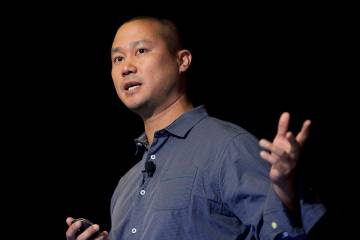

A year after he died, Tony Hsieh’s estate still in flux

Tony Hsieh needed help.

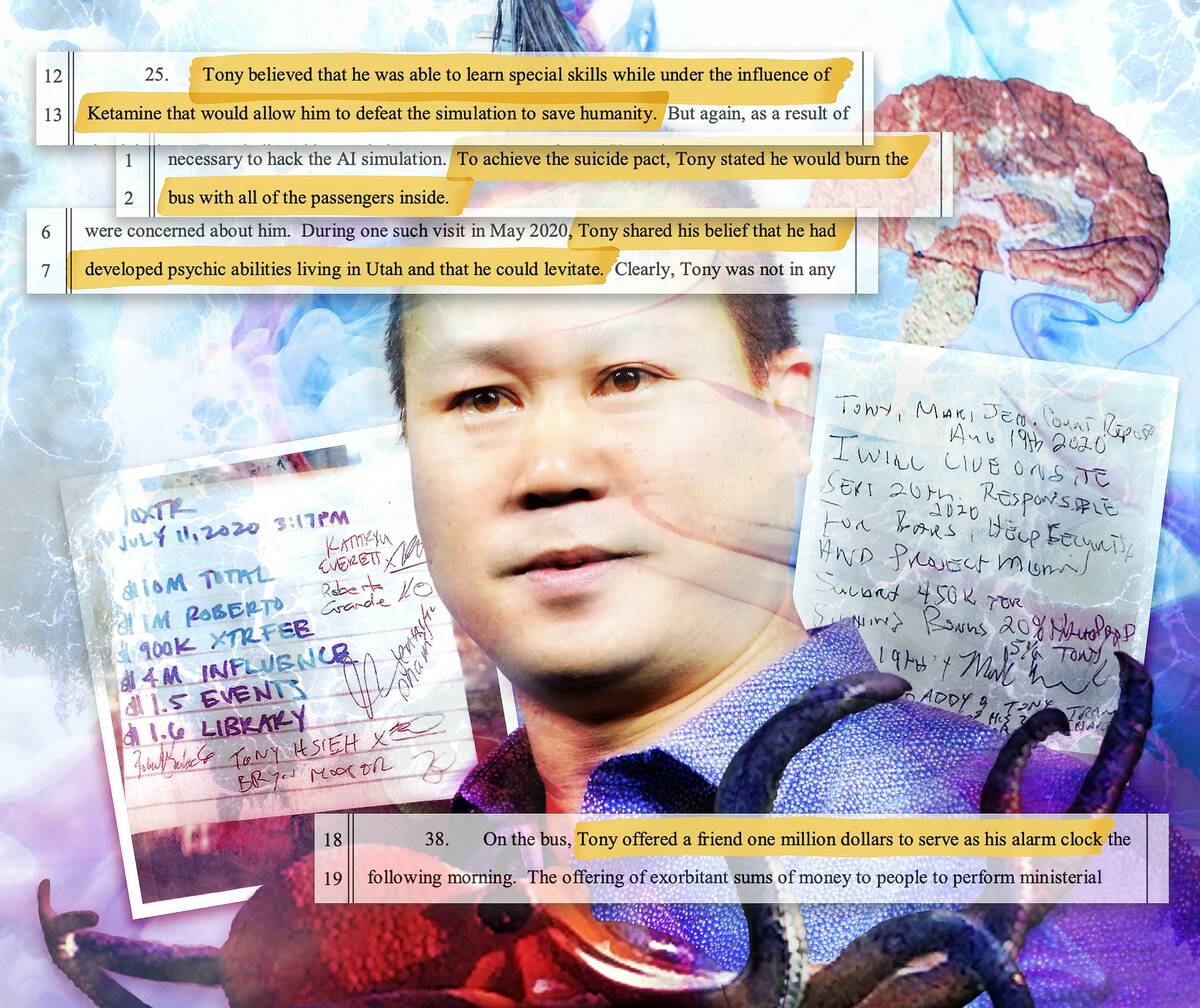

The Las Vegas tech mogul’s drug use, delusional thinking and erratic behavior had prompted longtime friends to arrange a trip from his new outpost in Utah to a Montana ranch, where prior visits had proved helpful. When it came time to leave, Hsieh boarded the bus wearing only pajama pants and brought only a box of crayons.

