EDITORIAL: Biden used a tax loophole to shave tax bill by $500K

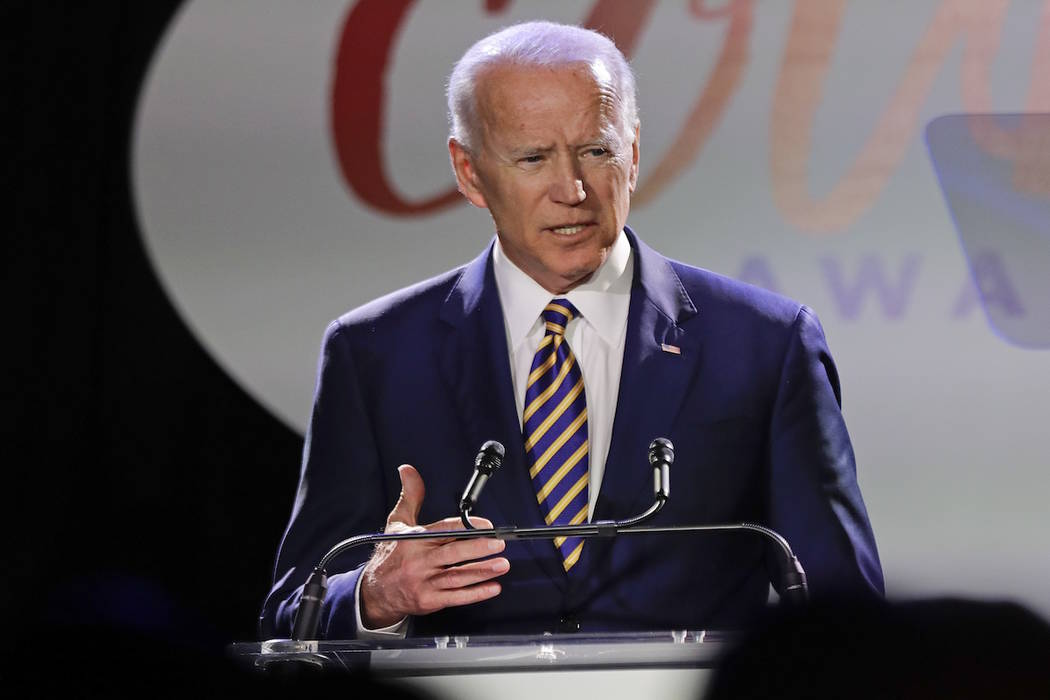

Former Vice President Joe Biden, now the front-runner in the race for the Democratic presidential nomination, hates tax loopholes. His platform includes getting high-income Americans to pay more in taxes and eliminating write-offs used by the rich.

But it looks like a “do what I say, not what I do” kind of commitment.

As Richard Rubin of The Wall Street Journal recently reported, Mr. Biden and his wife took advantage of a tax loophole that the Obama administration unsuccessfully attempted to close, substantially lowering their tax bill.

According to the couple’s recently released tax returns, they routed their book and speech income through so-called “S corporations,” which allowed them to bypass the 3.8 percent self-employment tax that would have applied had they been compensated directly. The move — which critics of Donald Trump suggest the president has also used — saved the Bidens $500,000 in taxes on their roughly $15 million in income.

As the Journal points out, Biden has been an outspoken opponent of such loopholes since Ronald Reagan was in office, and says the uncollected tax revenue should be used, in part, to make community college free for more students or to help fight climate change.

“We don’t have to punish anybody, including the rich. But everybody should start paying their fair share a little bit,” he said during a speech in Iowa last month. “When I’m president, we’re going to have a fairer tax code.”

Per current tax law, S-corporation owners can legally avoid paying the 3.8 percent self-employment tax on their profits as long as they pay themselves “reasonable compensation” that is subject to regular payroll taxes. The IRS definition of “reasonable compensation” is a tad fuzzy, however, which led to the Bidens reporting less than $800,000 salary on their reported $13 million in combined profits.

Mr. Biden has plenty of company when it comes to preening progressives whose actions don’t match their rhetoric. When the late Sen. Howard Metzenbaum — an unapologetic hyperliberal who never met a tax or regulation he didn’t like — passed away in 2008, it was revealed that he had saved millions in income and estate taxes by moving his residency to Florida from Ohio.

It must be pointed out that the Bidens did nothing wrong here. There’s nothing wrong with allowing wage earners to keep more of their own money, and they successfully used the rules of the tax code — passed by Congress — to do just that.

But if you’re going to talk the talk about soaking the rich and the immorality of tax loopholes that benefit the wealthy, it might be more effective if you also walked the walk.