MSG mum on when construction will resume on Sphere project

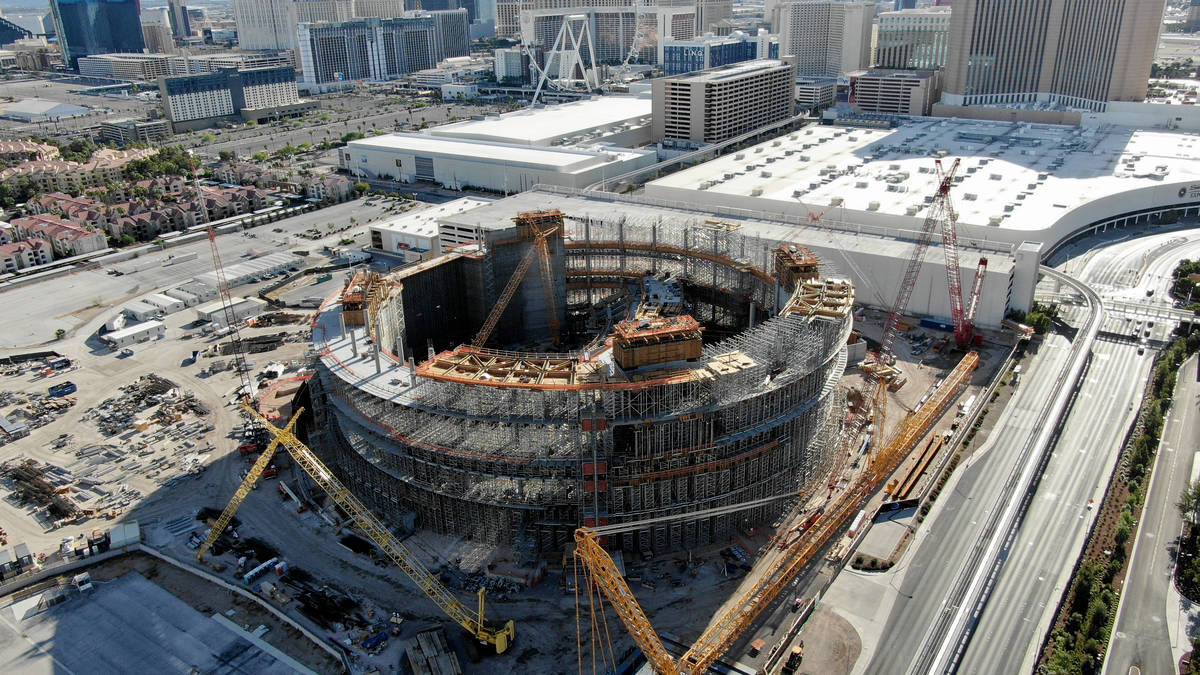

The MSG Sphere at The Venetian construction site remains dormant, and representatives of MSG Entertainment offered no updates Monday on when workers might return.

MSG Entertainment, the recently split-off arm of The Madison Square Garden Company, on March 31 announced it was shutting down construction on the $1.66 billion Sphere project because of the coronavirus pandemic. The site was cleared of workers by mid-April.

The 17,000-seat entertainment venue being built east of the Sands Expo and Convention Center at The Venetian has an undetermined completion date. Company executives said they no longer expect it to be finished by next year.

“Although MSG Entertainment no longer expects to open the venue in calendar year 2021, the company looks forward to resuming construction as soon as practicable,” the company said in a news release for its third-quarter earnings Monday.

Also in mid-April, Madison Square Garden Entertainment Corp. began trading on the New York Stock Exchange under the MSGE symbol, splitting off from its sports business that runs the National Basketball Association’s New York Knicks and the National Hockey League’s New York Rangers.

In its initial quarterly earnings report, the company reported a net loss of $128.6 million, $5.36 a share, on revenue of $199.9 million for its third quarter that ended March 31. A year ago, the entertainment side of The Madison Square Garden Company reported a net loss of $12.6 million, 50 cents a share, on revenue of $250 million, a 20.1 percent decline.

The pandemic led to the temporary closure of MSG Entertainment’s performance venues, with virtually all events postponed or canceled through June. In addition, the company’s 2020 Boston Calling Music Festival, which had been scheduled for Memorial Day weekend, was canceled, and Tao Group Hospitality, a subsidiary, has temporarily closed virtually all of its venues worldwide, including the Tao operations at The Venetian and Marquee Nightclub and Dayclub operations at The Cosmopolitan of Las Vegas.

Before the onset of COVID-19, the company was showing strong growth across its businesses, including its bookings business, which in recent years delivered continued increases in the number of events and attendance.

Company executives believe the company is well-positioned to navigate the shutdown. As of May 1, MSG Entertainment had an estimated $1.4 billion in cash and cash equivalents and short-term investments, including the net proceeds from the sale of The Forum in Inglewood, California. Adjusted for the sale of The Forum, as of March 31, the company had approximately $220 million in advance cash proceeds — primarily related to tickets, suites and sponsorships — all of which will be addressed through refunds, credits, make-goods and rescheduled dates.

The company said to date the majority of impacted events have been postponed and are expected to be rescheduled.

Madison Square Garden Entertainment Corp. shares, traded on the New York Stock Exchange, were down $1.06, 1.3 percent, to $77.43 a share on slightly below average trading volume Monday. There was no change in after-hours trading.

The Review-Journal is owned by the family of Las Vegas Sands Corp. Chairman and CEO Sheldon Adelson. MSG Sphere is a project by Madison Square Garden and Las Vegas Sands Corp., which operates The Venetian.

Contact Richard N. Velotta at rvelotta@reviewjournal.com or 702-477-3893. Follow @RickVelotta on Twitter.