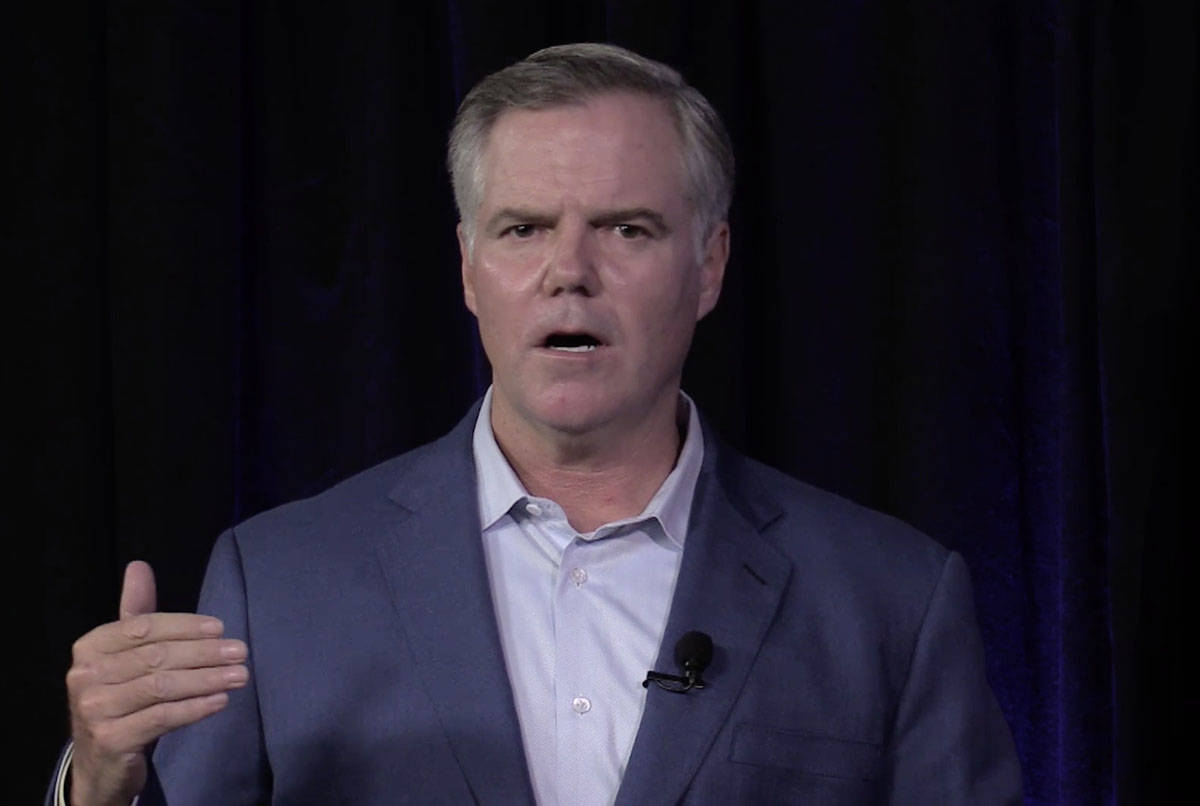

PlayStudios going public through merger with Jim Murren-led firm

Las Vegas-based mobile gaming company PlayStudios is set to go public with the help of former MGM Resorts International CEO Jim Murren.

The Andrew Pascal-led company plans to merge with Acies Acquisition Corp., a publicly traded blank-check company chaired by Murren. The transaction values PlayStudios — known for its loyalty program with real-world awards — at roughly $1.1 billion, according to a Monday news release.

“What I was really hoping for when we created (Acies) was to find a situation where we could bring value to a great business,” Murren told the Review-Journal. “We can do that here. We can provide value given our M&A (merger and acquisition) experience and our contacts, to help Andrew (Pascal) and his team grow his business.”