He offered a friend $1 million to be his alarm clock the next morning, and as the bus arrived in Montana, Hsieh thought a gunman was attacking, causing him to trash the vehicle.

He also asked friends to join him in a suicide pact, saying that dying was the best way to transcend human consciousness.

His plan: Set the bus on fire with everyone inside.

Hsieh’s family described the June 2020 incident in court papers — one of many alarming accounts of his final year alive to be outlined in the multipronged legal battle over his estate.

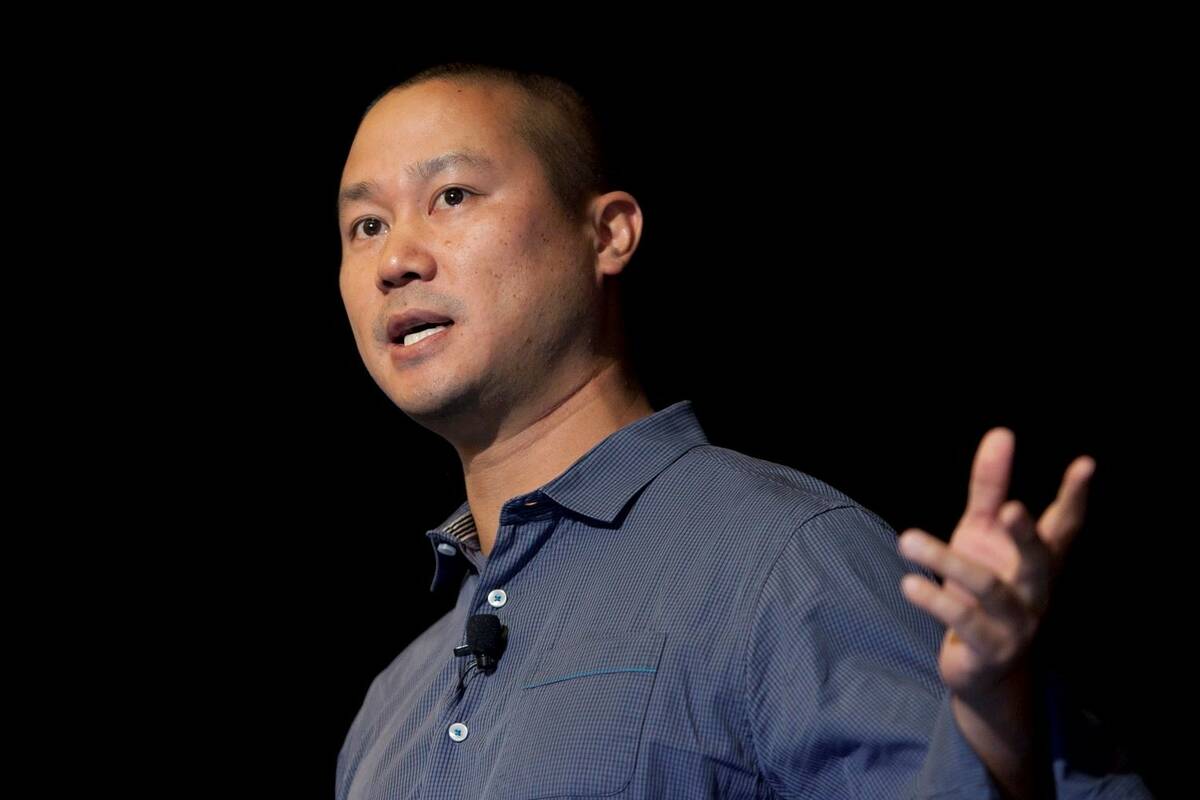

Hsieh, the former CEO of online shoe seller Zappos and face of downtown Las Vegas’ revival, died at age 46 on Nov. 27, 2020, from injuries suffered in a Connecticut house fire. He was unmarried, did not leave a will and left a massive portfolio of real estate holdings.

