Jobless rates jump in Nevada, Las Vegas; benefits running out

Times are tough and getting tougher for Nevada's long-term unemployed.

A Friday report from the state Department of Employment, Training and Rehabilitation revealed that unemployment insurance benefits are running out for jobless Nevadans, and the state's labor market isn't producing enough jobs to get them back on track.

The report said 22 percent of Nevada's 163,700 jobless receive regular state unemployment insurance payments. That is down from more than 50 percent at the downturn's height in late 2009 and early 2010. Federal aid boosted payments from 26 weeks to nearly two years, so the drop in payouts indicates just how widespread long-term unemployment is in Nevada, said Bill Anderson, chief economist of the employment department.

Nevadans who run through their jobless benefits handle the income loss in several ways, experts said.

Some leave the state, Anderson said.

Others rely on a spouse's income or double up on housing with family, friends and colleagues, said Brian Gordon, a principal in local research firm Applied Analysis. Still others take odd jobs for cash and don't report the income, or they retire early to access Social Security benefits, said Steve Brown, director of the Center for Business and Economic Research at the University of Nevada, Las Vegas.

What they're not doing is finding steady work.

Unemployment jumped in Nevada and Las Vegas in July, as residents flooded the labor market and national malaise meant poor job growth.

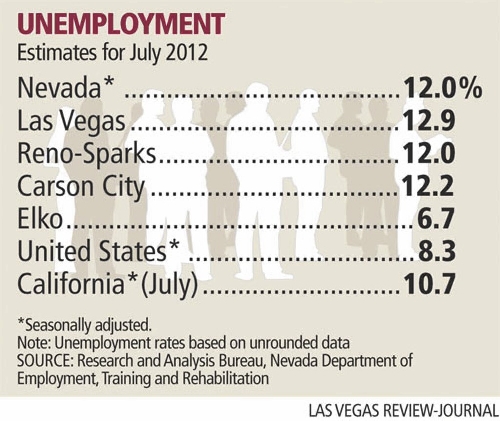

The Silver State's jobless rate increased to 12 percent in the month, up from 11.6 percent in June. Local joblessness jumped to 12.9 percent, up from 12.2 percent.

Include Nevadans who quit looking for work, or who work part-time but would rather have full-time jobs, and the state's jobless rate is even higher, at

22.1 percent.

Brown blamed higher local unemployment partly on seasonal factors such as the annual slowdown in tourism in the hottest part of the summer and traditionally greater hiring activity in June rather than July. Unlike national numbers, local unemployment is not seasonally adjusted.

But the size of the jobless gain is "depressing" and "very discouraging this far into recovery," Brown said.

Gordon said the rise in unemployment was higher than expected and an indication that "we are by no means out of the woods at this point."

"We can expect to experience continued volatility in unemployment numbers, and to the extent there are improvements, they'll be modest at best," Gordon said.

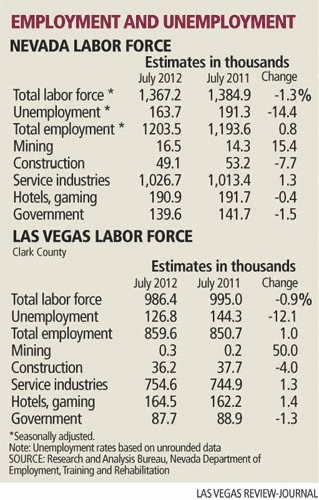

The Las Vegas Valley had 811,100 jobs in July, down from 814,100 in June. But more people chased that dwindling number of jobs: The local labor market increased to 986,400, up from 980,900.

The only solace comes in comparing July's numbers with figures from a year ago, Brown said. The July 2011 jobless rate was 13.8 percent in Nevada, and a record 14.5 percent in Las Vegas.

Plus, job growth was stronger year-to-year, with Nevada employers adding 10,300 jobs. Half of those positions were in leisure and hospitality. Professional and business services, including accounting and law firms, added 4,000 jobs year-over-year in July. The state's jobs base was up 13,700 in the first seven months of 2012 when compared with same period in 2011.

Anderson said it's also important to note Nevada's not alone: 44 states saw unemployment increase from June to July, even as their jobs bases increased. That happened nationally, too, with the U.S. jobless rate ticking up from 8.2 percent to 8.3 percent, even as employers added 163,000 jobs.

Nevada still leads the nation in unemployment, a distinction it has had since May 2010. Only two other states - California, at 10.7 percent, and Rhode Island, at 10.8 percent - had double-digit unemployment in July.

Nevada is unlikely to see job growth that could bump it from the top spot before year's end.

Gordon predicted "modest growth at best" through December. Local unemployment will probably stay above

12 percent, he added.

Without a pickup in the national economy, the local job market will move sideways, with ups and downs through year's end, he said.

Contact reporter Jennifer Robison at jrobison@reviewjournal.com or 702-380-4512. Follow @J_Robison1 on Twitter.