DesertXpress project to California faces rising costs

For much of the past decade, the debate surrounding the proposed DesertXpress bullet train has focused on one name: Victorville.

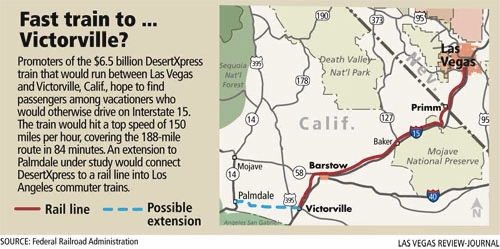

The fault line that separates proponents and critics is whether it would make sense to have a 188-mile high-speed train terminate in the high-desert city of 115,000 on the northeastern fringe of metropolitan Los Angeles. Critics like to call it a fast train to nowhere. Backers tout it as good for the local economy -- a faster and more comfortable way for tourists to reach Las Vegas.

But as the federal government trudges closer to deciding how much taxpayer financing should go to the privately owned DesertXpress Enterprises LLC, the growing cost of the audacious project has started to attract more attention than the bedroom community that would be its southern endpoint.

The project's estimated construction cost, now estimated at $6.5 billion, has risen by 85 percent in the past four years. And that may be on the low end, if studies of other high-speed rail lines are any indication.

Moreover, high-speed trains elsewhere have covered their operating expenses, but rarely make enough to recoup construction costs. That's critical because the private company pushing DesertXpress now seeks a direct loan of as much as $6.5 billion from the little-known federal Railroad Rehabilitation & Improvement Financing program. A decision is expected this year.

While the proposal calculates that ticket sales would generate enough profit to pay off the construction debt, serious questions remain.

A MOVING TARGET

For decades, people have floated concepts for a train to zoom people from Southern California, the single largest source of Las Vegas visitors at 26 percent of the total, according to a 2010 survey by the Las Vegas Convention and Visitors Authority. Yet Amtrak halted its poorly performing service on the route 15 years ago, and nothing yet has taken its place.

With several key environmental and other regulatory approvals in hand, DesertXpress has come closer than anyone to reaching the elusive goal. Majority owned by an entity controlled by company Chairman Tony Marnell, a prominent Las Vegas builder, with real estate investor Gary Tharaldson and veteran transportation executive and engineer Tom Stone as partners, DesertXpress gained a political boost three years ago with an endorsement by Sen. Harry Reid, a longtime proponent of high-speed rail as a way to create jobs and attract visitors to Las Vegas.

If built, DesertXpress would be the second high-speed rail line in the United States. Amtrak's Acela Express, which runs the crowded Washington D.C.-Boston corridor, hits 150 mph.

The basic concept has remained the same since DesertXpress was incorporated in 2002, but key details have changed. Four years ago, the plan was for a $3.5 billion train financed entirely by private investors. Now, the budget has grown and the company would like taxpayers to fund it.

The DesertXpress timeline calls for finishing design by the end of this year, but there is no groundbreaking date.

Budgets for high-speed rail are a moving target, as seen in California, where the latest blueprint for a statewide system was revised late last year to between $98.5 billion and $117.6 billion -- more than double what voters were told four years ago in relation to a bond issue that included $9 billion to start a statewide network.

DesertXpress executives declined to be interviewed for this article, but did answer written questions. They blame rising costs on factors outside their control, principally changing federal standards and general inflation of labor and material costs in recent years.

"DesertXpress continues to adjust to these factors and will not be able to lock in pricing until (Federal Railroad Administration) requirements for high-speed rail are solidified," the company said in an email. "DesertXpress, however, does expect that cost savings will occur as the final design is completed and the regulatory environment stabilizes."

Other developers, while not building railroads, say construction costs have dropped due to the Las Vegas real estate collapse.

Dennis Smith, president of the Las Vegas consulting company Home Builders Research Inc., estimates that the vertical costs of subdivisions -- excluding land -- have dropped about 40 percent in the past six years.

