Consolidation in sports betting operations unlikely to slow down

The sports betting world is in midst of another flurry of billion dollar-plus consolidation moves that are shaking up the industry, a trend that isn’t expected to slow down anytime soon.

“(Merger and acquisition)activity is going to continue to be robust, not only in the short term, but in the long term as well,” said Brendan Bussmann, director of government affairs for Las Vegas-based Global Market Advisors.

The surge in consolidations comes as the rapid expansion of U.S. sports betting has companies on a constant push to scale up their platforms to reach the growing pool of customers as early as possible while still offering the latest in tech innovations, or risk being left behind.

Caesars Entertainment closed its $4 billion acquisition of sports betting giant William Hill in April and quickly rebranded it to Caesars Sportsbook. In August, Penn National Gaming announced its plans to acquire digital sports media company Score Media and Gaming in a $2 billion deal, which was followed days later by an announcement from DraftKings detailing the company’s plans to acquire Golden Nugget Online Casino for $1.56 billion in an all-stock deal. Last week, Las Vegas-based gaming manufacturer Scientific Games Corp. agreed to sell its sports betting business to the owner of UFC for $1.2 billion.

Even ESPN is looking to get in on the action in some way, with the sports media giant looking to license its brand to betting companies for at least $3 billion, the Wall Street Journal reported.

But none of those deals comes close to DraftKings recent $20 billion bid to buy the U.K-based sports betting company Entain PLC, a deal that could cause significant disruption in the industry as expansion efforts continue full bore.

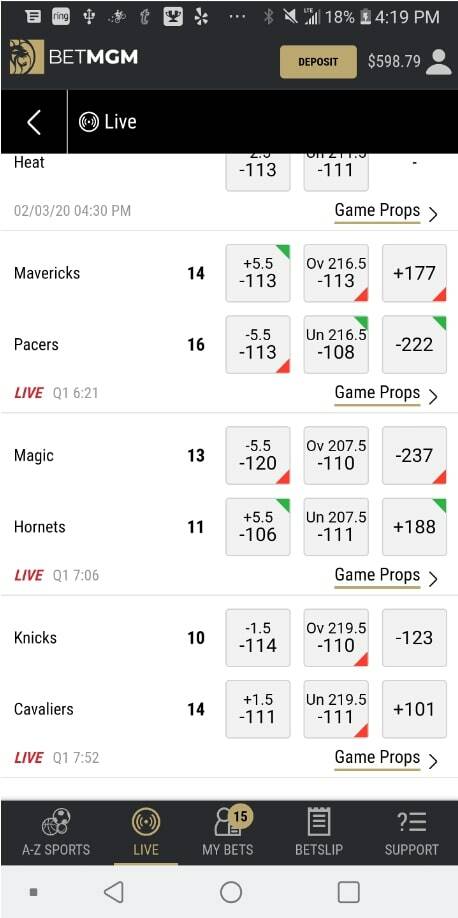

Entain and MGM Resorts International own and operate the sports betting brand BetMGM in a 50-50 joint venture. In January, MGM attempted to acquire Entain and take full ownership of BetMGM, but their $11 billion bid was rejected, and analysts believe the push from DraftKings could spark a second attempt from MGM to ensure control of their sports betting brand.

“I don’t see MGM, who has made this a priority, letting DraftKings in with their partner,” said Bussmann.

The importance of tech stacks

One of the key drivers behind the rapid pace of acquisitions is the need stay at the front of the field from a technology standpoint. Most of the mergers and acquisitions in the sports betting industry are being done so that companies have an opportunity to pick up the newest technology and incorporate it into their own portfolio quickly.

“Technology is going to be the great differentiator as we move into the next chapter of sports betting,” said Becky Harris, a distinguished fellow at UNLV’s International Gaming Institute and former chair of the Nevada Gaming Control Board. “Those that own their own tech stacks are at a significant advantage than those who don’t.”

Companies are also vying for increased market share as more states legalize sports gambling, and consolidations offer instant access to massive databases of new customers.

