General Growth faces financial shortfall

Credit woes that disrupted General Growth Properties' participation in Boyd Gaming's $4.8 billion Echelon resort represent just a small portion of the financial challenges facing the mall company that owns some of the priciest real estate on the Strip.

The Chicago-based company that owns Fashion Show and luxury malls in The Venetian and Palazzo resorts has more than $2.5 billion in debt maturing by the end of the year, $3.3 billion in 2009 and $17.6 billion by 2011.

The debt is coming due at a time when credit markets are dry, real estate values are stagnant or in decline and low consumer confidence is squeezing retailers who rent space in General Growth malls and other shopping centers across the country.

In addition to the delay at Echelon, General Growth officials announced they will delay development of the Shops at Summerlin Centre, a project with 1.4 million square feet of mixed-use space near Red Rock Resort.

They also floated the possibility of selling bonds backed by Fashion Show and other malls and refinancing loans against the Shoppes at Palazzo and the Grand Canal Shoppes in The Venetian.

"They have much too much debt for their cash flow. And quite a few of their properties are underwater," said Reggie Middleton, a Brooklyn, N.Y., investor who has published in-depth analyses of General Growth Properties on his Web site, Boombustblog.com. "If they do pay it off by some act of God, they still have 2009, 2010 and 2011."

General Growth officials rejected multiple interview requests.

Financing shortfalls are an unfamiliar scenario for General Growth, a company that used the economic boom of recent years to leverage its way to become the second-largest real estate investment trust in the country.

The buying binge culminated in 2004 when General Growth bought the Rouse Co., for about $14 billion, which gave it control of Fashion Show and the Summerlin Centre project. The Rouse deal also included Boston's Faneuil Hall Marketplace, South Street Seaport in Lower Manhattan and Baltimore's Inner Harbor.

General Growth stock peaked around $67 per share last year in March. Since then, it has fallen below $30.

Neither that General Growth was highly leveraged compared to similar companies nor signs that retail real estate was peaking before the company's debt would come due raised red flags in the corporate offices of Boyd Gaming, which announced in May 2007 that General Growth would be a joint venture partner on Echelon.

"A lot of businesses back in that time were in much different shape than they are today. I don't think it is a reflection of their depth or experience or professionalism," said Boyd Gaming spokesman Rob Stillwell.

A closer look at General Growth then could have shown potential for trouble down the road.

The company has more than $25 billion in debt and, compared to similar companies, a greater share is secured directly with real estate assets.

Fitch Ratings mentioned the debt late last year when it rated General Growth at "BB," a junk-level status.

"The use of secured debt in the capital structure encumbering substantially all assets serves to limit flexibility in a more difficult capital-raising environment," Fitch wrote in November.

Since then, the debt markets have worsened. Also, the Fitch rating praised General Growth's "sizable future development pipeline," which has since shrunk.

After General Growth reported earnings last week, the company's stock dropped 15 percent in value and three credit ratings firms downgraded the company, according to the online publication Chicago Business.

The debt is clearly making investors nervous.

"Fundamentals are deteriorating and continued refinancing risk is exacerbated by higher leverage and capital constraints," Citigroup analysts wrote in a report quoted by Chicago Business.

Digging its way out from under the debt will be difficult for General Growth.

Company officials have suggested they may rely on the unencumbered portions of the company portfolio to back refinancing plans. They have said repeatedly they won't sell properties at "fire sale" prices.

They haven't, however, announced any specific plans for refinancing the debt, other than that they intend to do it.

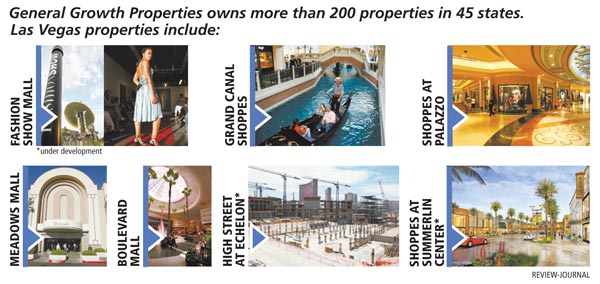

With more than 200 properties in 45 states, the General Growth Properties portfolio was valued at nearly $32 billion last fall, according to Fitch. Its assets were valued at $28.8 billion at the end of 2007, according to Google Finance. In addition to malls on the Strip and Summerlin Centre, it owns Meadows and Boulevard malls.

The company has a strong track record of balancing large amounts of debt and creating successful malls, which analysts have said works in its favor.

Whether it is enough goodwill to avoid resorting to drastic measures to stay ahead of debts during the downturn remains to be seen.

Stifel Nicolaus analysts quoted by Chicago Business said the outlook for General Growth could worsen before it gets better.

"General Growth continues to face significant balance sheet challenges, but mall demand headwinds are increasing faster than we expected," they wrote.

Contact reporter Benjamin Spillman at bspillman@reviewjournal.com or 702-477-3861.

BY THE NUMBERS General Growth shares are traded on the New York Stock Exchange under the ticker GGP. The stock's 52-week high was $57.84 on Oct. 11, and its 52-week low was $25.65 on Monday. It is the second-largest real estate investment trust in the country after Simon Property Group. At the end of 2007, General Growth had $28.8 billion in assets and $27.4 billion in liabilities. Source: answers.com/Google Finance/MarketwatchREVIEW-JOURNAL