A WHOLE LOT OF NOTHING GOING ON

Hold off on buying season tickets for the phantom NBA team that Las Vegas Mayor Oscar Goodman is busy courting.

It's yet to be determined whether the team is going to play in a 20,000-seat, $500 million sports arena planned by Harrah's Entertainment behind Bally's or the $1 billion REI Neon project proposed near the Arts District in downtown Las Vegas.

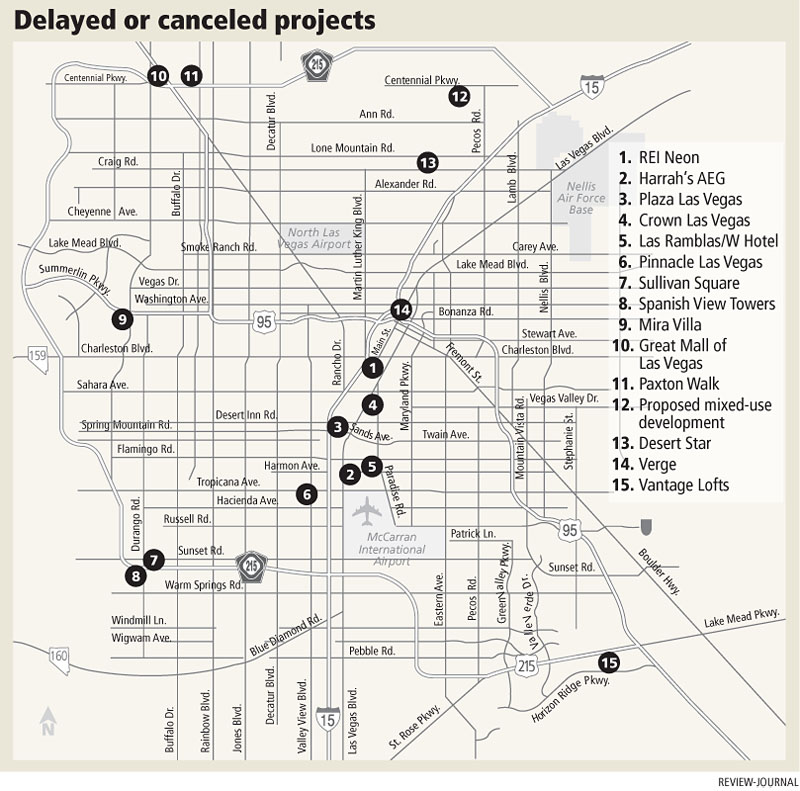

Neither project has made progress. Michigan-based REI has asked the Las Vegas City Council for multiple extensions on its proposal. Harrah's has said financing is readily available for its project and announced a partner, Anschutz Entertainment Group, but developers have done little more than announce hiring a designer for the proposed arena, which was originally planned to start construction this month.

Don't make hotel reservations at Plaza Las Vegas, either. The $8 billion casino resort planned at the former New Frontier site is on hold for a number of reasons, including financial and legal issues.

The same goes for Crown Las Vegas, a $5 billion resort that was scheduled to open in 2011 on the former Wet 'n Wild site on the Strip. The property was recently listed for sale after the Federal Aviation Administration denied a 1,900-foot height proposal for the hotel tower.

You had better not have plunked down a deposit for a luxury condo at places like Spanish View Towers, Vantage Lofts or Mira Villa. Construction is stalled on those projects as they proceed through bankruptcy protection. Cosmopolitan, a $3 billion condo-hotel on the Strip, is in foreclosure thanks to Deutsche Bank, though construction continues toward a 2009 opening.

In a city built on hype, deciphering what's real and what's not in Las Vegas is like trying to guess where the ball's going to land on the roulette wheel.

From high-rise condos and regional shopping malls to billion-dollar resorts and mixed-use developments, dozens of projects announced for Las Vegas have yet to materialize, and some probably never will.

Already laid to rest are The Curve, Las Ramblas, Ivana Las Vegas, Icon, Spa Lofts, Pinnacle, Urban Village and W Las Vegas Hotel.

Plans for an off-Strip Harmon entertainment corridor became one of the early victims of troubled financing in June 2006 when Las Ramblas, a 4,000-unit hotel-condominium project tied to actor George Clooney, sold its 25 acres of land to the Edge Group.