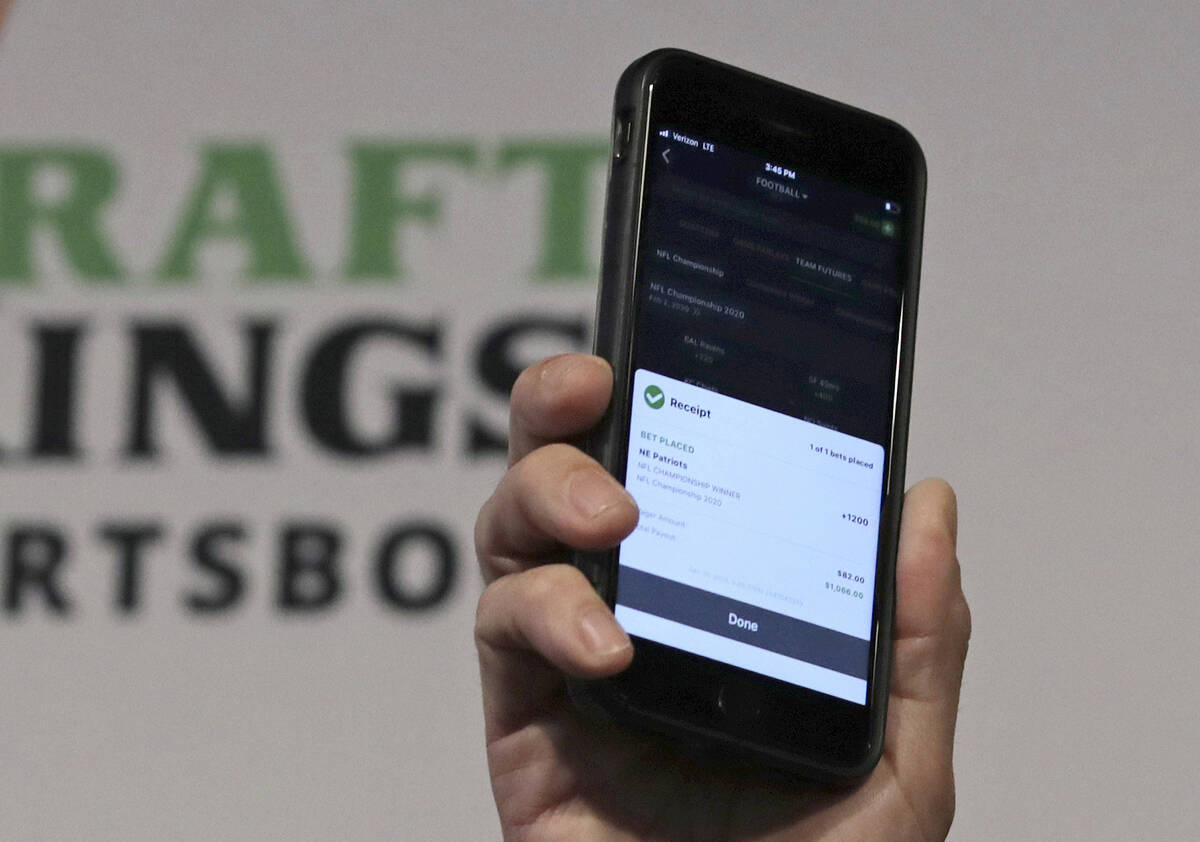

When DraftKings reached its deal to buy Golden Nugget Online Gaming, the company noted in its announcement that the acquisition would “enhance our ability to instantly reach a broad customer base.”

“The sportsbook business, it’s not a high margin business,” said Dan Etna, co-chair of the Sports Law Group at New York-based firm Herrick, Feinstein LLP. “It’s profitable business for sure, but the real way to make hay in this business is to have a large following of customers because this is such a scalable business in terms of revenue generation.”

Expansion continuing

For decades, Nevada held a monopoly on sports betting in the United States. But a 2018 ruling from the U.S. Supreme Court repealed the Professional and Amateur Sports Protection Act of 1992, or PASPA, opening the door for other states to enter the market.

Three years later, 27 states and Washington D.C. have live, legal sports betting, while five others have legalized the practice but are not yet operational. Two other states have pending legislation, according to the American Gaming Association.

It’s surprising that roughly one-third of states have yet to make the legalization jump, including the likes of California, Texas and Georgia, according to Harris.

“I thought we would see faster adoption than we have,” said Harris. “There was a lot of pent-up demand for it.”

That growth since legalization means a whole host of new customers for these sports wagering companies.

An annual survey from the American Gaming Association last month showed that 45.2 million Americans planned to wager on the 2021 NFL season, up 36 percent from the previous year.

The biggest increase, to no surprise, is expected in the online sportsbooks, where 19.5 million plan to bet online this season. That’s a 73 percent increase from the 2020 season.

And the race to capture those new bettors is clearly underway.

Contact Colton Lochhead at clochhead@reviewjournal.com. Follow @ColtonLochhead on Twitter.