New products, new game genres

The combined company is set to be listed on the Nasdaq market under PlayStudio’s name and the ticker symbol MYPS. Founder, Chairman and CEO Pascal will continue to lead the combined company with his current management team.

The transaction is expected to close in the second quarter.

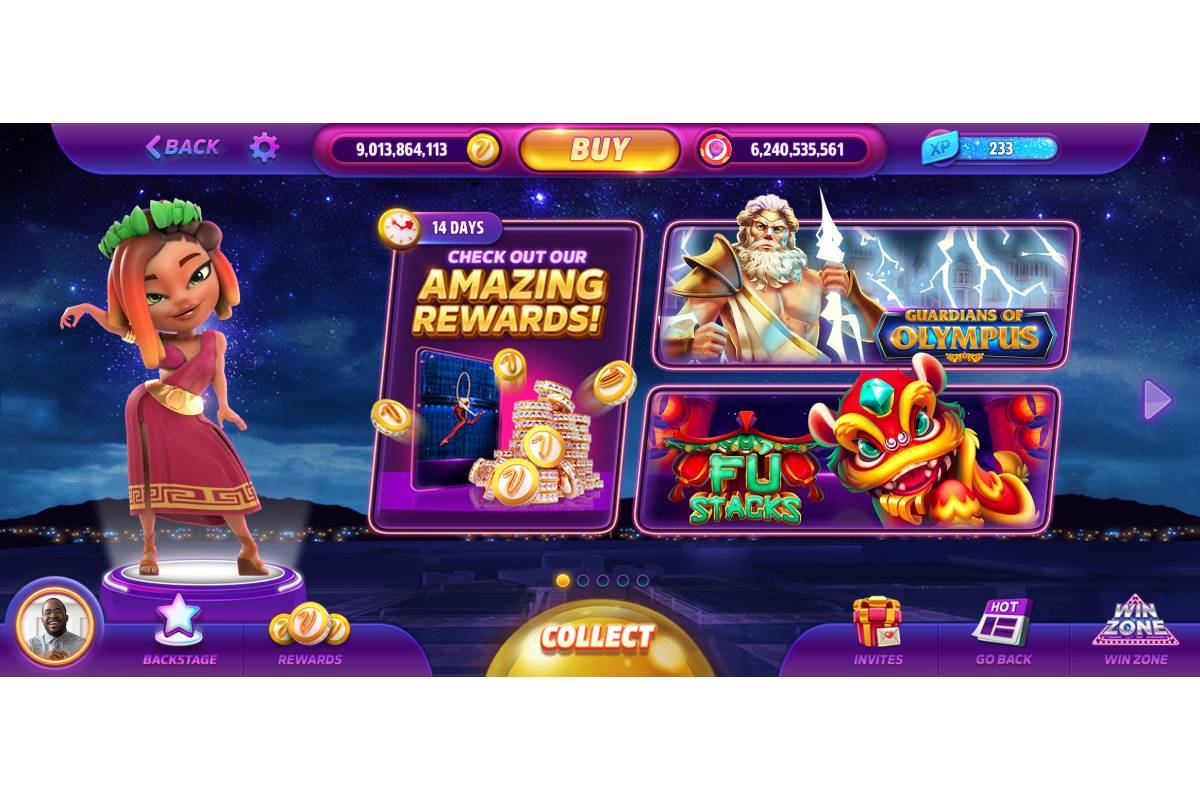

PlayStudios develops free-to-play casual games for mobile and social platforms. Its loyalty program, playAWARDS, lets users earn real-world rewards such as hotel-casino rooms, travel packages and show tickets from its partners and different entertainment, retail, travel, leisure and gaming brands. Partners include MGM, Wolfgang Puck Fine Dining Group, Cirque du Soleil and Allegiant Air.

So far, players have purchased rewards worth nearly $500 million, according to the release.