Eleven months later, Edge Group's minority partner Starwood Hotels and Resorts Worldwide pulled out of the $2.5 billion W Las Vegas mixed-use project, leaving the future of 50 acres along Harmon up in the air. An investment group, Israeli-based Africa Israel Investments, controls the land but has been quiet about its plans.

Goodman said he's working on the REI Neon proposal nearly every day, negotiating with some of the most "responsible entrepreneurs" in the country, including Baltimore-based Cordish Co. and Goldman Sachs investment firm.

"These are interesting economic times, but I'm dealing with deep-pocketed people who have an accordance to (build) an arena," Goodman said. "These are not easy projects. They don't happen overnight. These economic times don't make it any easier. But I'm dogged in having an arena downtown and putting up my word that we're not going to put taxpayers at risk, and that's part of our negotiations."

The involvement of Goldman Sachs has sparked speculation that the downtown arena could move to 17 undeveloped acres next to the Stratosphere, which was bought in February by an affiliate of the financial firm.

AEG, Harrah's and the owners of the Stratosphere have refused to discuss the speculation publicly.

The resort corridor isn't the only area affected by stalled developments.

Triple Five's Great Mall of Las Vegas, for instance, is a 5-year-old idea, but nothing more than that, except that its freeway signs dot the northwest valley. Executives at Triple Five did not return phone calls for comments.

Athena Group and Vestar Development Co. created a lot of hype over a 160-acre, mixed-use development at Craig Road and North Fifth Street by asking the community to come up with a name for it and awarding a four-year college scholarship to the winner. That's about as far as it's gone.

Athena was supposed to break ground on the Desert Star project in 2007. Plans call for 1.5 million square feet of commercial space, 1.3 million square feet of townhomes and lofts, 15 restaurants and recreational areas.

Developers are shying from starting new projects now, Athena Chief Executive Officer Louis Dubin told The Real Deal in April. "We have put off a number of projects for the foreseeable future in '08," he said. "Our new projects won't start until '09."

Another group is interested in buying property owned by Jack Binion near the northern Beltway and Losee Road for a mall, hotel and 2,000 residential units.

"They're still moving forward and we're still meeting with the developers," North Las Vegas economic development manager Mike Majewski said. "I can't tell you what stage they're at, but we're still working with them and everything's a go. They're not delayed. It's just the natural course of buying the land and getting the zoning."

Majewski is also waiting on a 32-acre commercial development at Las Vegas Boulevard and Hamilton Street in the heart of North Las Vegas. He said California developer Jose de Jesus Legaspi is lining up tenants and hopes to break ground on the $130 million Las Flores center in first quarter 2009.

While some condo projects such as Manhattan West and The Mercer are moving forward, others face uncertainty.

Verge moved its sales office onto its downtown site at Main Street and Bonanza Road, but has yet to open the doors while the project undergoes a redesign. Sullivan Square, a mixed-use development in the southwest valley, is mired in a legal dispute between the developer and lender.

Las Vegas-based GSG Development has resigned its position as manager of Sullivan Square, leaving future development of the project in the hands of Harcourt Developments, GSG founder and managing partner Kenneth Smith said.

"It's a very strange situation when you have a majority partner stop funding critical aspects of a project and yet claim that they are proceeding with the project," Smith said. "As our lawsuit alleges, it just became an impossible situation having us as manager and yet Harcourt not keeping their word, or dealing with the buyers and consultants in a professional manner. My hope is that Harcourt moves forward with the best interest of Sullivan Square's buyers and this community in mind."

Paxton Walk in northwest Las Vegas suspended sales until the market recovers.

The recession is a "self-cleaning of the economy" that will sift out developers who came to the party late, said Avi Ruimi, principal of Woodland Hills, Calif.-based Blue Marble Development. He bought the land for Paxton Walk before the run-up in prices.

"They all had good intentions. I feel bad for them," he said. "Each of them made a different mistake. I can analyze those mistakes in retrospect. At the time they made the decision, they were right. It's very difficult to predict a market like Vegas. It's not a market that gives you a sign before the bubble bursts in your face."

