Taxable sales rise sharply in Nevada, Clark County

Taxable sales jumped in September, led by sharp sales bursts from restaurants, clothing stores and car dealers, the Nevada Department of Taxation reported Tuesday.

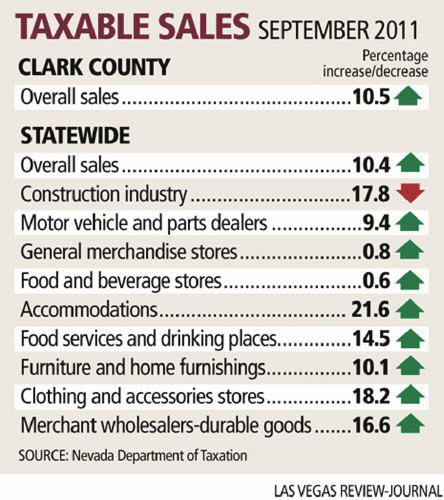

Taxable sales across Nevada totaled $3.58 billion in the month, up 10.4 percent from $3.24 billion in September 2010, with 14 of the state's 17 counties showing a year-over-year increase.

Only Lincoln, Nye and Washoe Counties recorded decreases.

Sales in Clark County rose to $2.57 billion, up 10.5 percent from $2.32 billion a year earlier.

Clark County bars and restaurants -- the single biggest spending category with 28 percent of the total -- increased sales by 14.5 percent, to $716.5 million.

Clothing retailers posted an 18.2 percent gain, with sales of $289.2 million. Dealers of cars and car parts improved their sales by 9.4 percent, to $238.3 million.

Other spending categories showing increases included furniture retailers, stores and boutiques inside hotels and motels, and general merchandise stores, such as department stores.

Construction-related categories in Clark County fell to $31.7 million, down 41.5 percent from $54.2 million.

Statewide, collections on cigarette taxes, liquor taxes and live-entertainment taxes are ahead of projections.

Jeremy Aguero, principal of Applied Analysis business advisory firm, said the key for Southern Nevada is that consumers are feeling better about the economy and they're spending a little more.

Visitor volume and visitor spending have also increased, he said.

"Retail sales are up ... and expectations are up going into the holiday," Aguero said late Tuesday. "We see that materializing in Las Vegas. Look at automobile sales and food and beverage, both hugely important categories for us and trending positively."

Revenue collections from taxable sales help fund prisons and schools, among other public services. Gross revenue collections from sales and use taxes were $280.3 million in September, a 9.6 percent increase compared with the same month a year earlier. The general fund share of sales and use taxes totaled $71 million, a 9.3 percent gain over September 2010.

Tax revenue in the first quarter of fiscal 2012, which began July 1, is $3.8 million, 4.3 percent ahead of projections by the Economic Forum, a nonpartisan group that forecasts state revenue for budgeting purposes.

The department reported $90.7 million was collected and distributed to the general fund in the third quarter for modified business tax from businesses and financial institutions. That is down 5.15 percent from the prior-year quarter.

Businesses reported $9.3 billion in gross wages and took $735.1 million in health care deductions for the quarter, or 7.9 percent of the gross wages.

A report from the U.S. Commerce Department on Tuesday showed that gross domestic product grew by less than expected during the third quarter, reflecting a drop in inventories that points to a pickup in growth as 2011 comes to a close.

Forecasts for consumer spending remain upbeat despite challenges from the economy.

Fears of a double-dip recession will affect consumer confidence and shopper behavior during this holiday season, retail consultant Jeff Green of Phoenix said. There is potential for Black Friday to be less effective with early discounts and more online sales, he said.

Review-Journal reporter Hubble Smith contributed to this report. Contact reporter Jennifer Robison at jrobison@reviewjournal.com or 702-380-4512. Contact Smith at hsmith@reviewjournal.com or 702- 383-0491.