Forecast grim for Southern Nevada

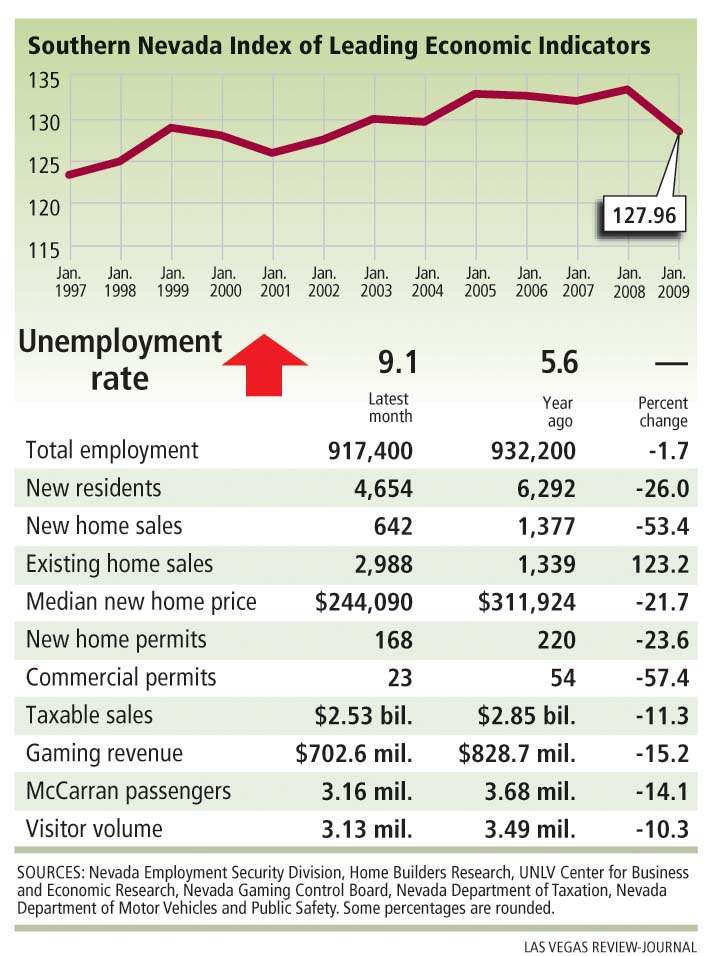

The Southern Nevada Index of Leading Economic Indicators declined for the third straight month, dropping to 127.96 in January as every data series showed negative percentages from a year ago.

Eight of the 10 series posted double-digit decreases in November, the month of data used for the January index.

Not since the aftermath of Sept. 11, 2001, has there been as sharp of a one-month decline in the index, said Keith Schwer, executive director of the Center for Business and Economic Research at the University of Nevada, Las Vegas. It's down from 129.56 in December.

"The fallout of the September failure of Lehman Brothers continues to show up across the United States, including Nevada, which some once thought was immune to such national economic events," the local economist said. "It is highly likely that we may see a few more months of difficulty before things get better. It may well be that we are amid the most difficult part of this recession."

The index, compiled by the research center, is a six-month forecast from the month of the data, based on a net-weighted average of each series after adjustment for seasonal variation.

The accompanying Review-Journal chart includes several of the index's categories, along with data such as new residents and employment and housing numbers, updated for the most recent month for which figures are available.

The index has fallen from its peak of 133.56 a year ago.

Construction categories led the way. Residential building permits declined 87.7 percent to 296 and the value of those permits fell 92.1 percent to $31.9 million. Similarly, commercial building permits fell 55 percent to 49 and their value dropped nearly 60 percent to $141.1 million.

The Clark County construction index dipped to 97.84 in November, the lowest level since 1985.

With a surplus of empty homes and falling employment numbers, prospects for selling new homes remain dim, causing builders such as Las Vegas-based Astoria Homes to suspend any new construction. Other builders such as Engel, Woodside and Kimball Hill have filed for bankruptcy.

"Nobody's building right now," Dennis Smith of Home Builders Research said. "One of the things the numbers don't document is financing availability. I know a couple of apartment complexes that were stopped because the lenders got nervous. Finance companies and banks are holding the key to what it takes. I know builders who have projects ready to go and can't start because they can't get financing."

Clark County's tourism index also tumbled in November, falling to 132.15 from 142.99 in October.

Gaming revenue has fallen to its lowest level since July 2004 and hotel occupancy rates dipped under 80 percent.

Consumers facing economic hardship and those expecting further turmoil have cut back on big-ticket purchases and discretionary spending such as travel and vacations, Schwer said.

He said nobody knows what the impact of the proposed stimulus package will be and right now it's like trying to put out a fire with a leaky bucket.

"One group is arguing to let the place burn down, others are screaming to fix the leaky bucket and some just want to get the bucket in the water and get going," Schwer said.

Contact reporter Hubble Smith at hsmith@reviewjournal.com or 702-383-0491.