Financial companies urged to tap market potential of women

Women play an important role in household financial decisions, research shows, but the financial services industry has been slow to cater to them.

“The reality is women are a huge potential bigger market for financial services companies,” Amy Pressman, president and co-founder of Medallia, a provider of customer service technology said on Tuesday in Las Vegas. “If the companies that exist today don’t address it, I guarantee someone will come in and be a disruptor.”

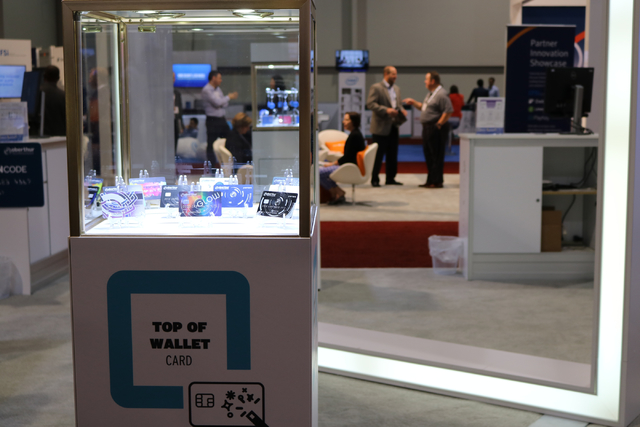

Her warning came during the second day of Money 20/20, the fifth annual global conference dedicated to FinTech.

The three-day conference is hosted at The Venetian and ends Wednesday.

Men and women invest differently and manage wealth differently. A Vanguard study from 2015, for example, found that women are 14 percent more likely to voluntarily take advantage of pretax retirement savings account, and save anywhere from 7 percent to 16 percent more than men depending on their income level. Yet, a report by the Boston Consulting Group from June stated that only 2 percent of wealth managers said that they actually considered women to be a specific client segment and had adapted their service model accordingly.

While women are taking advantage of financial services, the BCG report found women are not completely satisfied with the financial services they receive.

“When I’ve read about women experiencing condescension (in dealing with financial advisers and others in the financial services industry), and I talk to other women, all the women I talk to has a personal experience saying, ‘Oh yeah, they directed all the questions toward my husband, and I make all the decisions,’ or ‘They talk to me like I don’t understand financial choices and I have an MBA and I’ve worked at a bank,’” Pressman said.

Reetika Grewal, head of Silicon Valley Bank’s payments strategy and solutions group, said many company founders who are women are finding alternatives to the traditional venture capital funding route to raise company funds.

“They don’t want to be discounted for being a woman, so they’ll go to angel investors, or they’ll go to different platforms as a way to get money for their companies,” Grewal said. “Some will bring men with them in an attempt to raise more money.”

Kathleen Pierce-Gilmore, vice president and general manager of credit for the Americas at PayPal, told the same crowd of about 300 that in order to solve more diverse problems, there needs to be more diversity, gender and otherwise, among teams.

“Look at this conference,” she said. “Every session I have been in has been a sea of men. And the folks sitting up on the panel are solving problems that actually relate to folks that don’t look anything like them.

“They have no concept of what it feels like to be in their customer’s shoes,” she said. And 70 percent of buying decisions are made by women. You absolutely need diversity in the folks that are choosing what problems they’re going to solve.”

Contact Nicole Raz at nraz@reviewjournal.com or 702-380-4512. Follow @JournalistNikki on Twitter.