cost of shipping.

27. Requesting faster shipping

It’s hard waiting for your online purchases to arrive, but paying extra for expedited shipping is a waste of money. Patience is a virtue, but if you really just want everything now, sign up for a service such as Amazon Prime, which includes free two-day shipping on many items.

28. Paying unnecessary bank fees

Banks are desperate to get new customers in their doors and might be willing to cut fees to lure you in. Shop around and compare the offerings — you’ll likely find better and cheaper banking services somewhere else. There are some banking fees you should never pay.

29. Using a credit card with a high annual fee

Some credit cards — especially credit cards that come with amazing perks — charge high annual fees. But if you’re not using the credit card perks that justify the annual fee, find a card with a lower annual fee or no fee, so you can save more of your paycheck every year.

30. Paying any other unnecessary fees

From airline baggage and resort fees to investment fees, there is an added cost for everything these days. However, you can easily prevent fees from eating your paycheck by doing your research and finding ways to avoid them.

31. Collecting stuff you don’t need

Does your baseball card, comic book or “Star Wars” collection add value to your life? Or would you find greater value in cashing out? Even just trimming down a valuable collection can reduce clutter and give your bank account a boost.

32. Spending too much on snacks

Protein bars, chips and beef jerky might help you get through that traffic jam or just survive a boring day at the office. However, the cost of snacking can add up. If you plan your meals and shop with a grocery list, you won’t need to fill up on unhealthy and expensive snack foods.

33. Throwing your child a huge birthday party

Your child will forgive you for not throwing him or her an expensive birthday bash. But if you’re strapped for cash, you can still plan an unforgettable birthday party for your young one. Research creative DIY tips on how to bake a cake, make party favors and create fun entertainment options that don’t require a big budget.

34. Shopping impulsively

If you’re considering an impulse buy, wait 30 days and ask yourself if you still want or need that item. You might even forget about it completely, which pretty much answers the question for you.

35. Buying books

Books are definitely beloved items, but if you burn through them faster than a California wildfire, consider using a service such as PaperBack Swap to cut down on the costs. You’ll get to swap your collection with others online and have new titles mailed to you for free. You just have to pay for postage for the books you send out.

36. Not using coupons

From groceries and household items to clothing and jewelry, you can likely find coupons for anything you need. And you don’t have to clip them the old-fashioned way, either. You can use apps and websites, such as Coupons.com, to digitally clip coupons and score big savings.

37. Buying new instead of used

Thanks to the internet, you can find pretty much anything you need in good, used condition at a fraction of the price. Not everything should be purchased used, but pricey items — such as sporting equipment and furniture — can be great used buys.

38. Skipping breakfast

Eating breakfast ensures your day starts right and can keep you from buying a huge, expensive lunch. Try cheap breakfast foods, like oatmeal or eggs, which will keep your stomach (and wallet) full and prevent you from wasting money on those morning McMuffins.

39. Paying multiple student loans

Student loans can be an overwhelming debt to handle, but consolidating might be an option you should consider. By consolidating, you might be able to lower your monthly payments and extend your repayment period.

40. Ignoring your credit reports

A good credit score can help you save money on everything from personal loans to a mortgage. Use a credit monitoring service to keep an eye on your score and work toward building your credit.

41. Not using your benefits package

Some employers offer awesome benefits, like discounts on car insurance, free tickets to events, education reimbursement or personal improvement seminars. You work hard, so make sure you’re reaping all the benefits you are entitled to.

42. Manually paying your bills

One piece of money-saving advice that many people don’t follow is to automate their finances. Put your bills on autopay to avoid late fees or dings on your credit report and stop wasting money.

43. Hitting the bars

Drinking at bars with friends is fun, but nothing’s stopping you from dodging pricey drinks when you’re out on the town. At the very least, drink during happy hour so you’re not paying a premium for that gin and tonic.

44. Throwing out leftovers

Keep your food waste to a minimum by eating your leftovers. Or better yet, take them to work for lunch the next day.

45. Buying basic items at the grocery store

Many warehouse clubs give you the best bang for your buck on staples such as toilet paper, trash bags, laundry detergent and diapers. Bulk items usually offer better prices per unit — you just have to figure out where to store those 140 rolls of paper towels.

46. Paying too much for car insurance

Car insurance companies are constantly offering new ways to save on coverage, so do an annual audit of your policy and shop around for better rates.

47. Gambling

You might think it’s no big deal to shell out a few bucks here and there on lottery tickets or during your monthly poker party. But the reality is that gambling is an almost surefire way to burn through your paycheck — no matter how good or lucky you might be. Instead of throwing your hard-earned money away, put it to good use in a savings account or investment fund.

48. Paying too much in 401(k) fees

If you’re socking away money in a 401(k) to save for retirement, that’s great. But you should know how much you’re paying in 401(k) fees. High fees can reduce your retirement savings, so make sure you know exactly how much the investment house is taking off the top.

49. Shopping at the wrong retailers

As much as you love shopping at Target, Walmart, Costco or other retailers that offer serious savings, you might want to avoid buying specific items at these stores. For example, some experts say that Walmart and Target are poor choices for produce. Instead, hit up these two retailers for home goods and some electronics.

50. Paying too much in taxes

If you got a large tax refund last year, you might have overpaid in taxes. Take another look at your W-4 form, and make sure you’re claiming the right number of allowances. And when you get ready to fill out your return, be sure to take advantage of the tax deductions you qualify for.

Sydney Champion contributed to the reporting for this article.

This article originally was originally published on GoBankingRates.com: 50 Mindless Ways You’re Burning Through Your Paycheck.

More From GOBankingRates

401(k) vs. Roth 401(k): What's the Difference?

The Facts on High-Yield Savings Accounts

Best CD Rates and Accounts of 2020

5 Best Investment Apps: Commission-Free Trading and More