IN BRIEF

WMS Industries' earnings rise nearly 11 percent in quarter

Slot machine manufacturer WMS Industries on Tuesday reported a nearly 11 percent increase in net income for the second quarter.

The Illinois-based game maker said its net income was $26.5 million, or 44 cents per share, for the quarter ended Dec. 31, up from $23.7 million, or 41 cents per share, a year earlier.

Revenue rose 6 percent to $188.9 million.

"The consistent improvements from our continuous improvement initiatives support our focus on developing and funding future growth initiatives, including research and development spending for the creation of next-generation products," WMS Chairman and Chief Executive Officer Brian Gamache said in a statement.

Gamache said the company expects to benefit as casinos replace older slot machines as new markets in Australia and Mexico open.

Before the company announced earnings, Roth Capital Markets gaming analyst Todd Eilers said WMS has been slicing into its competitors' business.

Shares of WMS rose 4 cents, or 0.10 percent, on the New York Stock Exchange to close the day at $41.10.

DETROIT

Spyker agrees to acquire Saab brand from General Motors

A small Dutch automaker will try to do what U.S. auto giant General Motors Co. could not -- make money by selling Saab brand automobiles in an increasingly competitive global marketplace.

GM signed a deal Tuesday to sell Saab to Zeewolde, Netherlands-based Spyker Cars NV for $74 million in cash plus $326 million worth of preferred shares in Saab.

The deal hinges on a $550 million loan from the European Investment Bank, which the Swedish government on Tuesday committed to guaranteeing.

The sale is a coup for Spyker and a lifeline for Saab, which has lost money since GM bought a 50 percent stake and management control for $600 million in 1989. The Detroit automaker gained full ownership in 2000 for $125 million more.

NEW YORK

Shrinking landline business factors in loss for Verizon

Verizon Communications Inc. on Tuesday posted an unusual loss for the fourth quarter, as a charge for layoffs in its shrinking landline business overshadowed the growing, and profitable, wireless business.

The nation's second-biggest phone company lost $653 million, or 23 cents per share, in the quarter ended Dec. 31, reversing profit of $1.24 billion, or 43 cents per share, a year earlier.

Excluding one-time items, mainly consisting of a $3 billion charge for severance and other costs associated with layoffs, Verizon says it earned 54 cents per share. That was a penny below the average analyst estimate, as polled by Thomson Reuters.

Revenue rose 10 percent to $27.1 billion, largely due to the acquisition last January of Alltel Corp. Analysts were expecting $27.3 billion.

Shares of Verizon fell 51 cents, or 1.66 percent, on the New York Stock Exchange to close the day at $30.17.

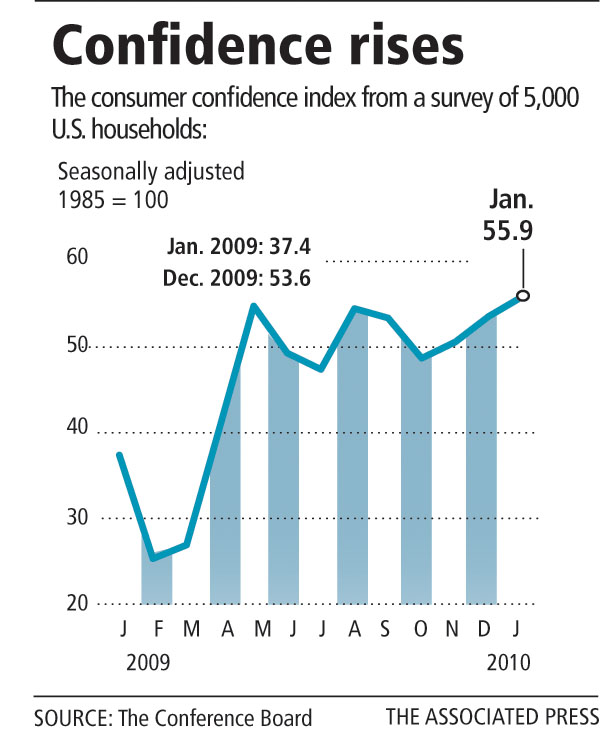

Consumer confidence rises for third straight month in January

Americans' confidence in the economy improved modestly in January for the third straight month, as they begin to feel slightly better about business conditions and the job picture, according to a survey released Tuesday.

The Conference Board's Consumer Confidence Index increased 2.3 points to 55.9 -- the highest reading in more than a year but still relatively gloomy. Wall Street expected 53.5.

Economists watch confidence numbers closely because consumer spending accounts for about 70 percent of U.S. economic activity. It takes a reading of 90 to signal an economy on solid footing and 100 or more to signal growth.

ATLANTA

Delta Air Lines posts loss of $25 million in fourth quarter

Delta Air Lines Inc.'s corporate travel demand is picking up, its trans-Atlantic business has rebounded and it is holding its own in Asia as it closes the books on a turbulent 2009.

The world's biggest airline on Tuesday posted a $25 million loss for the final three months of the year. That's an improvement from the $1.4 billion loss it posted a year earlier.

Delta hopes for a boost in 2010 from the economic recovery, as it looks to expand its presence in New York and Asia.

Delta expects a government decision by early February on a deal between it and US Airways to swap some takeoff and landing slots involving New York's LaGuardia Airport. Delta also wants to bring Japan Airlines into its SkyTeam alliance. Delta wouldn't say when it expects to hear if JAL plans to dump its alliance with American Airlines and join SkyTeam.

OMAHA, Neb.

Standard & Poor's indexes will add Berkshire after deal closes

Standard & Poor's will add Warren Buffett's Berkshire Hathaway Inc. to its S&P 100 and S&P 500 indexes after Berkshire acquires Burlington Northern Santa Fe.

S&P announced the stock index changes Tuesday. Buffett's company will replace BNSF in both indexes after shareholders approve Berkshire's acquisition of the railroad company next month.

Berkshire shareholders agreed to split the company's Class B stock 50-for-1 last week, and that move gave Buffett's company enough liquidity to meet S&P's criteria.

Standard & Poor's spokesman David Guarino says Berkshire, based in Omaha, Neb., is a good fit in the indexes because the company represents the U.S. economy and stock market well.

WHITE MARSH, Md.

General Motors will build own electric motors for vehicles

General Motors wants smaller, lighter, more powerful electric motors for its cars and trucks, and the way to get them is to make them, a GM official said Tuesday at the plant where the new motors will be made.

Tom Stephens, GM's vice chairman of global product operations, said Honda and Toyota now make their own electric motors in Japan, but GM plans to become the first U.S. manufacturer to do so.

Stephens said the company is developing an electric motor that will be 25 percent smaller, 25 percent lighter and have 20 percent more power. That motor will let the company put them in products from cars to full-size pickups and sports utility vehicles, he said.