John Knott, executive vice president of CB Richard Ellis, which handles commercial real estate, said, "The cost of construction has fallen from the peak because labor is less and there is less demand."

A Federal Railroad Administration spokesman declined to comment on DesertXpress, and could not cite specific regulatory ambiguities.

It's hard to compare high-speed rail projects because costs vary widely based on factors such as geography and the technology used. And as a private company, DesertXpress isn't required to make detailed financial plans public. But according to a standard transportation benchmark, cost-per-mile, DesertXpress' cost estimates have always been on the low side.

The current estimate runs nearly

$35 million per mile. DesertXpress said its numbers "are verified to be appropriate for the project scope."

But a 2009 Government Accountability Office survey identified a high-speed rail line in Spain as the least expensive at $37 million per mile. The most expensive: $143 million per mile in Japan.

A 2010 World Bank report found

a "typical range" of $55 million to

$133 million per mile.

And estimates for the California state system, which includes higher-cost construction in urban areas, range from $84.8 million to $109.3 million per mile. Experts now reviewing that plan warned in January that costs could go even higher.

However, rail experts acknowledged that local conditions cast big influence over costs. The GAO noted that the high-end Japanese line between Takasaki and Nagano came with high land purchase costs and required numerous bridges and tunnels, as well as expensive seismic bracing.

DesertXpress, by contrast, would benefit from low land costs -- it would hug Interstate 15 almost all of the way, using government-owned right-of-way -- and would largely avoid steep climbs and sharp turns. It would also have just two stations, with no intermediate stops.

Asked about the cost comparison to California's plan, DesertXpress replied, "We do not have sufficient information on California High Speed Rail to make a comparison nor should we."

WHO PAYS?

DesertXpress executives four years ago pledged to secure 100 percent private funding, but cold markets forced them to backtrack. Documents from the Federal Railroad Administration, which hired a consultant to review the company's confidential loan application, describe the potential size of the loan as $5.5 billion to $6.5 billion to be repaid over 35 years at government borrowing rates, which are generally lower than what commercial lenders charge.

Adding DesertXpress to the portfolio would mark a departure for the federal loan program, which has generally financed existing small freight-rail projects such as laying new spur lines or reconfiguring switch yards. Its only passenger rail money has gone to Amtrak and for a station in Denver. DesertXpress hopes to borrow four times more than all loans made by the program since its creation 10 years ago.

DesertXpress has said it also expects to raise some private debt or equity, and to include "collateral that provides the appropriate amount of protection for the lender." However, it did not provide specifics, partly because the project is still in development.

"This project is unique in that the private sector has assumed all the liability up front," said Las Vegas transportation consultant Tom Skancke, referring to the expense of the ongoing planning and approval process. "I don't think they would have made this investment if the DesertXpress weren't feasible."

Forecasts of 6.5 million annual round-trip riders when service starts, rising to 8.9 million trips in 35 years, "demonstrate that revenues from passenger fares will cover project and financing costs with a going concern valuation that exceeds the (federal) collateral requirements," Marnell wrote last July.

But the World Bank concluded that high-speed rail generally produces only enough revenue to pay for daily operations.

"The evidence is that it is very difficult for a stand-alone high-speed railway to recover much of its capital costs from the passenger revenue stream alone, except in the very densest corridors," the World Bank warned. Governments pursuing high-speed rail "should also contemplate the near-certainty of copious and continuing budget support for the debt."

One of the few lines that covers both capital and operating costs runs from Tokyo to Osaka, Japan, carrying more than 140 million passengers a year in a corridor with a population of about 55 million. By contrast, the DesertXpress would link Southern California, with about 20 million people, to Las Vegas, with about 2 million.

Even in Japan, high-speed rail has not always been a winner. The Japanese National Railways was broken up in 1987 as it buckled under the debt amassed in building bullet trains.

"In each of the three countries we visited (France, Spain and Japan), the central government paid the up-front construction costs of their country's high-speed rail lines and did so with no expectation that its investment would be recouped through ticket revenues," the GAO reported.

WILL PEOPLE RIDE?