A year later, it seems the future of his fortune isn’t close to being determined through court cases that include detailed accounts of Hsieh’s drug use and bizarre behavior, and allegations that people close to Hsieh took advantage of him financially as his health spiraled downward.

‘He planted the seeds’

Hsieh’s father, Richard Hsieh, and brother Andrew Hsieh are overseeing his estate. All told, more than $150 million in creditor’s claims had been filed in his probate case as of Monday morning, and at least three lawsuits alleging breach of contract have been filed in Clark County District Court and remain open.

Court records include a $40,000 creditor’s claim for a custom “ceiling brain prototype” and a transcript of Hsieh hiring someone for $450,000 per year under a loosely defined job that could include, as the boss put it, working on “random projects like koi fish or tree houses.”

Among other questions, it remains unclear what will happen to Hsieh’s real estate holdings. If they sell, it would put swaths of downtown Las Vegas in new hands and potentially spark more development, as Hsieh’s portfolio included boarded-up buildings and vacant lots.

Hsieh’s family filed more than 100 sale notices in District Court in a two-day span in February for his Las Vegas properties and nearly 20 sale notices in one day in March for his properties in the wealthy Utah ski town of Park City. An attorney for the family previously said that the sale notices were filed “to allow for a possible future sale” and that Hsieh’s estate may keep some or all of the holdings.

By September, it appeared that only one of Hsieh’s properties — a luxury home in Las Vegas’ Scotch 80s community — had been formally put on the market.

Uri Vaknin, a partner with real estate investment firm KRE Capital, said he has heard Hsieh’s family wants to sell, but he hasn’t seen marketing brochures or offering memos being circulated.

Vaknin, whose firm previously owned the majority of units in downtown’s Ogden condo tower, indicated that no one has stepped up to invest as much in downtown as Hsieh did. But he believes Hsieh inspired other activity, including in Las Vegas’ Arts District, which has seen a surge of new businesses.

“He planted the seeds for all that’s happening now,” Vaknin said.