“From our inception, we set out to create wonderfully compelling games that were free-to-play and offered real-world rewards,” Pascal said in the release. “We’ve now demonstrated the positive, long-term impact of this value proposition with our current portfolio of apps, and we’re poised to carry that success into new products and new game genres.”

Murren said the post-merger goal is to “super-charge” PlayStudios’ growth by expanding its rewards program into new categories like sports entertainment. The company is also set to focus on acquisition opportunities and explore the option of openings its playAWARDS platform under a loyalty-as-a-service model.

“We hope to be a resource to Andrew (Pascal), to help run down, vet, validate, underwrite potential acquisition targets for PlayStudios,” he said. “When I embarked upon this SPAC, I couldn’t have dreamed it could have resulted in partnership that would yield a Nevada-based business that’s going to grow to the benefit of our community. It just makes me feel really warm inside.”

SPACs’ popularity

Pascal and Murren have known one another more than 25 years. Both have been involved with Las Vegas-based casino operating companies, with Pascal formerly working for Wynn Resorts Ltd., a company co-founded by his aunt, Elaine Wynn. Pascal has previously described Murren as a mentor and friend.

Pascal teamed up with Murren, the chair of Nevada COVID-19 Response, Relief and Recovery Task Force, last year to help roll out the state’s COVID Trace app. The two are also neighbors in The Ridges, an upscale neighborhood in the far west Las Vegas Valley.

The pair are united once again through Murren’s blank-check corporation, a type of company that has been picking up steam in recent years.

Murren said he was looking to merge his SPAC with a dynamic, rapidly-growing company that has carved out a particular expertise in its field.

“My duty … is to find a situation that will create long-term shareholder value,” Murren said. “The way to achieve that that is to find the right management team operating the right business in the right industry, and we have accomplished that in spades here.”

Blank-check companies like Acies have no commercial operations. These entities — also referred to as special purpose acquisition companies, or SPACs — are formed solely to raise money through an initial public offering and merge with existing, operating companies.

This style of merger gives private operating companies a fast pass through the IPO process and offers the SPAC founders a stake in the newly acquired business.

Pascal said PlayStudios started looking into SPACs as a vehicle to go public back in the summer, and he called the deal with Murren’s company “serendipitous.”

“We felt like we had built out our business organically, and now we’re in the position to position ourselves to find companies we can acquire and … accelerate our growth,” Pascal said. “It just became really clear that their skill set and experience (at Acies) was a perfect compliment to our own.”

Along with Murren, Acies’ management team includes former Morgan Stanley managing directors Dan Fettersand Edward King as Co-Chief Executive Officers.

SPAC mergers have been a trend in the gaming space in recent months. Tilman Fertitta, owner of the Golden Nugget brand and Landry’s Inc., announced plans Monday to take their parent company public via a SPAC merger. Las Vegas-based Affinity Gaming announced last month that it is looking for acquisition opportunities through a SPAC, and Vegas Golden Knights owner Bill Foley has a blank-check company that announced plans in December to merge with an online payments processing firm tied to big-name casino companies.

Going public

Boards of directors of Acies and PlayStudios have unanimously approved the transaction. The deal still needs approval from Acies stockholders and is subject to other closing conditions, including regulatory approvals.

The transaction includes at least 89.1 million shares of Acies stock and up to $150 million in cash. The combined company is expected to have about $290 million of cash.

After the deal closes, PlayStudios’ existing shareholders are set to own 64 percent of the combined company. Acies sponsors would own 3 percent, public stockholders 15 percent and participants in a $250 million private investment in public equity — which include MGM, BlackRock, ClearBridge Investments, and Neuberger Berman Funds — are expected to own 18 percent.

Executives will discuss more details during an investor call scheduled for 5:30 a.m. Tuesday.

Acies shares closed up 4 percent Monday to $11.41 on the Nasdaq.

Contact Bailey Schulz at bschulz@reviewjournal.com. Follow @bailey_schulz on Twitter.