The question of how many people would use DesertXpress elicits widely different answers.

The company expects close to 90 percent of its passengers will drive to Victorville, park their cars and then take the 84-minute train ride rather than fight the "overcrowded I-15 corridor at Victorville."

When traffic flows smoothly, the drive from Victorville to Las Vegas is about two and a half hours, or just more than an hour longer than the proposed train ride.

"I think the train is a great opportunity," said Robert Lovingood, chairman of the Victorville Chamber of Commerce. "People will want to ride rather than face the stress and all that traffic on 15."

When asked about I-15 congestion, California transportation officials refer questions to Lance Todd, program director for Highway Radio in Barstow. He said the only northbound I-15 chokepoint is on Fridays north of Victorville, where I-15 narrows from four to three lanes, and then to two.

On Sundays or holiday Mondays, there are four southbound trouble spots, the worst being the agricultural inspection station at Yermo, about a dozen miles east of Barstow, he said. There, drivers must slow down, causing traffic to back up for several miles on peak days.

But there are alternatives to ease I-15 congestion. Nevada DOT estimates that it costs about $5 million per mile to add a lane in each direction to an interstate in a rural area, or about $750 million to make I-15 six lanes from Primm to Victorville.

Even if I-15 stays just as it is now, will enough freeway-hardened Angelenos choose the train, rather than just keep driving, to pay for DesertXpress?

According to Nevada Department of Transportation figures, about 40,300 cars each day crossed the state line at Primm both ways on I-15 last year, for a total of 14.7 million vehicles for the year.

The state doesn't track where those cars came from, how many people were in each or where they were going, but the Convention and Visitors Authority says about 10 million Southern California residents visited Las Vegas last year. That includes an unknown number who flew.

DesertXpress, then, expects about two-thirds of all Southern California visitors will take the train, paying $110 for a round-trip ticket -- comparable to flying nonstop most days from one of Southern California's six commercial airports.

DesertXpress said three outside consultants have reviewed its ridership estimates, including an "investment grade analysis" last April.

But a paper written for the Monorail Society in 2001 noted that passenger estimates for the bankrupt Las Vegas Monorail were also reviewed by three outsiders, including one report termed "investment grade." They concluded that the 3.9-mile overhead line would draw at least 19 million paying customers a year. It carried 4.9 million last year.

Two of the monorail consultants, URS Corp. and Wilbur Smith Associates, have also helped formulate DesertXpress numbers. One of the three authors of the Monorail Society paper, Tom Stone, did work for the monorail and was the DesertXpress CEO until he retired in late 2010.

What some critics call the "optimism bias" has shown up elsewhere. A survey of 25 high-speed railways around the world by Oxford University professor Bent Flyvbjerg found that actual ridership averages only half the amount stated in preopening studies. This would bring DesertXpress down to about 3.25 million annual round-trips during its initial years.

DesertXpress also faces a basic belief of transportation planners: People who start a trip on one mode of transportation don't like to switch.

"There is a lot of psychological baggage that comes with having to transfer from one mode to another. People don't like to do that," said University of California, Berkeley professor Robert Cervero, who has studied the issue elsewhere.

One solution, raised by DesertXpress in the past, would be an extension from Victorville to Palmdale, about 50 miles to the west, to connect with the proposed California high-speed system.

But with the California system in doubt because of that state's budget problems, DesertXpress now refers to Palmdale as a Metrolink station, part of the Los Angeles-area commuter rail network.

When evaluating DesertXpress as a whole, Skancke said history will view it as inaugural segment of a national high-speed system.

"Once Americans see what 200 mph trains really are, they'll be clamoring, screaming for it in communities all over the country," he said.

But the World Bank calls for a more measured approach:

"(We do) not suggest that public financial support may not be justified, but argue for a candid prior weighing of the overall economic benefit against 'likely' public financial support, rather than just 'picking up the bill after the feast.'"

Contact reporter Tim O'Reiley at

toreiley@reviewjournal.com or 702-387-5290.