Concern rises over possible ‘flood’ of evictions if protections end

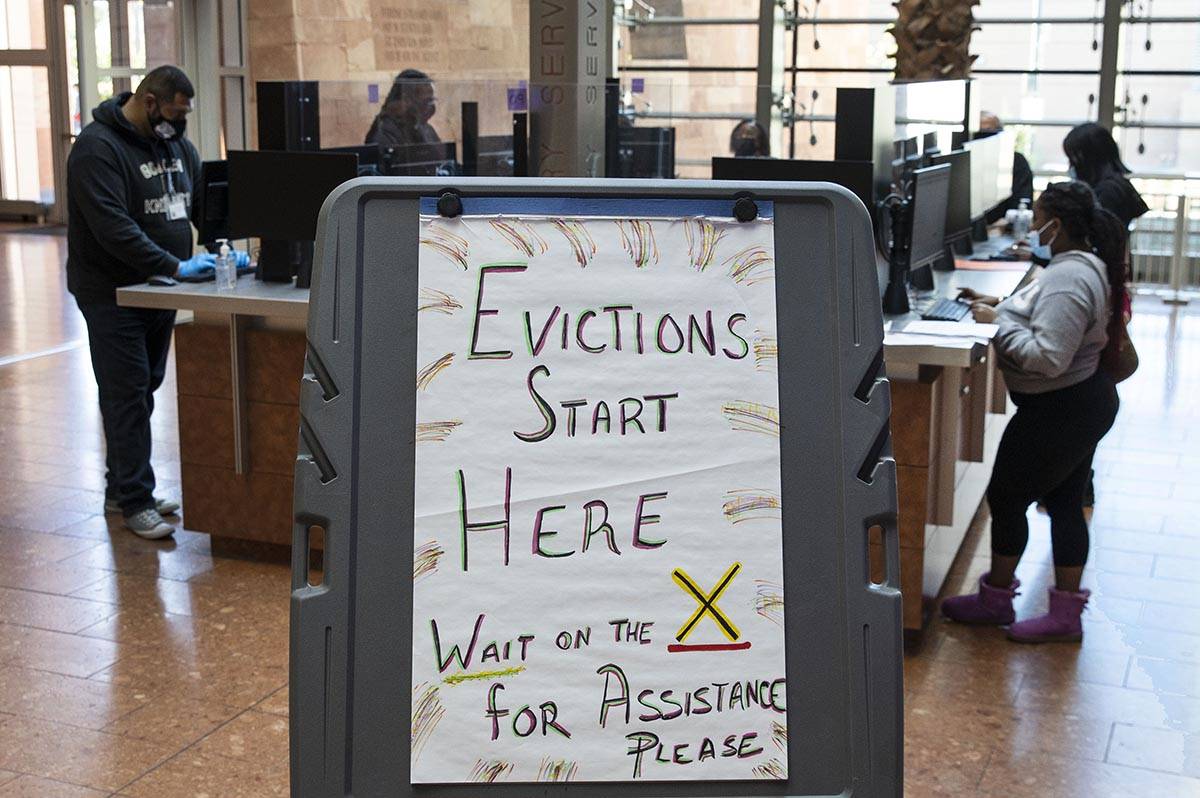

State and federal eviction moratoriums — which have helped thousands of Nevadans stay in their homes — are set to expire in less than a week unless protections are extended.

That means Nevada landlords could soon start the eviction process to remove tenants.

Gov. Steve Sisolak reinstated the state’s eviction moratorium in December, with protections set to end Wednesday. Similar to the Centers for Disease Control and Prevention’s order, Nevada’s moratorium requires eligible renters to opt in by signing a declaration form and giving it to their landlord.

“The Governor and his office are in regular communication with all stakeholders around the eviction moratorium and are working diligently to assess potential options, as well as watching any news from the federal government about the status of the CDC moratorium,” Sisolak spokeswoman Meghin Delaney said in a statement Thursday to the Review-Journal. “As more information is available, we will be certain to share it with the press and the public.”

Biden urged to act

Nearly 2,300 groups, including nine Nevada organizations, wrote a letter to President Joe Biden last week urging him to extend the CDC’s moratorium, and to bolster enforcement of the order and close loopholes.

The Biden administration may extend the national moratorium, with the CDC submitting a proposal last week to the Office of Management and Budget for regulatory review. The proposal, categorized as a notice, is titled “Temporary Halt in Residential Evictions to Prevent the Further Spread of COVID-19.”

Stacey Lockhart, executive director of HopeLink of Southern Nevada — one of the local nonprofits that signed the letter — said there is funding that is not reaching people in need of assistance, especially residents who are stuck in a backlog of applications.

Clark County officials said last week during a virtual town hall that more money is coming for the CARES Housing Assistance Program.

