U.S. unemployment soars

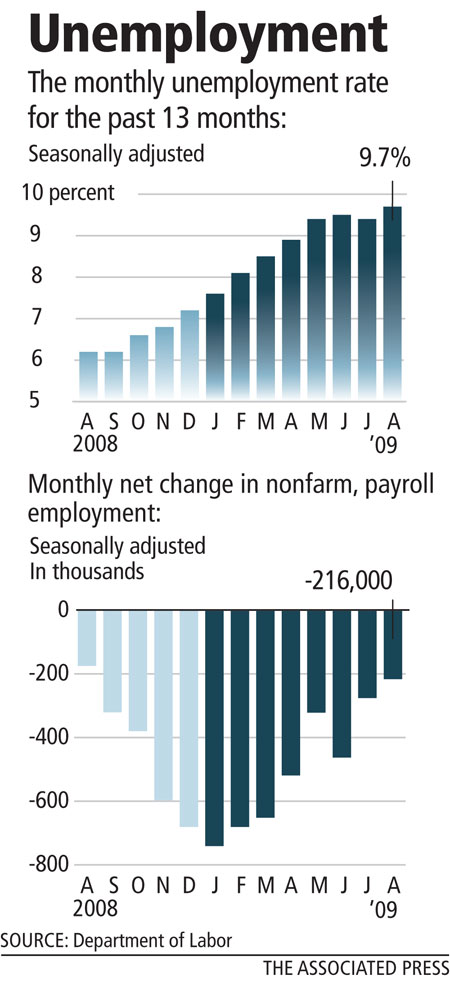

WASHINGTON -- The unemployment rate jumped almost half a point to 9.7 percent in August, the highest since 1983, reflecting a poor job market that will make it hard for the economy to begin a sustained recovery.

While the jobless rate rose more than expected, the economy shed a net of 216,000 jobs, less than July's revised 276,000 and the fewest monthly losses in a year, according to Labor Department data released Friday. Economists expected the unemployment rate to rise to 9.5 percent from July's 9.4 percent and job reductions to total 225,000.

"It's good to see the rate of job losses slow down," said Nigel Gault, chief U.S. economist at IHS Global Insight. But "we're still on track here to hit 10 percent (unemployment) before we're done."

The Nevada Department of Employment, Training and Rehabilitation hasn't released jobless data from August yet. But the agency's July numbers showed a record statewide unemployment rate of 12.5 percent. In Clark County, 13.1 percent of workers lack jobs.

The state lost 15,000 jobs from June to July and now has 179,300 residents who are unemployed and seeking work. Include the discouraged workers who have stopped seeking jobs and the underemployed who are working fewer hours than they want, and the state's joblessness likely approaches 20 percent, experts and economists say.

Nevada claims the third-highest jobless rate in America, after Michigan (15 percent) and Rhode Island (12.7 percent).

The August rise in the nation's jobless rate was partly due to 73,000 people joining the civilian labor force and the government finding that the number of unemployed Americans jumped by nearly 500,000 to 14.9 million. Those figures are from a different survey than the report on total job cuts.

The civilian labor force usually grows as a recession winds down and optimism about finding work grows. But as long as Americans remain anxious about their jobs, consumer spending isn't expected to rise enough to power a rebound.

"There isn't the underlying fuel there for strong consumer spending growth," Gault said.

Analysts expect businesses will be reluctant to hire until they are convinced the economy is on a firm path to recovery. Many private economists, and the Federal Reserve, expect the unemployment rate to top 10 percent by the end of this year.

If laid-off workers who have settled for part-time work or have given up looking for new jobs are included, the so-called underemployment rate reached 16.8 percent, the highest on records dating from 1994.

But earnings rose and the number of hours worked stayed above a recent record-low. Average hourly wages increased to $18.65 from $18.59, the department reported. Average weekly earnings increased to $617.32.

The number of weekly hours worked remained at 33.1, above the low of 33 reached in June. That figure is important because economists suspect companies will add more hours for current workers before they hire new ones.

The recession has eliminated a net of 6.9 million jobs since it began in December 2007. Job cuts last month remained widespread across many sectors.

The construction industry lost 65,00 jobs. Factories cut 63,000, while retailers pared 9,600 positions. The financial sector eliminated 28,000 jobs, while professional and business services dropped 22,000. Even the government lost 18,000 jobs, as the U.S. Postal Service cut 8,500 positions.

Health care and educational services was the only bright spot, adding 52,000 jobs.

And the pace of layoffs is slowing. Job losses averaged 691,000 in the first quarter and fell to an average of 428,000 in the April-June period.

Other economic data released this week has been positive. The Institute for Supply Management, a trade group, said Tuesday that the manufacturing sector grew in August for the first time in 19 months. On Thursday, the ISM said its service sector index rose to 48.4 last month, the highest level in nearly a year. Home sales, meanwhile, have increased for several months and prices are stabilizing.

Federal Reserve policymakers said in minutes from an August meeting that they expect the economy to recover in the second half of this year. But labor market conditions are still "poor," the Fed minutes released Wednesday said, and many companies are likely to be "cautious in hiring" even as the economy picks up.

Some economists credit the Obama administration's $787 billion economic stimulus package of tax cuts and spending increases, along with the "Cash for Clunkers" program, with contributing to a recovery. But they worry about what will happen when the impact of the stimulus efforts fades next year.

Vice President Joe Biden defended the stimulus package Thursday against Republican critics who say it is too costly.

"The recovery act has played a significant role in changing the trajectory of our economy, and changing the conversation in this country," Biden said. "Instead of talking about the beginning of a depression, we are talking about the end of a recession."