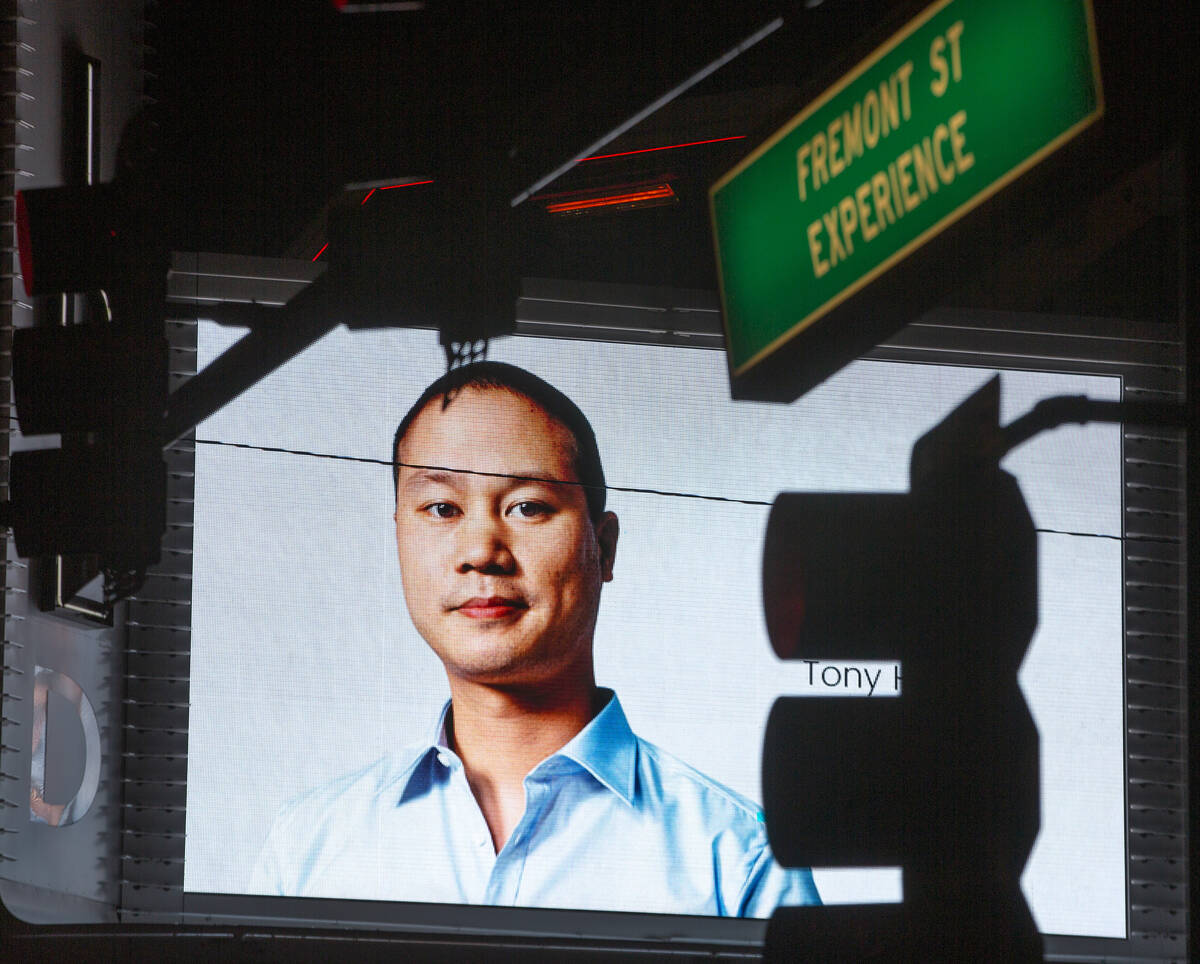

Coming out of the Great Recession, Hsieh invested heavily in the Fremont Street area through a $350 million side venture originally called Downtown Project. He bankrolled bars, restaurants and tech startups and became one of downtown’s biggest property owners, buying apartment complexes, office buildings and other sites and developing projects such as retail hub Downtown Container Park.

Overall, Hsieh was an “inspiring” figure who wanted to create something new and vibrant, Las Vegas Mayor Carolyn Goodman said.

Goodman said that she never got the sense that Hsieh had a darker side and added that he loved the feeling of bringing people together. But she noted that lonely people often feel a need to be surrounded by others.

“He was a gentle, good soul,” Goodman said.

‘Excessive intake of nitrous oxide’

Much of the legal battle over Hsieh’s estate involves Jennifer “Mimi” Pham, who, in court filings by her lawyers, was described as Hsieh’s assistant, right-hand person and friend for 17 years.

Hsieh used Pham’s cellphone account for his main number, had cable and utility accounts in her name, and shared the same address on their driver’s licenses, the court papers state.

Pham, through various limited liability companies, filed two lawsuits early this year alleging contracts she had with Hsieh weren’t being honored.

She has also filed more than $130 million in creditors claims, the largest of which, at $75 million, is the “anticipated profit” from Hsieh’s venture in a documentary-movie streaming service.

The claim total also includes $20 million in damages against Hsieh’s estate over alleged interference with a services agreement and $25 million in damages over alleged interference with another contract, according to court filings Nov. 19.

Attorneys for Hsieh’s family, meanwhile, filed court papers stating that Pham; her boyfriend, Roberto Grande; and financial manager Tony Lee were among those with greatest access to Hsieh, and that it was “obvious” to them and others that Hsieh was “physically and mentally unwell.”

Hsieh had been “perpetually under the influence of Ketamine” for a period, thought he could transform into animals or objects, lost a “tremendous amount of weight” and believed he had “discovered the mathematical algorithm for world peace,” court papers claim, adding the trio of insiders had also seen or been told of Hsieh’s “excessive intake of nitrous oxide.”

