Economist: Two more years for construction to rally

Even with modest signs of economic growth, tough conditions will permeate the construction industry for at least two more years, the chief economist for Portland Cement Association said at ConExpo-Con/Agg 2011 in Las Vegas.

Edward Sullivan said he's optimistic about construction overall because of pent-up demand being generated across both the residential and nonresidential sectors.

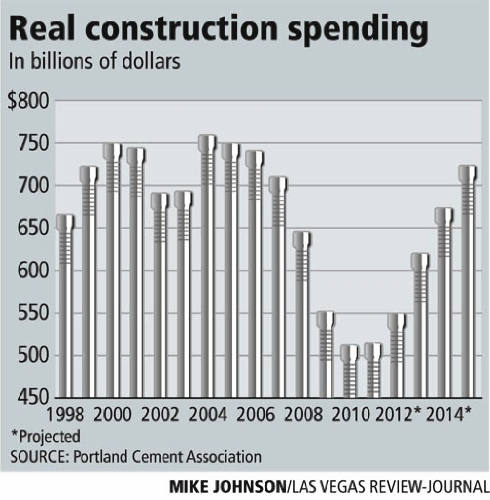

Construction spending will show meager gains in 2011 and into 2012, but Sullivan said he doesn't expect to see any significant increase in real construction spending until 2013.

The economist is projecting a 2.7 percent growth in gross domestic product and 1.5 million jobs being created this year, compared with most economic forecasts of 3.5 percent GDP growth and 2 million jobs.

"Our industry never wants to be surprised on the downside," Sullivan told about 150 people attending his economic outlook at ConExpo on Wednesday. "They like to be surprised on the upside. That's why I layer my projections with conservatism."

The economy was shedding 750,000 jobs a month not long ago and business crashed to the lowest level of any recession. More than 8.5 million jobs were lost. Had it not been for federal policy, the economy could easily have dipped into a depression, Sullivan said.

The office sector lost 2.4 million jobs. As office occupancy declined, net operating income and return on investment for commercial property plummeted. Office vacancy is at 17 percent nationally, closer to 25 percent in Las Vegas. Office employment would have to grow by 500,000 jobs to stabilize lease rates and by 5 million to fill the vacancy, the economist estimated.

On the residential side, homeowners face mounting foreclosures and excess housing supply.

"These are huge impediments that must be overcome before we see recovery in construction," Sullivan said. "Look at it as a wound: the deeper the cut, the longer the recovery."

In a separate indicator of construction activity, the Architecture Billings Index rose to 50.6 in February, up slightly from 50.0 the previous month. However, the index is not exhibiting the strength of business conditions that were seen in the final quarter of 2010. The index reflects the nine- to 12-month lag time between architecture billings and construction spending.

Concrete consumption has declined by 50 million tons a year and the imbalance between supply and demand dwarfs that of any past recession by multiples, going back to the Great Depression, Sullivan said.

"We shut down 16 plants, eight of them permanently," he said. "Even when the economy recovers, the cement industry will not."

The credit crisis that was sparked by subprime mortgage defaults spread into consumer spending, which accounts for two out of three GDP dollars, Sullivan said. That led to job losses, state budget deficits and rising energy prices.

The credit pendulum has swung from being too loose to too tight, though lending standards are starting to ease at certain credit rating levels, he said.

With very little private money funding construction, recovery will have to start with public works, Sullivan said. The American Recovery and Reinvestment Act provided $5 billion in spending in 2009 and $11.5 billion in 2010, which leaves about $9 billion to be spent, most of it this year.

Composition of the spending is getting away from resurfacing roads to widening and building new routes and bridges, he said.

The political reality of the proposed $1.1 billion highway construction bill is that everyone recognizes the need to improve the nation's infrastructure, but few leaders in Washington will vote for the 5-cent fuel tax required to fund the projects, Sullivan said.

State spending on transportation accounts for $120 billion a year, he said. Only three states in the nation have no deficit shortfall in their budgets. Nevada's deficit is 20 percent.

"Deficits always go away," the economist said. "It happens every time you have a recession. You cut spending and raise taxes. That's met with job recovery and those surpluses return. We get more money, we spend it and the next time we have a recession we're in trouble again."

On the floor at ConExpo, Andrew Cope of exhibitor Chicago Pneumatic said the first three months of the year have been pretty good for business. The company is selling more tools on the industrial side and for metal fabrication. Tool distributors and rental companies are restocking inventories, he said.

Colby Slining of RDO Equipment Co. in Sioux Falls, S.D., said he was attending his first ConExpo in Las Vegas and was impressed with the equipment at the show.

"We've been crazy busy, even last year," the businessman said. "It's almost hard to keep up at times. A lot of it has to do with our part of the world. People don't overextend themselves. It never got as bad as it did here. The only thing we have a concern for right now is fuel prices."

Turnout for ConExpo 2011 has been outstanding, said Brian Turmail, public affairs director for the Associated General Contractors of America. Attendance is estimated at 125,000 for the four-day show at the Las Vegas Convention Center.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.