“I fear that, if the moratorium ends now, there will be an overwhelming flood of evictions filed, placing a significant burden on the courts, legal aid, mediation services and social service organizations who will not be able to handle the volume,” Lockhart said Thursday. “If the moratorium were extended for a few more months, it would allow landlords and tenants an opportunity to breathe rather than forcing parties to ‘drink from a firehose’ to work through the end of the moratorium. An extension would provide more financial assistance to assist landlords and give tenants the opportunity to get a few paychecks under their belt, particularly as things reopen and capacities increase.”

Surge of help-seekers expected

A representative of another nonprofit, HELP of Southern Nevada, said she expects to see a surge in emails and calls about next steps once the moratorium is lifted.

The organization was among 14 agencies that provided rental assistance as part of CHAP. Abby Quinn, chief communications officer for HELP of Southern Nevada, said the nonprofit was able to help more than 1,000 families through the process.

Still, HELP of Southern Nevada receives emails from Las Vegas Valley residents who need rental assistance, many of them worried about the moratorium lapsing.

“There’s a huge need right now for rental assistance and a lot of the people we talk to, some of their rents that they owe are still from 2020, so you’re still talking about a lot of back rent,” Quinn said. “It’s not really someone just needing one or two months of rent, so we are concerned and we’re getting prepared.”

The nonprofit is getting its outreach and crisis teams ready in case the moratorium isn’t extended, Quinn said.

“That’s when we’ll see a lot more people on the streets and coming in because they’re living in their cars and so we do anticipate an influx, again, of people once that moratorium is up,” she added.

‘Devastating’ for landlords

The Nevada State Apartment Association, which represents more than 140,000 rental units and is one of the largest trade groups in the state, said it had a brief meeting with Sisolak’s office in recent weeks to provide a snapshot of how multifamily properties are doing.

Susy Vasquez, head of the association, told the Review-Journal on Thursday that the situation for mom-and-pop landlords — many of whom rely on rental income for their income or to pay their mortgage on their properties — has been “devastating, especially for those with few units.”

The picture for many Nevada landlords is dire, Vasquez said, as savings have depleted and foreclosure “may be inevitable.”

The trade group said rent delinquency — when a tenant does not make a payment on time — continues to grow with its members, to the tune of $15 million per month in losses. Vasquez said an internal survey conducted recently with its members found that only 15 percent of Clark County residents are in a payment arrangement plan, compared with 57 percent a year ago.

Danielle Gallant, president elect and legislative chair of the National Association of Residential Property Managers’ Southern Nevada chapter, agrees.

“My fear is that by the time the eviction moratorium is lifted many landlords will be so far in the hole with the mortgage company that the owners will not be able to crawl their way out and foreclosure will be inevitable,” Gallant said. “The landlords are also being hit with unpaid utilities with the water companies. The utility companies could not turn off services for about six months so landlords have had the water bill reverted into the owner’s name and demands to pay thousands of dollars.”

Gallant added that many of the smaller landlords are barely scraping by. Tenants have not paid rent for months, which means that many are unable to fulfill any repair requests because there is no money.

Vasquez said that most of the association’s members continue to work with residents “who remain communicative.” As rent delinquency grows, offers to forgive last year’s rent entirely with a 2021 payment arrangement or offers to forgive all past-due rent by letting residents turn in keys to their apartments have been unsuccessful, she said.

“Many are refusing to apply for rent assistance and some are betting on rent assistance coming to the rescue but with added income restrictions, fewer will qualify,” Vasquez said, adding members don’t expect a tsunami of evictions. “There will be a wave but only because we haven’t had the ability to evict in more than a year.”

New online system

Erik Pappa, a spokesman for Clark County, said Thursday that it has helped more than 22,500 households with rent or mortgage assistance. Most of these residents were assisted through the $97 million set aside for CHAP. When the initial program money ran out in December, there were still about 12,000 households with pending applications so, with the second round federal grant coming, county officials decided to carry over those applications to the new program.

Pappa said that the new program had very different application requirements and restrictions, so the county had to create a new online system for it.

The county had to wait to receive the funding, and in late January and early February, Pappa said, Clark County received $32 million for that new program and the guidelines on how it could be used.

Since then, county officials have processed more than 4,000 applications manually under the new program. The online portal went live with the new rules last Saturday, Pappa said, which will increase the number of applications that can be processed.

“Also, we never stopped allowing residents to submit applications and we now have about 23,500 applications pending,” he said. “We are expecting about $129 million in additional funding for this second assistance program from the state and neighboring cities. The combined $161 million is expected to be enough to help 40,000 households.”

For more information about CHAP and how to apply for the assistance, readers can visit chap.clarkcountynv.gov.

Contact Jonathan Ng at jng@reviewjournal.com. Follow @ByJonathanNg on Twitter.