The lawyers wrote that Hsieh’s house was “littered with thousands of empty nitrous oxide cartridges, broken glass, dog feces, and rotten food.” He once stepped on some glass, cutting his foot, and walked around the house leaving a blood trail, figuring it would make it easier to find him.

Pham, Grande and Lee encouraged Hsieh to pursue “impulsive, poorly planned” or “incoherent” investments to make Park City a “mecca for creatives,” but any vision he had for the town “was clouded by his manic and delusional thinking,” his family alleged.

For several years, Hsieh had paid Pham a management fee of about $9,000 per month, plus travel expenses; in 2020, her compensation jumped to $30,000 per month, and she received a 10 percent commission based on funds invested by Hsieh, court papers claim.

As Hsieh’s mental health worsened, Pham and Grande allegedly “conspired to exploit” her close relationship with Hsieh “to extract millions of dollars from him in a few short months,” attorneys claimed.

Lee, meanwhile, filed a lawsuit through a limited liability company called Pelagic stating that he had worked in banking and had known Hsieh for years. He started working for Hsieh in 2020 and alleged that Pelagic was owed almost $6.9 million in compensation under a guaranteed contract.

Attorneys for Hsieh’s family, Pham, Grande and Lee did not respond to requests for comment.

Fatal fire

Born in 1973 to Taiwanese immigrants, Hsieh went to Harvard University, sold online marketing firm LinkExchange to Microsoft Corp. for $265 million in stock in 1998, and was an early investor in Zappos, founded in 1999 as ShoeSite.com.

The online retailer moved from San Francisco to Henderson in 2004 to better build its customer service operations, and Hsieh sold the company to e-commerce giant Amazon in a $1 billion-plus deal in 2009.

He also moved Zappos to the former Las Vegas City Hall in 2013 and launched his downtown-focused investment vehicle — now called DTP Companies — in 2012.

Hsieh had long been known as an unconventional mogul. He lived downtown in an Airstream trailer with a pet alpaca, had a fondness for Northern Nevada’s Burning Man festival and sported a mohawk.

But after the coronavirus pandemic abruptly ended his interactions, events and good times in Las Vegas, Hsieh emerged in Park City, buying several houses there last year as part of a then-mysterious undertaking.

He also was replaced as CEO of Zappos in summer 2020 without a formal announcement from the company he had led for two decades.

In fall 2020, he took a trip to Connecticut. Around 3:30 a.m. Nov. 18, the New London Fire Department responded to a report of a house fire with someone trapped in a storage room. Fire crews forced their way into a pool-equipment storage area and found Hsieh unresponsive.

A 20-pound propane tank rolled out when crews forced the door and was “venting product,” the department reported.

Hsieh, after being airlifted to a hospital, died from complications of smoke inhalation nine days after the fire.

New London Fire Marshal Vernon Skau reported there was “physical evidence to lead investigators to theorize that Hsieh could have been impaired or intoxicated at the time of the fire.”

Skau indicated that several Whip-It brand nitrous oxide chargers, a whipping-cream dispenser, a marijuana pipe, and Fernet-Branca liqueur bottles were found around him.

‘Forever grateful and thankful’

Hsieh’s darker side was soon in the spotlight after his death, as news groups reported that he had been using drugs and displaying erratic behavior.

People familiar with Hsieh’s life in Park City told the Review-Journal late last year that the walls of a mansion he owned there were covered with Post-it notes; that the house was a regular party spot; and that Hsieh was known for staying in his room for days at a time.

Vaknin, of KRE Capital, said that some of Hsieh’s behavior outlined in court filings this year was “not unknown” but that its extent was a “little surprising.”

For all of the drug use and manic behavior, Vaknin said, the business tycoon still left a permanent imprint on downtown Las Vegas.

“For that I’ll be forever grateful and thankful,” he said.

Contact Eli Segall at esegall@reviewjournal.com or 702-383-0342. Follow @eli_segall on Twitter.