The 1 million-square-foot World Jewelry Center is another large question mark in downtown Las Vegas. Construction was scheduled to begin in 2007.

Goodman said he recently met with developer Robert Zarnegin in Beverly Hills, Calif., for a status update.

"They're diligent about their presentation," Goodman said. "They have a tremendous amount of money in it, and they're traveling all over the world signing letters of intent with jewelry manufacturers and designers."

The Lady Luck, purchased by Los Angeles-based CIM investment group, has sat vacant for more than a year.

New York investors Barnett Lieberman and David Mitchell have been talking to city officials about plans for 14 acres they assembled in five square blocks downtown. They've got "buildings on the drawing board," Goodman said, along with an agreement to build an intermodal transfer center for the Regional Transportation Commission.

The economic slump that started with the subprime mortgage crisis and downturn in the housing market has spread to the commercial markets.

In the past couple of years, rising construction costs and a scarce amount of available land for industrial development in Las Vegas have made developers wary about starting new projects, broker Xavier Wasiak of Grubb & Ellis said.

Of the projects that did get under way, most are now complete. However, the amount of new buildings under construction is starting to dwindle as many planned projects once feasible are being scaled back or even canceled, he said.

"If you do not make it a general practice to regularly re-evaluate your methods, conditions faced by today's market force you to rethink everything you thought you knew about the industry," Wasiak said.

This story first appeared in the Business Press. Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491. Contact reporter Arnold M. Knightly at aknightly@reviewjournal.com or 702-477-3893.

LACK OF FINANCING BIG OBSTACLE FOR CONDOS

The primary reason many condominium projects are on hold or were canceled is the inability to secure development financing, said Eileen Bechtol, senior vice president at Chicago Title of Nevada.

Even before the credit crunch, lenders required projects to have a certain percentage of contracted buyers, not just reservations, and some projects failed because they couldn't get enough "true sales," she said.

"With the new, more stringent underwriting requirements (that) lenders must utilize, projects that might otherwise have gotten financing won't now," Bechtol said. "I'm sure there are other reasons, but I know that's a big part of it."

Laura Lane of Sedona, Ariz., said she and her husband put money down on a unit at Vantage Lofts, a residential project at Gibson Road and Horizon Ridge Parkway in Henderson. They were wondering what's happening there after the Review-Journal reported in March that construction had ground to a halt and some $17 million in liens were filed by subcontractors.

Henderson-based Slade Development filed for Chapter 11 bankruptcy protection on Vantage Lofts in June. Chairman Stacy Slade said he wants to get the project completed and pay the subcontractors.

"It's been a real battle," Slade said. "The lack of sales in the market, because of the downturn, it's no surprise, especially in the condo market."

Developers of the $650 million Pinnacle Las Vegas, distinguished by a "sky bridge" that would have connected two 36-story towers, were confident the project wouldn't end up in the junk pile with Krystal Sands and Aqua Blue because the 20-acre site was owned free and clear.

When they couldn't get financing, the developers closed the sales gallery in February and returned buyers' deposits.

"It's unfortunate because we were very successful in selling the units in a short period of time," Rise Realty broker Kyle Waugh said. "I talked to several buyers and they're happy that their deposits are being returned, but they're disappointed that it didn't get out of the ground."

HUBBLE SMITH/REVIEW-JOURNAL

SOME SURVIVORS

Several high-profile projects have come to fruition or are making progress in Las Vegas. However, the surviving projects are backed by large ventures with deep pockets.

Las Vegas Sands Corp.'s $1.8 billion Palazzo opened in late December, Wynn Resorts Ltd.'s $2.1 billion Encore is on track to open this December.

MGM Mirage's $9.2 billion CityCenter, the $2.9 billion Fontainebleau Las Vegas, and Anthony Marnell III's $1 billion M Resort are all taking shape for 2009 openings.

Boyd Gaming Corp.'s $4.8 billion Echelon project is under construction with a projected opening in the late summer 2010.

Away from the Strip, the $250 million Eastside Cannery is scheduled to open in late August and the $675 million Aliante Station in North Las Vegas is set for a Nov. 11 opening.

ARNOLD M. KNIGHTLY/REVIEW-JOURNAL